Billing hours effectively is a crucial skill in the legal field, directly impacting both a firm’s profitability and an attorney’s career progress. The goal of this guide is to offer grounded, actionable advice on how lawyers can better manage and maximize their billable hours.

Drawing on the expertise of seasoned legal professionals, this blog will offer insights that cover the major frustrations in legal billing today. We’ll cover topics like:

- Understanding billable hours

- Effective billing practices and tips

- Increasing your billable hours

- Cutting down on non-billable hours

- Setting realistic billable hours targets

- Using legal time tracking software

By leveraging these proven tactics, our guide aims to empower you with the knowledge that can transform how you manage your billable hours, setting the stage for enhanced efficiency and success in your legal career.

How Are Billable Hours Charged?

Lawyers charge billable hours by logging the time spent on client work and multiplying these hours by their hourly rate, usually using 6 or 15-minute increments to ensure precise billing. This detailed method helps maintain clarity and fairness in billing, which is critical to building trust and maintaining professional client relationships.

For instance, consider an attorney who spends three hours and ten minutes drafting a contract. If using six-minute increments, they would log this time as 3.2 hours. At an hourly rate of $300, the charge for this task would be $960.

This method ensures clients are billed fairly for the exact amount of time spent on their case, while attorneys receive appropriate compensation for their skilled services. By keeping detailed records of the time spent on various tasks, firms can provide transparent invoices to clients, highlighting the value delivered in each segment of the legal process.

How Do You Bill Hours Effectively?

Effective billing practices are foundational for maintaining both profitability and client trust. Here are insights and methodologies that even seasoned lawyers can use to refine their billing processes:

1. Enter Your Time Immediately

Enter your billable hours as soon as you complete a task to prevent underreporting. For instance, if you draft a legal brief and then immediately log the time spent right after, you can capture all the time you spent and not accidentally forget it or underestimate it later.

The American Bar Association (ABA) notes that if you wait until the end of the week to enter your billable hours, you’ll lose about 25% of your time. So, as you can see, entering your time as soon as possible is vital to ensuring no lost hours and meeting billable hours goals.

2. Breakdown Each Task

Instead of block billing, where multiple tasks are lumped into a single time entry, itemize each activity.

For example, rather than entering “Draft and review contract, correspond with client, revise filing – 4 hours,” break your description down further: “Draft and review contract – 2 hours; Email correspondence with client regarding contract specifics – 1 hour; Revise filing according to client feedback – 1 hour.”

This clarity helps clients understand the value delivered at each step and can help mitigate disputes.

3. Use Legal Billing and Timekeeping Software

79% of law firms use legal technology specifically for billing purposes, acknowledging the significant time and headaches this software saves.

For example, Bill4Time’s interface lets you enter time from desktops, tablets, or mobile devices immediately after completing tasks. You can use the timer feature to time your tasks or manually enter time. It also supports multiple billing rates, which can be tailored for different clients or tasks, allowing nuanced financial management within diverse cases.

You can also create detailed invoices that clearly communicate the value you’ve delivered, enhancing transparency and trust with your clients. As a bonus, you can automate invoice follow-ups for clients who haven’t paid, ensuring you get paid promptly. These are just some of the many features legal software offers to support your billable hours practices.

See how Bill4Time works with a free trial (no credit card required).

4. Don’t Forget to Bill for Short Tasks

When handling client communications and other brief yet frequent tasks, it’s crucial to recognize each contribution to a case, no matter how small. As you tackle daily emails or quick client updates, diligently record these efforts immediately.

For instance, if you spend about five minutes each day responding to emails on a particular case, log these individually in your timekeeping software right after completion. Your clients will appreciate the transparency this method provides, seeing a detailed account of how their legal services are being rendered day by day. Plus, it ensures you are paid fairly for all the time you dedicate to a case.

Think about it this way — say you send three emails a week in one case over the course of a year, and each email takes you about five minutes. That’s 15 minutes per week, which translates to roughly 13 hours annually just for these emails. If you’re billing at a rate of $300 per hour, not logging these short tasks means missing out on approximately $3,900 over the year.

As you can see, these small tasks add up quickly, so be diligent about recording them as they happen.

5. Optimize Your Billing Descriptions for Better Client Understanding

When detailing your billing entries, specificity can significantly enhance client understanding and satisfaction. Instead of a generic entry such as “document review,” take the extra step to specify which document you reviewed and for what specific purpose.

For instance, instead of just listing “Reviewed contract,” expand to “Reviewed employment contract for compliance clauses and potential liabilities.” This description clarifies the precise nature of the task and highlights your thorough approach and expertise, justifying the time spent on each task.

Remember, clear and comprehensive billing descriptions can lead to fewer questions from clients regarding the nature of billed services and facilitate smoother invoice approval processes. This practice also aids in quicker payments and reduces disputes, enhancing the client relationship.

