Can you identify a successful firm vs. a shrinking firm?

According to a recent Legal Trends report, successful law firms maintain a 90 percent (or better) collection rate from clients, with no exceptions. What about shrinking firms?

Their collection rates decline to 81 percent over time.

The research shows firms that struggle, fail to perform in two key areas: (1.) They don’t have the processes they need to collect payments reliably from their clients and (2.) They aren’t able to find high-quality clients who are both willing and able to pay.

Why getting paid faster matters to law firms

Investopedia explains why getting paid faster is so important to a law firm’s cash flow.

“If your payables (your debts) are due before your receivables (money from a sale you haven’t collected yet) come in, you’ll face cash flow problems. This, in turn, means you won’t be able to pay your bills on time, which can lead to bigger problems, like making payroll in a timely fashion and facing questions of creditworthiness.”

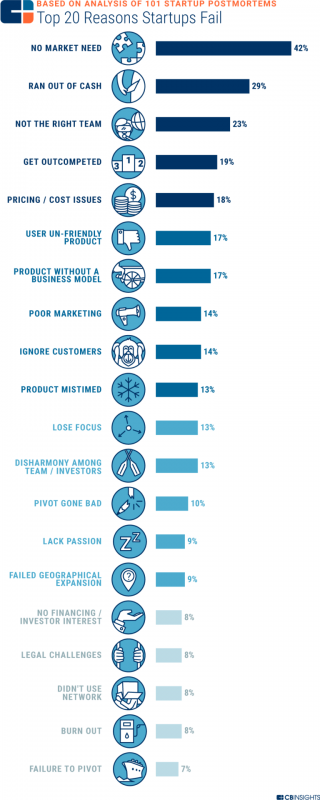

If you aren’t able to regulate cash flow, your firm will eventually experience a cash flow crunch, leading to the headaches listed above and layoffs or a loss of talent. CB Insights performed a postmortem on 101 and one failed businesses, identifying the most common reasons for failure.

The second biggest reason?

The business ran out of cash and was unable to remain solvent.

Source: CB Insights

Cash flow management is the foundation and the most important component of your business. Getting paid faster reduces the odds of your firm experiencing a cash flow crunch. Here are # tips you can use to get paid faster and remain cash flow positive.

Tip #1: Build a firm clients fight to retain

How do you accomplish this for your firm?

You create a compelling value proposition for your law firm. A value proposition answers the question, “why should I retain your firm?” with an actionable and persuasive response. If your value proposition is compelling and well known in the marketplace, it’ll be easier to attract, win, and retain top tier clients.

What makes a value proposition so special?

It creates an economic moat for your law firm. Warren Buffet popularized the idea of an economic moat. An economic moat helps your business retain clients; it minimizes churn, and it makes it extraordinarily difficult for competitors to attack your business.

Here are five moats that affect your law firm.

- The brand moat.With the brand moat, clients are willing to pay more for your services because of your reputation and the benefits they receive in return (e.g., winning, prestige, conferred trust, etc.).

- The secret moat.Intellectual property – copyrights, patents, trademarks, trade secrets — anything that fits into these categories makes direct copying (or stealing) illegal, making it harder for competitors to compete with you. Amazon’s one-click, Google’s search algorithm, and KFC’s secret recipe are all secrets.

- The toll moat.This means you have exclusive control over a market or niche. You’re the only game in town, so if clients want the [best], they’ll have to come to you. This could be a collection of data, an experienced employee roster (i.e., all of our attorneys are former judges).

- The switching moat.Businesses with a strong switching moat are an intrinsic part of their client’s life. These clients are so dependent on their firm that switching or separation is incredibly difficult.

With a strong value proposition, your firm can fight off larger or better-funded competitors who are looking for a way to infringe on your marketshare.

Why does this work?

It turns the attorney/client dynamic on its head. It shows clients that they need you more than you need them. If you have a waiting list of clients who are eager to work with you, clients aren’t as willing to relinquish their position.

As a result, clients are motivated to perform.

They’re far more likely to pay you fully and on time. They’ll avoid misbehaving; they’ll focus their attention on cooperating with you. A compelling value proposition enables you to attract clients who are eager, willing, and able to pay for your services.

