How Much Does Legal Billing Software Cost?

04/24/2025 By Dan Bowman

Attorney time and billing software can cost around $30 per month per user to hundreds of dollars per month per user, depending on the provider. There are a variety of legal e-billing vendors to choose from, each with their own sets of features, all of which are around a similar price point. But if you really want to know how much a billing software will cost you per month, you’ll need to consider more than price; it’s also about worth.

The true value of billing software is in saved time, smooth workflows, and an overall easier collection process. With that in mind, the best software will feel less like an expense, and more like an essential piece of your practice — one that runs things behind the scene so you can focus more attention on your clients and billable tasks.

What Factors Affect the Cost of Legal Billing Software?

The main factors that affect billing software’s price are the features they offer, the size of your firm, any unique needs of your practice, and the provider’s payment plans. You will commonly see multiple ‘tiers’ of pricing with scaling offerings of features, support, and integrations. Depending on the provider, there may also be added fees to look out for, particularly if their software does not have its own payment processor.

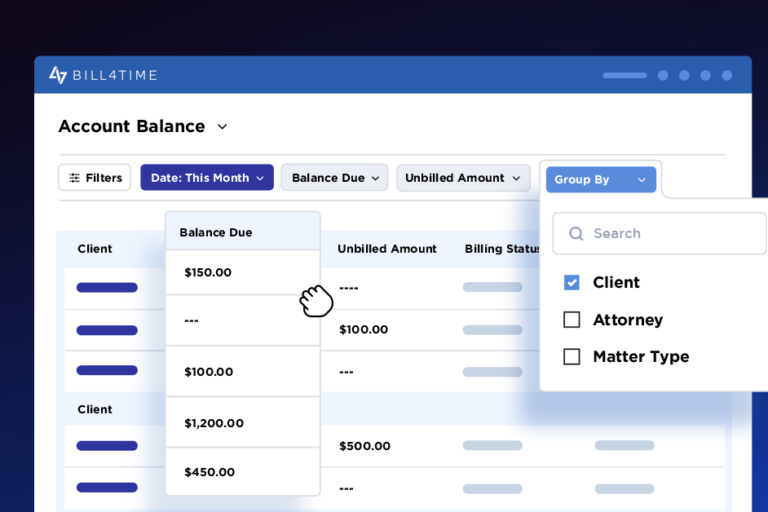

Regardless of the numbers, providers typically price on a per-user, per-month basis. Sometimes, they will offer a slight discount for paying annually versus monthly; for example, Bill4Time’s basic plan comes at a lower rate when paid annually and includes more within its base pricing than many others at a similar level.

Another factor for pricing is whether the software is cloud-based or uses on-premise technology. Typically, cloud-based software is almost always the best option; it’s cheaper due to using less hardware and requires far less maintenance from you, the end user. Additionally, cloud-based billing software is far more flexible, particularly those that come with mobile app support.

Cloud technology also saves money by letting you incorporate smart devices your business already has, cutting down upfront investment even further. On top of that, cloud technology has consistent pricing and can easily scale up as your business grows and gains new, loyal clients.

Is Free Legal Billing Software an Option for Law Firms?

That depends on how you define ‘option.’ Free tools may seem like a smart move, but in reality, they will end up costing you more than they ‘save.’ So, when it comes to legal billing software, free is less of a green light and more of a red flag.

The word free is pretty tempting, especially for a small law firm owner. But free software rarely offers any security, support, or meaningful features. Even if the software does happen to have good features, they will most likely be sitting behind a paywall. On top of that, you’ll likely be stuck figuring it out solo, with no guidance on ways to actually improve your billing process.

Rather than asking, “What’s the cheapest billing tool I can get by with?” ask: “What software is actually going to help my practice thrive?” The right billing solution won’t feel like an expense; it’ll be momentum to your firm’s success. If it doesn’t feel like that, then it’s not the right choice.

With that in mind…

What’s the Right Legal Billing Software Budget for Your Firm?

The right budget strikes a balance between price and value: a price you can afford, with a value that you want. So to find the right fit, start by asking: what is most valuable to your firm?

- Are you looking to save time?

- Do you want support for compliance?

- Want to simplify the invoicing process?

- Need to speed up collections?

- Seeking a better billing workflow overall?

Any or all of these can be answered with legal billing software. But finding the right software for your firm’s practice matters more than picking something with trendy features. A solid way to evaluate cost is to consider how many billable hours you could recover by using the software. If it saves even a few hours a month on invoicing, follow-ups, or reconciling payments, the time regained may outweigh the monthly fee.

Before committing to any software, make sure to do a free trial — regardless of who the provider is. Just because a platform has high marks and five-star reviews doesn’t mean it will work well with your firm. Plus, since most software is cloud-based, free trials don’t require tons of setup.

How Much Should Billing Software Cost for a Small Law Firm?

Billing software pricing can vary widely depending on the provider, the size of your firm, and the features included. Most platforms offer tiered plans to accommodate different needs. For instance, Bill4Time’s entry-level plan starts at $39 per user, per month when billed annually.

But price is just one of many factors that determine the true “cost” of billing software. The “cheapest” option might cost less money, but it also might end up costing you missed hours, clerical errors, and unpaid invoices.

If the software doesn’t actively save you time, stress, and energy, then it’s not worth the price. Look for software that’s both affordable and helpful. Good providers offer software that’s user-friendly, flexible, and efficient — and that’s what we provide at Bill4Time.

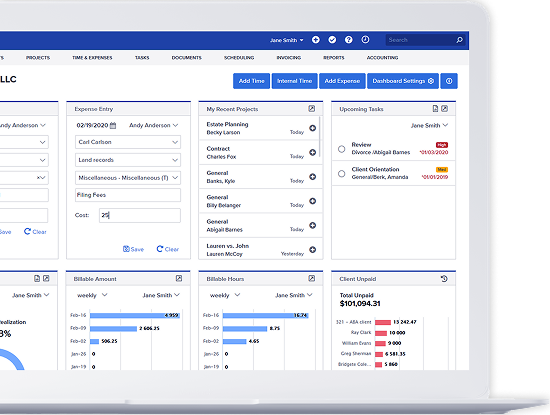

Bill4Time strikes a keen balance between cost and value. For less than $40 per month, you’ll have a simple, efficient, streamlined way of handling your billing. From initial time tracking to collecting the final payment, everything goes into one single source — including a native law firm payment processor, which means more secure collections for you and your clients. Firms of all sizes use Bill4Time for case management, time tracking, trust accounting, and much more.

You’ve probably seen plenty of threads discussing the best legal billing software on Reddit and other forums — and it’s smart to look at what other attorneys are saying. Once you’ve done your research, the next move is to see how platforms like Bill4Time perform in real life. Start a free Bill4Time trial today, or click below to schedule a demo tailored to your firm. Let us show you how billing software can boost your firm’s operations and be an excellent return on investment.