Legal consultants typically log their time as they work on tasks, using timers or manual entry systems. These methods allow them to track how much time they spend on each activity, providing a clear record of their billable hours.

Many consultants often use legal time tracking software to log their activities precisely. High-quality legal software distinguishes between billable hours vs. actual hours, ensuring every minute spent on client-related work is billed correctly and not overlooked.

An important aspect of this process is determining the increments you will bill time in. But what type of increments can you bill in? Do consultants bill in 15-minute increments? What are the benefits of billing incrementally? In this short guide, we will explore the tools and methods legal consultants use to track and bill their time effectively, as well as the advantages of different billing increments.

How Do You Bill in Increments as a Consultant?

Billing in increments as a legal consultant involves breaking down your time into smaller, standardized units, typically ranging from six to fifteen minutes. This method, common in the legal profession, allows for precise tracking of time spent on various tasks.

Why Use Incremental Billing?

- Improved Accuracy: Billing in smaller increments makes sure that every minute of work is accounted for. This method eliminates guesswork, reducing the risk of underbilling or overbilling clients.

- Transparency: Clients appreciate the detailed breakdown of tasks. Incremental billing provides a clear picture of how you spend time on a case, fostering trust and transparency in the client-consultant relationship.

- Efficient Time Management: For consultants, this method helps in managing time more effectively. By tracking time in smaller units, consultants can better analyze productivity and identify areas for improvement.

- Enhanced Client Satisfaction: Clients often feel more satisfied when they see a detailed, itemized invoice. It shows that the consultant has dedicated specific periods to their case or project, justifying the costs and highlighting the value of the services provided.

In the legal field, where precision and accountability are of the utmost importance, billing in increments can help you demonstrate your professionalism. This level of detail shows clients that you only charge for the actual time spent on their case, enhancing their trust and satisfaction.

How Does Billing in 15-Minute Increments Work?

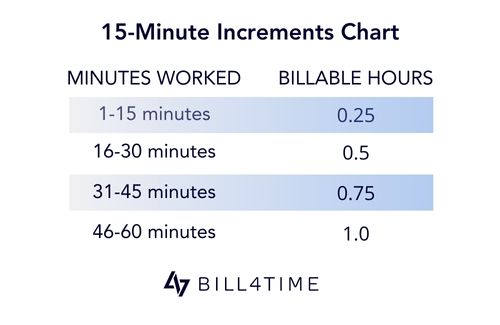

Billing in 15-minute increments involves dividing your work time into 15-minute blocks, each representing 0.25 of an hour. This method can simplify time tracking and invoicing, making it easier to manage and understand.

To illustrate, consider a case where you’re working on a client’s case for 1 hour in 15-minute increments. The breakdown might look something like this:

- 15 minutes on a phone call with the client (0.25 hours)

- 30 minutes researching case law (0.5 hours)

- 15 minutes drafting a letter (0.25 hours)

You would bill these tasks as 1.0 hours in total. Billing in quarter-hour increments reduces the complexity of time tracking compared to more granular methods like six-minute increments. Legal consultants can quickly tally their billable time, saving administrative effort.

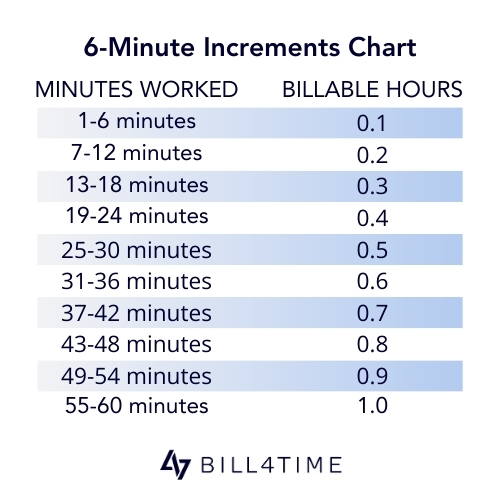

How Do You Bill Time in 6-Minute Increments?

Billing time in six-minute increments involves dividing each hour into ten six-minute segments, each representing 0.1 of an hour. Many legal consultants use this method to ensure that all work is accounted for precisely and accurately. The billing increments chart below provides a more comprehensive breakdown.

Let’s say you need to bill for the following tasks:

- 18 minutes drafting a contract (0.3 hours)

- 36 minutes on a client call (0.6 hours)

- 24 minutes reviewing documents the client sent you (0.4 hours)

By breaking these tasks into six-minute increments, the consultant can bill for exactly 0.3, 0.6, and 0.4 hours, respectively, providing a detailed and accurate representation of the time spent on each activity. The two main benefits of billing this way include:

- Precision: Six-minute increments offer a high level of detail, which is crucial for justifying billable hours to clients. You can account for every small task and only bill clients for the exact time spent on their matters.

- Reduced Risk of Overbilling: Unlike larger increments, six-minute billing minimizes the chances of rounding up time excessively, which can lead to overbilling and client dissatisfaction.

While tools like a billing increments chart are helpful, legal consultants often use time tracking software like Bill4Time to streamline the process further. Bill4Time can automatically divide time into six- or 15-minute increments, convert it to decimals, and multiply it by your hourly rate. This type of software helps legal consultants optimize their administrative workflows and reduce the potential for human error in manual calculations.

How Do Consultants Charge for Their Time Using Software?

Legal professionals can simplify their entire billing cycle, from entering time to receiving payment, by using time tracking software like Bill4Time. The Bill4Time platform can help you with tasks like:

Entering Time

Using Bill4Time, consultants can easily start tracking their time. When beginning a task, you can start a timer directly within the software and connect it to any client. If you prefer to enter time manually, you can do so by selecting the client and matter and then inputting the task’s duration.

Generating Invoices

Once you’ve logged your time on a case, Bill4Time can generate detailed invoices. These invoices include a breakdown of each task performed, the time spent, and the corresponding fees. Bill4Time automatically calculates the total billable amount based on the consultant’s hourly rate. For example, if you log 3.5 hours of work at $200 per hour, Bill4Time will generate an invoice showing a total of $700.

Sending Invoices and Receiving Payments

Bill4Time simplifies the invoicing process by allowing you to send invoices directly to clients in multiple ways: email, text, or the Bill4Time client portal. You can customize the invoices with your logo and branding, building credibility. Clients can then make payments online through Bill4Time’s native payment processor, making the process convenient for both parties.

Ready to streamline your billing process and improve your efficiency? Sign up for a free trial of Bill4Time today or schedule a free demo to see how it can support your consulting practice.