Tip #2: Create payment systems and procedures

As we saw in the beginning, struggling firms often don’t have the systems and procedures needed to stabilize collections. If they remember to bill their clients, they’ll send out an invoice.

In time, this produces a cash flow crunch.

Adopting the right systems and procedures is an easy way to speed up the payment process. Here’s a sample process to show you what I mean.

- Compile invoices accurately, adhering to client billing guidelines

- Shepherd your client’s invoice through ebilling, looking for red flags or trouble spots

- Send invoice to your client, making sure to clarify due dates and methods of payment

- Send an email payment reminder to your client on the invoice due date

- Call your client once the invoice is one week late

- Call client again, send out an email, and snail-mail reminder once the invoice is two weeks late

- Visit client in person once the invoice is one month late [special cases only]

- Place client account with a collections agency, suspend or terminate representation

Can you see what’s happening?

You’re making a good faith effort to reach out to your clients, this way there’s no confusion about your outstanding invoice. You’re approaching them directly, asking for what you want, and concluding the relationship if they’re unwilling to cooperate.

Here’s why these systems and procedures are essential.

They keep your firm healthy. If you’re dealing with a delinquent client, there’s a definite end to the relationship if they’re unwilling to maintain their end of the deal. If they’re struggling with hard times or they’re willing to restore their account to good standing, there’s a path forward.

Tip #3: Use alternative fee arrangements

A Legal Trends report found 44 percent of law firms list client’s inability to pay all at once as the most common reason for nonpayment. Firms also state that 31 percent of clients pay late even when they have the funds. This is a cash flow crunch waiting to happen.

How do we know?

In Cash is King: Balance and Buffer Days, JP Morgan analyzed 600,000 small businesses, to see how they managed their cash flow. Here’s what they found.

- The median small business has average daily cash outflows of $374 and average daily cash inflows of $381, with wide variation across and within industries.

- The median small business holds 27 cash buffer days in reserve.

- Small businesses in labor-intensive or low-wage industries hold fewer cash buffer days than those in capital-intensive or high-wage industries.

Clients are unwilling to pay all at once, while firms are expected to wait for payment that’s rightfully theirs. This unpleasant scenario can be avoided if you’re willing to use alternative fee arrangements (AFAs) in your firm. So far, only 22 of the 650 law firms serving the Fortune 1,000 rely on AFAs.

Maybe these AFAs are unprofitable?

Actually, it’s the opposite. As I mentioned in a previous article, 84 percent of proactive firms find their non-hourly projects to be at least as profitable as their hourly projects. Nontraditional AFAs can generate a significant amount of income.

Here are several ways you can use AFAs to get paid faster.

- Require clients to prepay (they will if you’ve done tip #1)

- Use fixed fees to systematically increase your rates and pay in large blocks (i.e., 25% upfront)

- Increase contingency fees via barter (i.e., get cash advance now)

- Require prepay via holdbacks

- Use portfolio fixed fees to auto-bill clients for a portfolio of bundled services each month

- Create subscriptions for routine work at a predetermined price that’s both prepaid and paid monthly

What does this mean for your law firm?

It means a cash flow crunch is optional. With the right strategy and tactics, you don’t have to experience a crunch on a regular basis. Even better, you can use these ideas to produce more consistent income for your law firm.

Successful firms get paid faster

They collect on 90+ percent of their invoices, and they maintain that average with no exceptions. Shrinking firms struggle to maintain a high collection percentage. They attract the wrong clients, and they neglect the payment systems and procedures that would boost their revenues.

A cash flow crunch is all but inevitable for these shrinking firms.

Cash flow is the lifeblood of your law firm. Attracting high quality clients is not enough; you need these high-quality clients to pay you for your hard work. They need to pay you quickly and completely, without extensive discounts, write-downs, or write-offs.

Follow these three tips, and you’ll find you’ve left the shrinking firms in your industry behind.

Great tips! I think that being on time and quick with your invoices can definitely make life easier. Thanks for sharing!

Wonderful tips indeed, we just started using bill4time 3 months ago and i am really happy to report that tracking my staff time spent has been a breeze which is now helping our firm zero in on low productivity. Wasted time is now clearly visible by staff and management so they are now more mindfull of how they spend time daily.