It’s the end of a long day at your firm. Your associate stares at their laptop, trying to piece together how they spent the last ten hours. Court appearances, client calls, research, drafting — what was billable? What wasn’t? Across the office, a paralegal flips through their notes, trying to separate admin work from tasks that can actually be invoiced. It’s a familiar struggle in law firms everywhere.

But here’s the truth: most lawyers and paralegals aren’t guessing anymore. They’re using software.

Legal time tracking software has become the backbone of law firm billing, replacing messy spreadsheets and end-of-day estimations with precise, real-time tracking. Instead of scrambling to remember what they worked on, legal professionals log their time as they go — on their desktops, in mobile apps, or through automated tools that sync with calendars and emails.

And the best legal time tracking software doesn’t just record hours. It categorizes tasks, assigns different billing rates for attorneys and paralegals, and integrates with accounting tools so firms don’t leave money on the table.

In this short guide, we’ll explore the different ways firms are handling time tracking and why using time tracking software has become the best option.

How Do Lawyers Manage Time Tracking?

While most lawyers are using some sort of software, the truth is that time tracking methods vary. Ask twelve lawyers how they track their time, and you’ll probably get a dozen different answers. Some still rely on old-school methods like scribbling hours on a notepad or logging them in a spreadsheet at the end of the day. Others use dictation tools to record their billable activities on the go.

The problem? It’s easy to forget billable tasks, unconsciously round down time, or miscalculate your total hours.

Others rely on Outlook or Google Calendar as a rough record of client meetings and casework — better than nothing, but far from precise. Then there are lawyers who dictate their hours into a voice recorder or send themselves emails throughout the day, hoping to compile everything later. While this approach captures more detail, it still requires someone — whether the attorney or an assistant — to manually enter those hours into the billing system.

The real question is how should lawyers track their time? The answer is simple: technology. The firms that get the most out of their billable hours rely on dedicated time tracking software. Instead of leaving hours up to memory or messy notes, software makes tracking seamless, reducing the risk of lost revenue.

However, there is a key to using time tracking software effectively: using it contemporaneously. It’s best to record time as you work, rather than trying to recall what you did at the end of the day (or worse, the end of the week).

Other features that set time tracking software apart:

- Mobile apps – Lawyers aren’t always at their desks. A mobile time tracker allows you to log hours from court, client meetings, or even the airport.

- Automatic tracking – Some platforms integrate with calendars, emails, and case management systems to track time spent on client-related activities.

- Reminders and prompts – If you forget to log time for a certain activity, software can nudge you to fill in the gaps.

- Reporting and analytics – Software provides insights into where time is spent, helping firms optimize billing and identify inefficiencies.

At the end of the day, manual tracking is a hassle. It leads to lost billable time, inaccurate invoicing, and frustrated attorneys trying to piece together their work. Time tracking software removes that burden, making it easier to bill accurately and get paid for every minute of work.

How Do Paralegals Manage Time Tracking?

Paralegals juggle more of a mix of billable and non-billable work, which can make time tracking even trickier for them than it is for attorneys. Unlike lawyers, whose hours are mostly dedicated to client work, paralegals handle everything from drafting documents and conducting research (billable) to administrative tasks like organizing case files and sending invoices (non-billable).

This makes time tracking one of the most important skills for a paralegal. That constant shift between billable and non-billable time makes accurate tracking essential — for transparency, and for helping your firm optimize workload distribution and billing efficiency.

Most law firms rely on a single time tracking system where attorneys, paralegals, and support staff log their hours as separate users. This setup keeps everything in one place, making it easier to review and invoice billable time accurately. Additionally, you’ll want to look for:

- Pre-set categories – Quickly distinguish between billable legal work and admin tasks without needing to manually classify each entry.

- Role-based billing rates – Automatically apply the correct billing rate for attorneys, paralegals, and other staff to prevent underbilling or overbilling.

- Time entry organization – Sort and filter time logs based on client, matter, or task type, so no billable work slips through the cracks.

