Need a quick way to track overdue fees from past due invoices? With the new Automated Interest feature in Bill4Time, it’s never been easier. You have the ability to turn on or off whether you would like interest to be calculated automatically or if you would like to continue manually applying fees to invoices.

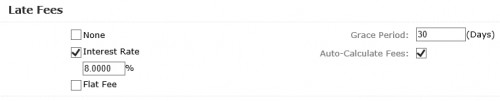

Under Invoice Setup you can check the box next to Auto-Calculate Fees along with entering your Fee Type and Grace Period. Once that is saved, the system will automatically track your interest based on your settings. These settings can also be changed per Client and Project.

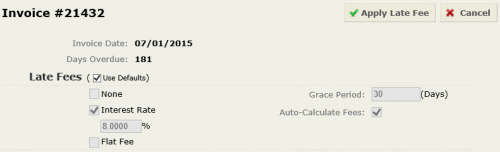

From the invoice, you can check to see the amount applied. You can also edit the late fee to make any changes or adjustments if you need to override the default settings. Each day an invoice is overdue it will accrue interest.

Adding a late fee to your invoices gives your clients an incentive to pay their invoices on time. The automated late fee will also give you assurance that valuable time and money is not being lost.

In order to create an invoice activity needs to happen on a matter. Will this feature automatically create an invoice if no activity happened? so for example the client hasn’t paid their bill but nothing was done in the matter. When I go to create an invoice at the end of the month, will there be an invoice charging the finance charge?

I was really hoping that an invoice would be prompted for anything with an aged balance, work or no work. So while interest accrues, we will not know, unless we do an AR report and there is no way to generate a professional looking statement to send. So we are still forced to create a time entry every month, just to show accruing interest. :/

Hello Precilla,

The system does not permit the creation of an invoice when there is not any new work activity to bill. Statements are used when you have to send a document saying that a previous invoice was not paid in full. The Statement will contain a separate line item for late fees accrued on outstanding invoices This way, you make reference to a past invoice without resending the invoice. Please feel free to contact Support with any additional questions, thanks!

the statement is not something that can be sent to a client. I would suggest being able to create an invoice with a previous balance if there is one. it is so frustrating trying to collect the a/r without having something to send the client on a regular basis.

Is it safe to assume that this is setup for simple interest only? Or is simple vs. compounding controlled in the settings?

Yes, that is correct, the interest is simple only.

When a check mark is put in the Interest Rate box, how is that calculated?

You have the ability to charge interest based on a percentage or flat fee. Once an invoice goes past the Grace Period you setup, it charges interest based off this fee. If it’s setup to auto calculate the late fees then it will charge the past due invoices till they are paid.

It does not appear that the interest expense created by this feature transfers to Quickbooks with the B4T Connector. Can you verify this? If this is true, what is your recommendation for dealing with the interest expense in my QB accounting? If a payment is received in B4T for the principal and interest balance, there will be a credit created in the client’s QB account because the additional interest expense isn’t there to balance it out. I suppose that I can just create an invoice in QB to apply the credit, but that isn’t exactly the most efficient process. Any suggestions?

Is there anyway to change the wording “Late Fee” to “Interest” on the billing?

Hello Lisa, at the moment, there is not a way to change this term however I can certainly pass that suggestion over. Any future suggestions can be submitted here for others to vote on: https://support.bill4time.com/hc/en-us/community/topics/200188090-Ideas-Feature-Requests

Will this now allow for interest to be calculated only on an unpaid balance? For example, if a balance is partially paid will it still continue to accrue interest on the entire balance or will it accrue on only the outstanding balance? Has this been fixed yet?

I mirror Tyler’s comment. The “late fee” feature really messes up QuickBooks when using the B4T connector because the connector does not pass those additional late fee charges on to QuickBooks. It requires manual adjustment in QuickBooks which makes the Late fee feature unusable. I have started to manually enter a late fee on the latest invoice. It’s the only way to avoid this QuickBooks problem.

Will this allow for interest to be calculated only on an unpaid balance? For example, if a balance is partially paid will it still continue to accrue interest on the entire balance or will it accrue on only the outstanding balance? Has this been fixed yet?

Hello Jennifer,

The Late Fee’s accrue on only the unpaid balance of the invoice. So once a payment is applied to the invoice, the remaining outstanding balance is the figure used when calculating the amount of interest accrued going forward. If you have any further questions, please contact Support and we’ll be happy to assist you. Have a nice day!