6. Regularly Train Staff on Billable vs. Non-Billable

Understanding which activities count as billable versus non-billable is vital for the financial health of your law practice. Conduct regular training sessions to outline and update these definitions based on current laws and firm policies.

For example, drafting correspondence directly related to a client’s case is billable because it directly contributes to their legal representation. In contrast, time spent on general administrative tasks, such as organizing client files or scheduling appointments, does not typically count as billable unless specifically agreed upon with the client under certain conditions.

7. Negotiate Billing Terms Upfront

Clearly discuss, agree upon, and put into writing what will be billed and what will be off the record with your client before beginning work. For instance, deciding that all communication will be billable unless purely administrative prevents misunderstandings about charges for emails and calls.

It’s also wise to outline how you will handle expenses related to the case, such as filing fees, document retrieval fees, or even travel expenses. Specify whether your firm will absorb these costs, pass them directly to the client, or bill them separately. For instance, you might decide to bill for travel time only when it involves out-of-town proceedings or client meetings that require significant time away from the office.

8. Time Your Invoices at the Right Moments

It’s best to time your invoices to coincide with moments when the client values your service the most — perhaps right after a major court victory or upon delivering a crucial set of documents that significantly advance their position.

Sending an invoice during such a high point increases the likelihood that your bill will be settled swiftly as the client’s satisfaction with your service peaks.

Additionally, align your billing with your client’s payment cycles. By scheduling invoices to arrive just before their financial review periods, you can reduce the waiting time for payments. For example, if your client typically processes payments on the 1st of each month, aim to have your bills reach them by the 24th. This practice ensures your invoices are at the top of the pile, ready to be processed first.

9. Offer Multiple ePayment Options

In a recent ABA survey, 40% of clients admitted that they would never hire a lawyer who doesn’t accept credit and debit cards. Clearly, offering electronic payment options is basically a requirement to thrive in today’s digital age.

Plus, facilitating electronic payment options can significantly speed up the payment process. For example, a system like Bill4Time Payments, native to Bill4Time legal software, streamlines the payment process by linking billing and payment functions into a single platform. You can easily send clients payment links via an email, text, or the client portal, allowing them to pay invoices directly through the interface where they review their billing details.

10. Automate as Much of the Billing Process as You Can

Automating elements of your billing process is an effective strategy to ensure timely and accurate billing. Within platforms like Bill4Time, certain automation features can significantly reduce manual entry and minimize errors. For example, you can set up recurring billing for ongoing cases, which automates the invoice generation process based on a predefined schedule.

Another practical use of automation within Bill4Time is the automatic late fee calculation. If you’ve ever wondered how to calculate billable hours with late fees, Bill4Time can do the heavy lifting for you. If an invoice goes unpaid past its due date, the system can automatically apply a predetermined late fee. This process incentivizes timely payments and maintains cash flow without the need for manual monitoring.

How to Bill More Hours as a Lawyer

Maximizing your billable hours not only boosts profitability but also reflects the true extent of your efforts on behalf of your clients. To enhance the effectiveness of your billing practices, consider these tailored strategies that complement the rigorous demands of legal work.

- Prioritize self-care: Maintaining work-life balance is essential for lawyers to prevent burnout. For example, research by Christina Maslach, a well-known psychologist, emphasizes the importance of enhancing social support at the workplace, such as creating mentorship programs or peer support groups to provide emotional and professional support.

- Batch similar tasks: Organize your day by grouping similar legal tasks, like reviewing case files or drafting related legal documents. This process minimizes context-switching and promotes deeper focus.

- Limit non-essential meetings: Consolidate your meeting schedule to only meetings directly impacting client outcomes or case progression. Implement succinct, agenda-driven meetings to maximize efficiency.

- Regularly update case progress: Keep your clients informed with frequent updates. These updates build trust and justify the ongoing work and associated costs, particularly during prolonged cases.

- Monitor your productivity: Use software that tracks how much time you spend on different tasks. This technology helps identify less obvious billable tasks and ensures accurate billing for brief client consultations or quick legal research.

- Set clear daily goals: Aim to meet a daily minimum of billable hours. Setting tangible goals can provide motivation and help you maintain a steady pace, reducing the risk of underutilizing billable hours.

- Capitalize on cross-practice expertise: When cases intersect with other legal specialties — like a divorce matter involving a real estate transaction — offer to manage these aspects. This practice broadens your billable hours and enhances client service by providing comprehensive legal guidance.

Remember, consistency in billing more hours is as important as increasing the number of hours billed. By staying vigilant and proactive, you can significantly enhance your productivity and ensure that your billing practices keep pace with your professional output.

How Can I Reduce Non-Billable Hours?

Every attorney faces the challenge of implementing non-billable hours best practices. Reducing these hours can dramatically increase your efficiency and overall profitability.

A first and crucial step is to clearly define billable vs. non-billable for your firm. What counts as non-billable hours, exactly? These tasks include:

- General clerical work (filing, photocopying, etc.)