Without a reliable system in place, firms risk losing revenue from untracked or misclassified time. That’s where software like Bill4Time can help. With Bill4Time’s built-in categorization features, firms can easily separate billable from non-billable work and assign different billing rates to different roles so that every minute is accounted for. Instead of sorting through spreadsheets or manually calculating rates, paralegals and attorneys can enter their time directly into the system, and the software takes care of the rest.

Paralegals play a vital role in legal work, and their contributions — both billable and non-billable — deserve to be accurately documented. With the right software, your firm can track every minute with confidence, making sure that both your lawyers and paralegals get credit for their work.

Do Lawyers Get Paid for Billable Hours?

Not exactly. While clients pay for the hours lawyers bill for their work, that money goes straight to the firm, not the individual attorney. Lawyers typically earn a salary and, in some cases, bonuses for exceeding billable hour targets. The exact structure depends on the firm, but even solo practitioners don’t pocket every dollar they bill.

Where Does the Money Go?

Let’s break it down with a quick example. The average lawyer billing rate in the U.S. varies by state and practice area, but a mid-range estimate is around $300 per hour. If a lawyer bills 1,800 hours a year — a common goal in many firms — that’s $540,000 in revenue for the firm. But that doesn’t mean the lawyer is walking away with half a million dollars.

Here’s why:

Firm Overhead – A large portion of firm revenue goes toward operating costs. Rent, legal research tools, practice management software, staff salaries, employee benefits, insurance, bar dues, marketing, and technology all come out of the firm’s earnings before lawyers see their share. Some firms have high overhead costs, especially in major cities, while others keep expenses lean, but no firm operates without them.

Non-Billable Work – Even though billable hours drive firm revenue, lawyers don’t spend every working hour on billable tasks. Internal meetings, business development, client intake, and administrative work all take time but don’t directly generate income. Since salaries and bonuses are usually based on the firm’s overall profitability — not just an individual lawyer’s billed hours — there’s not always a direct correlation between what a lawyer bills and what they take home.

Profit Margins & Partner Distributions – Like any business, law firms need to turn a profit. After covering overhead, firms allocate revenue to partner distributions, reinvestment in the business, and other financial priorities. Partners — especially equity partners — typically take a percentage of firm profits, which means a portion of the revenue from associate billables goes toward partner compensation.

Most law firm associates receive a fixed salary, sometimes with bonuses tied to hitting high billable hour targets. Solo lawyers, on the other hand, get paid directly from what they bill — but they also have to cover office expenses, malpractice insurance, marketing, and every other cost of running a practice.

What Do Lawyers Spend Most of Their Time Doing?

Billable hours don’t tell the full story of a lawyer’s workload. Attorneys spend a significant portion of their day on case preparation, legal research, client communication, and administrative work — some of which is billable, some of which isn’t. Time tracking software helps firms separate billable from non-billable tasks, making it easier to see how much time is actually bringing in revenue.

At the end of the day, lawyers aren’t directly paid for billable hours — they’re paid based on a mix of salary, performance incentives, and firm profitability. While billable hours drive firm revenue, they don’t translate dollar-for-dollar into an attorney’s paycheck.

Do Paralegals Get Paid for Billable Hours?

Just like lawyers, when clients are billed for the hours paralegals work, that revenue goes to the firm, not straight into the paralegal’s pocket. Paralegals typically earn an hourly wage or a salary, with the firm collecting fees from clients for their billable work.

However, many firms offer bonuses tied to productivity and billable hour goals, providing financial incentives for paralegals to meet or exceed their targets. For example, some firms have tiered bonus structures where paralegals receive increasing bonuses as they surpass specific billable hour thresholds. These bonuses can range from a few thousand dollars to significantly higher amounts, depending on the firm’s policies and the individual’s performance.

How Much Do Paralegals Make?

According to the National Association of Legal Assistants (NALA), the median hourly wage for paralegals and legal assistants in the United States was $24.87 per hour as of 2020. However, it’s important to note that paralegal billing rates in 2025 charged to clients are typically higher to account for overhead and profit margins. For example, some firms bill paralegal time at rates ranging from $50 to $200 per hour and beyond, depending on the complexity of the work and the market rates in their region. The difference between the billing rate and the paralegal’s pay contributes to the firm’s revenue, covering operational costs and profitability.

