Dual Taxation Feature

Bill4Time has now released an additional invoicing feature: dual taxation. This is particularly helpful for those countries that require businesses to include a secondary tax to their services, such as the Canadian Goods and Services Tax/Harmonized Sales Tax (GST/HST). Now Bill4Time makes it even easier to invoice!

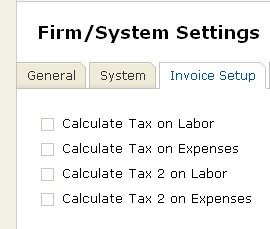

Just go to Settings at the top right corner, click on the Invoice Setup tab, and you’ll see this:

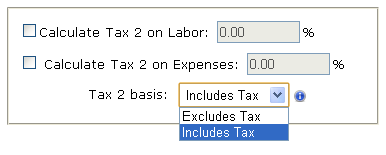

After you click the Edit button, you can edit the settings.

The second tax basis can be either exclude or include the first tax. The “Excludes Tax” setting makes it a separate tax and bases it upon the invoice total before taxes. The “Includes Tax” setting makes it a cumulative tax and bases it upon the invoice total plus the amount yielded by the first tax.

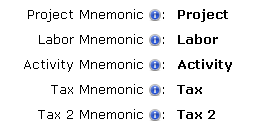

In the Firm/System Settings, you can change the mnemonic for both taxes. This will be reflected in invoices, statements, and reports.

Faster Upload Time

The page loading speed has improved across the entire system. Companies with a large amount of client, accounting, and invoicing data will especially notice the improved upload time.

Leave a Reply