- Travel time not specific to a client’s case

- Training sessions for new software or procedures

- Internal meetings not related to client-specific cases

- Organizing physical or digital files

- Scheduling appointments

- Managing non-billable employees

- Volunteer legal services

- Routine email checking not specific to client cases

- Preparing and delivering internal presentations

- Time spent on billing and invoicing

- Office management tasks

- Reading and responding to general professional correspondence

- Website updates and marketing content creation

- Employee reviews and HR activities

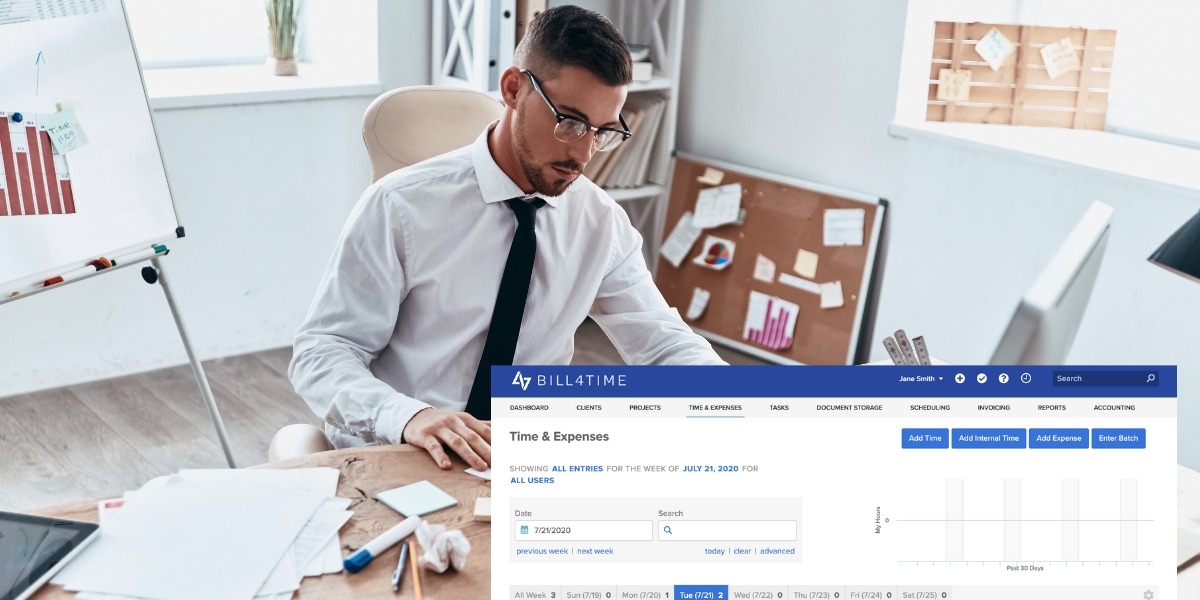

Additionally, consider tracking your non-billable time along with your billable time. Software like Bill4Time allows you to track both, giving you comprehensive insights into exactly where your time is going. From there, you can make adjustments like reallocating resources or further training for junior staff on tasks like preliminary research, allowing senior lawyers to dedicate more time to complex, billable work.

How Many Billable Hours Are Realistic?

The number of billable hours can vary widely depending on the type of practice, the firm’s size, and the individual lawyer’s role within the firm. Let’s break billable hours down a bit further below.

How Many Billable Hours Are Realistic in a Year?

Recent research from the National Association for Law Placement (NALP) shows a general increase in both total hours worked and billable hours across various firm sizes.

For instance, in larger firms (701+ attorneys), average billable hours rose from 1,817 to 1,873 over a year, reflecting an increase in workload and possibly efficiency improvements or increased client demands.

Smaller firms (101-250 attorneys), however, reported virtually unchanged billable hours, averaging around 1,752 to 1,757 annually. This suggests that smaller firms may have more stable year-over-year billable hours expectations.

How Many Billable Hours in a Month?

Translating the annual data into practical targets monthly, attorneys in larger firms might aim for approximately 156 billable hours (based on 1,873 annual hours), while those in smaller firms should consider around 146 hours monthly (based on 1,752 annual hours).

How Many Billable Hours Are Normal for a Week?

Weekly, the data indicates that lawyers should target around 36 to 39 billable hours to meet the higher end of the annual spectrum observed in larger firms. For smaller firms, aiming for about 34 to 36 hours per week aligns with their yearly averages.

This breakdown can help you plan your workload more evenly throughout the year and manage your time effectively.

How Do You Master Billable Hours? With Bill4Time

As you implement these billable hours best practices, consider the benefits of leveraging a specialized legal billing platform like Bill4Time. This software eases the complexity of tracking and logging billable hours and improves the way you manage invoices.

If you’re a legal professional striving to hone your billing methods, it’s time for Bill4Time. Start with a free trial and see the positive impact on your practice’s efficiency and financial outcomes.