Trust accounting is a large part of everyday life for lawyers and businesses. Think estate planning, banking, real estate, and other groups that manage large amounts of money. So, as a lawyer, how do you use trust accounting at your law firm?

Imagine this:

You’ve won over a prospective client! A major new client has just signed on the dotted line. You’ve received a sizable retainer with the promise of more work if the initial project goes well. Your clients trust you enough to sign on the dotted line, but their trust isn’t where it should be. Not yet. A single mistake can end the client relationship before it begins. The good news is you’re an experienced pro. If you’re like most A-player firms, you take client ethics seriously. You use trust accounting to maintain appropriate financial boundaries.

What Is Trust Accounting?

A trust account is simply a special bank account an attorney must maintain. Attorneys receive money from their clients, which are then held in this special bank account.

In the past, attorneys kept track of client trust funds using ledger cards, with the vague hope that their records were both accurate and current. Thankfully, we’ve software that can help manage these kinds of accounts and more accurately track the cash flow.

Why should your law firm use a trust account? Here’s what makes a trust account significant.

- The money in this account belongs to the client, not the attorney.

- Attorneys have to earn this money.

- Attorneys are required to follow the rules and regulations laid out by the state bar and local government.

Wait a minute. Why would attorneys need trust accounts in the first place?

As you know, attorneys take on the role of fiduciary. When you represent your clients, you’re acting on behalf of your clients for their interests and you’re expected, by law, to provide the highest standard of care.

If you’re an established attorney you’re probably aware of the ins and outs of a trust account. Your clients, on the other hand, might not be familiar or understand it. This article is a helpful primer you can share with them.

It’s a big deal for clients. It means there’s built-in protection, assurances that are in place to ensure they’re treated fairly and their firm behaves ethically.

Trust Accounting Rules and Regulations

The American Bar Association sets specific rules outlining the dos and don’ts of trust accounts. Believe it or not, these rules are helpful conversion boosters. They’re marketing details you can use to gain client confidence.

If your firm operates above board, going above and beyond other firms you have an advantage. Teach clients your firm’s processes and how you do things, show them the benefits of doing things the right way. Help your clients truly understand how things work, what protections are in place for their benefit, and how your firm follows those closely.

Let’s take a look at the rules.

1. No Commingling or Mixing Funds

You can’t mix personal/professional funds with trust accounts. If you’re short on payroll, you can’t dip into trust accounts to borrow what you need, so you can replenish it later.

At no time should your funds be stored together or mixed with trust accounts.

You may have one trust account with your bank but you should have multiple sub-accounts for each client. Your accounting software should enable you to create the appropriate sub-accounts for each client.

2. Maintain a Separate Ledger

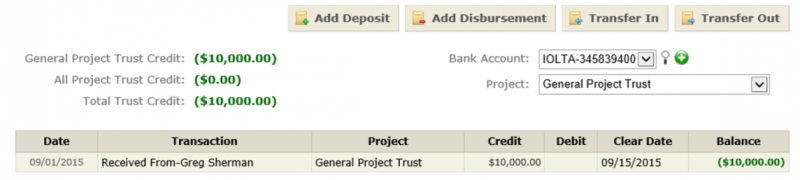

Attorneys must maintain a separate ledger for each client with money in the trust accounts. Clients should be allowed to see their specific ledger at any time, inconvenient as that may be.

Your client ledger should show all relevant transactions (funds coming in or going out). Clients, at the absolute bare minimum, should receive their client ledger at least once per year.

3. Verify Trust Accounts Regularly

You’ll want to complete a three-way reconciliation of your trust account each month. Check the actual bank balance against the balance you show in your accounting records.

If there are any deposits made after the statement cutoff date, add that to the balance shown on the statement. Any withdrawals after the statement cutoff date, subtract that from the balance shown on the statement.

4. If You Haven’t Earned It, Don’t Touch It

The funds in your trust accounts shouldn’t be listed as an asset of the firm on your financial statement. It should be listed as an “other current liability.” If your clients demand a refund from this trust account, you should be able to issue that refund immediately.

Create deposit and withdrawal protocols into your trust account procedures. Funds in this account should never move without a paper trail and an appropriate reason.

5. Don’t Rob Peter to Pay Paul

You’re acting as a fiduciary so you’ll need to be able to provide the right kind of data to your clients. Save everything – the date, amount and purpose of each and every deposit. Save the same data for withdrawals/disbursements.

Make sure the appropriate client’s name is on every trust account check. Doing this dramatically reduces the odds that you’ll overspend in one account while acting on behalf of another client.

6. Create Checks and Balances

The staff members responsible for deposits should not be responsible for disbursements and so on. Both employees/teams should be responsible for balancing the accounts at the end of the month.

Never sign checks or issue approvals without the records for said transactions. Doing this reduces your ability to catch and prevent questionable purchases. Last thing: Make sure you’re an engaged part of the account reconciliation process.

7. Follow State Bar and Government Regulations

The state bar sets, manages and enforces the rules and regulations for trust accounts. The state bar or other governmental body may randomly audit a group of lawyers/firms and their trust accounts. These random audits keep attorneys honest.

8. No Collecting Interest

Attorneys aren’t allowed to earn interest on trust accounts. All interest earned by trust accounts is paid to the appropriate IOLTA program. This non-profit program funds legal services for the indigent and other programs that support other legal causes.

That’s a lot to cover, isn’t it?

But we still haven’t covered when you’d actually use trust accounting. So let’s take a look.

- Real estate transactions. As any real estate attorney knows, funds related to a real estate transaction will flow through their trust account. Escrow payments, appraisal and title fees, loan payoffs, real estate agent commissions and homeowners insurance are all common examples. The protocols, policies and procedures we’ve discussed above are crucial to maintaining a stable firm.

- Legal settlements. A personal-injury payout, payouts from a class action lawsuit, or a workers’ comp award are all examples of settlements passing through a trust account. The lawyer receives settlement fees into a trust account. They’re able to distribute the funds as needed once the money is available as appropriate.

- Retainers. Attorneys typically charge a retainer at the beginning of the relationship. This retainer doesn’t belong to the attorney. Not yet at least. This retainer is simply a security deposit that’s used to pay for future billings/services.

When an attorney issues an invoice to their client, they’re able to draw against the funds in the trust accounts to settle their client’s account. If the attorney uses the funds in a trust account there should obviously be an agreement or engagement later stating that fact.

You may be surprised at the amount of lawyers and firms that aren’t managing their trust accounts properly. These attorneys are rolling the dice with their careers, their firm, and their clients’ financials.

If you’ve read this far, there’s a good chance you’re conscientious. Someone who’s orderly or industrious, willing to do what’s best for their firm.

How to Use Trust Accounting at Law Firms

Trustworthy firms use trust accounting software.

It’s good for clients. It’s great for attorneys.

Go above and beyond other firms by using a trust accounting software that makes it easy to manage trust accounts for your law firm. Teach prospective clients about the value you provide. Show them, in an appealing way, how you do things. It’s one more way to extend your firm’s success.