If you’re still relying on manual processes for your law firm invoicing, you can create delays in your payments and opportunities for errors that can cost you money and your reputation with key clients.

Having an invoice management process is key to handling your invoices efficiently and keeping accurate financial records.

Continue reading to learn how to create more efficient invoice management processes that save your firm’s time, get you paid faster, and provide a stellar experience for the client.

What Is Invoice Management?

Invoice management for law firms refers to the systematic and organized handling of invoicing processes within a legal practice. It encompasses various tasks such as generating, reviewing, tracking, and processing invoices to ensure accurate and timely billing.

Effective invoice management also involves:

- Verifying the details of legal services provided (time spent, fees, and expenses incurred)

- Reconciling invoices with client agreements and contracts

- Ensuring compliance with billing guidelines and ethical standards

By implementing efficient invoice management practices, law firms can streamline their financial operations, improve cash flow, enhance client satisfaction, and maintain transparent and accountable billing practices.

The Timeline of an Invoice

Let’s delve into the key components of effective invoice management:

Step 1: Invoice Generation

Once legal services are provided, you can generate an invoice with detailed information about your billable time, legal services, and any expenses that pass through to the client, such as expenses for court filing fees or research.

Step 2: Verification of Invoice Accuracy

The verification stage plays a pivotal role in confirming the accuracy of invoices. It involves cross-checking the billed amounts against agreed-upon rates, contracts, and services rendered. This step helps prevent overbilling or underbilling, ensuring transparency and fairness in financial transactions.

The invoice approval process is often owned by the accounting department in a large firm or a senior attorney. Any adjustments to the invoice are made at this stage.

Step 3: Invoice Delivery to the Client

Once the invoices are thoroughly reviewed and verified, they need to be promptly delivered to clients. Efficient invoice management involves utilizing appropriate channels, such as email or traditional mail, to ensure clients receive their invoices in a timely manner.

Step 4: Payment and Collections Tracking

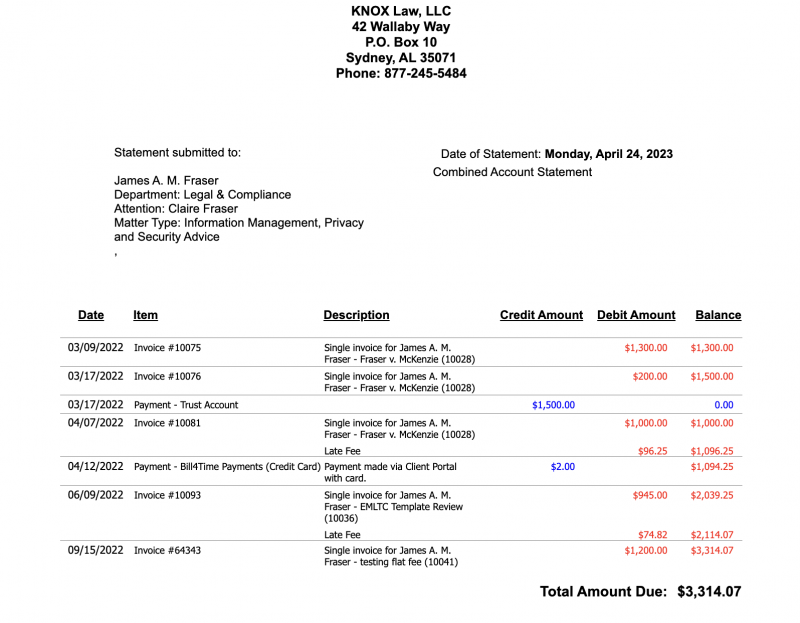

Tracking payments and collections is an integral part of effective invoice management. This entails closely monitoring the status of invoices, tracking payments received, and identifying outstanding balances. By diligently managing these financial aspects, law firms can proactively address any delays or issues that may arise during the payment process.

Depending on your law firm’s processes, this may be by mail or email. For a more modern approach, some firms also offer online payments or a client portal where clients can make secure payments. The client then reviews the invoice and makes a payment.

Evolution of Invoice Management at Law Firms

Historically, invoice management has been a manual process for law firms – record time, prepare invoices with billing entries, rates, and expenses, approve them, send them to the client, and get paid. However, it was rarely as simple or smooth as it should be and still isn’t in many firms.

Increased adoption of technology, the need for efficiency, and client demands have forced the largely traditional legal industry to shift its practices. Automation, in particular, offers an opportunity for law firms to streamline their processes and reduce errors in the invoicing process. This creates more accurate and timely bills that also improve client confidence and retention.

Benefits of Automated Invoice Management

Automated invoice management offers many advantages for law firms and their clients. Here are some of the key benefits:

Reduces Manual Entry

The legal industry relies on a lot of manual processes, but they’re often time consuming and prone to error. Staff members can spend a lot of time with manual entry – sometimes resulting in double entry – that pulls them away from other tasks that they need to complete.

Bill4Time takes care of this process with automated time tracking and invoice templates to free staff time to focus on more critical tasks. It also closes the gap between the many parties involved in invoice management, reducing the risk of error and keeping everyone on the same page.

Improves Accuracy

Automated invoice management ensures accuracy by following predetermined rules to enforce billing guidelines and policies. When invoices are more accurate, the client has a better experience and fewer disputes that lead to wasted time or delays in payment.

In addition, when clients have accurate invoices, it builds trust in your firm and your services. In return, you can build positive word-of-mouth recommendations from current and past clients to generate new leads and fuel future growth.

Use Less Paper

Paper methods are expensive, cumbersome, and error prone. It’s easy for paper documents to be misplaced, not to mention that you need to search through documents to monitor and track invoices.

With Bill4Time, you can generate, store, and deliver invoices on the same platform. Once an invoice is generated in Bill4Time, simply send it via email or the client portal.

Simplified Payment Tracking

Once an invoice is delivered, it can feel like a waiting game until the payment is submitted. There are many variables that go into the timeline of when an invoice is paid by the client, so it’s important to have a standardized billing policy and proper collections processes.

The best way to easily track payment status and ensure your firm is paid on time is to adopt online payments. Bill4Time Payments is an online payment processor built in the BillTime platform. The same place your invoice was generated, is the same place you’ll process and allocate clients payments.

With Bill4Time Payments, you’ll have access to OneLink, which allows your firm to create custom payment links to add to invoices, emails, or your website. Clients can use a laptop, tablet or mobile device to submit to their invoice payment front anywhere.

As payments are submitted, use Bill4Time Payments robust payments dashboard to review the status of all your invoices.

Robust Invoice Reports

A centralized invoice management system keeps all your invoicing and payment information in one place to stay on top of your business finances.

With Bill4Time, you can generate robust reports to track all aspects of your firm’s billing. This includes time and expense, invoice balances and payment activity, and balance adjustments and more!

Having a process of reporting on your firm’s financial health can help identify gaps and opportunities for your law firm.

Final Thoughts

If you’re still relying on manual processes that leave room for major errors and delays that only cost your firm in the long and short term, there’s a better way. Bill4Time’s law firm invoicing software has the modern features to streamline your invoicing process, save time, improve the client experience, and get your firm paid faster. With features like custom invoice templates, branded invoices, and automated time tracking — your firm can standardize and simplify the billing process.