The Role of Billable Hours in Career Advancement

Firms may use billable hours as a metric for performance evaluations, influencing decisions on raises, promotions, and bonuses. Effective time management and diligent tracking of billable hours are crucial for paralegals who want to advance in their careers and maximize their earnings.

So, while paralegals don’t receive direct payment for each billable hour, their compensation is closely tied to the revenue generated from their work. Understanding your firm’s billing practices and striving to meet billable hour goals can lead to financial rewards and career advancement opportunities.

Bill4Time: The Best Way to Track Time Accurately

Whether you’re a lawyer tracking every minute of client work or a paralegal juggling billable and non-billable tasks, one thing is clear: time tracking software makes a difference. The old ways — handwritten notes, spreadsheets, or relying on memory — lead to lost revenue, inaccurate billing, and extra administrative headaches. That’s why law firms of all sizes turn to Bill4Time to streamline their timekeeping and billing processes.

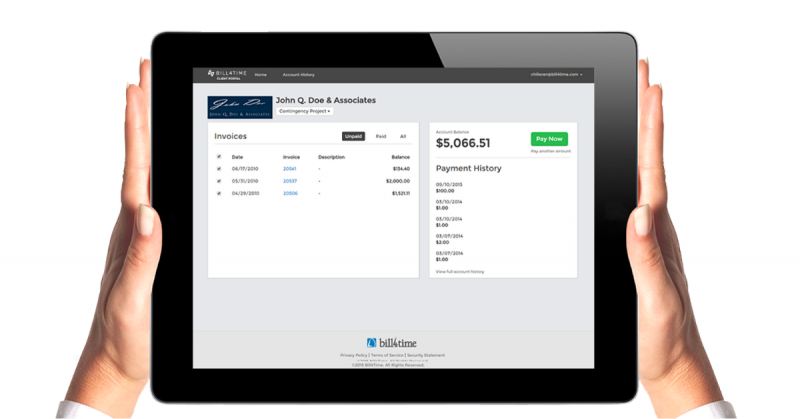

Bill4Time is built for law firms, making it easy for everyone on the team to log their hours accurately, whether they’re in the office, in court, or working remotely. With role-based billing rates, firms can correctly classify and charge for lawyer and paralegal time without extra manual effort. Some of the features that make Bill4Time the go-to choice for all legal professionals:

- Multi-user tracking – Assign different billing rates for lawyers, paralegals, and staff, ensuring accurate invoices.

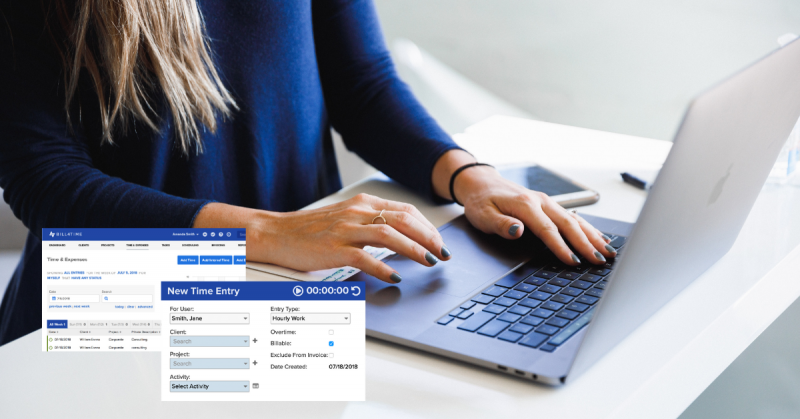

- Contemporaneous time tracking – Log billable hours as you work, so you never forget what you did.

- Mobile access – Track time on the go, no matter where you are.

- Easy invoicing – Turn billable hours into professional invoices with just a few clicks.

The best way to understand how Bill4Time simplifies time tracking? Try it for yourself. Sign up for a free trial today, or click the button below to schedule a free demo. You can experience firsthand how Bill4Time can help your firm track every billable hour effortlessly, eliminate manual errors, and boost profitability.