Would you like your clients to pay you faster?

According to LawPay, law firms that accept online payments get paid 39 percent faster. If you offered your clients Net 30 terms, this means you’d be paid 11.7 days faster. This would have a drastic effect on your cash flow if you received payment for every invoice faster.

This doesn’t usually happen.

If you offer your clients Net 30 terms via traditional payment methods, what’s likely to happen? The payment terms you provided your clients may become Net 45 or Net 60. If this continues, firms may find it difficult to stay on top of their financial obligations.

Do your clients care about online payments?

Card payments are mainstream for most clients. They’re comfortable using their credit and debit cards for large and small, routine, or one-time transactions. Clients expect their providers to accept online payments, but it’s something the legal industry still hasn’t adapted to fully.

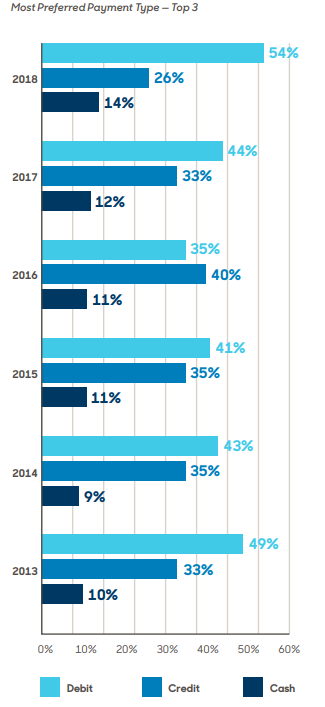

Maybe clients aren’t as eager to use credit cards? Let’s take a look at the data. According to Statista:

- There are 1.1 billion credit cards in the U.S.

- There are 97 million MasterCard holders in the U.S.

- 345 million Visa credit cards in circulation

TSYS’ 2018 U.S. Consumer Payment Study confirms these findings stating that 80 percent of consumers prefer to use their credit or debit card over cash (14 percent) alone.

What about business to business transactions? Are business clients interested in online payments as well? Forrester Research thinks so; they forecast that U.S. B2B ecommerce transactions will reach $1.1 trillion by 2020.

Even more surprising is the fact that B2B clients spend more than offline-only clients. “Omnichannel customers spend more than single-channel, offline-only customers. For example, 60 percent of B2B companies report that their B2B buyers spend more overall when those customers interact with multiple channels.”

What are the advantages of accepting online payments?

Your clients are used to online payments; are the benefits worth it for law firms to invest? If several firms have an established book of business, why go to the trouble of accepting online payments?

Benefit #1: A substantial revenue increase

Drazen Prelec And Duncan Simester, researchers at MIT, published Always Leave Home Without It: A Further Investigation of the Credit-Card Effect on Willingness to Pay.

“This empirical note presents new evidence supporting the proposition that consumers are willing to spend more for a product when using a credit card. This is the first study that demonstrates that willingness-to-pay is increased when customers are instructed to use a credit card rather than cash. The results are surprising both due to the size of the premium and the ubiquity of credit card use.”

The obvious question here is, how much more?

Research by Richard Feinberg demonstrated that consumers with credit cards were willing to spend a significant amount above and beyond cash or check expenditures.

“Participants were asked how much they would be willing to spend for various consumer products in a setting where credit card paraphernalia — ostensibly unrelated to the task were displayed on the experimental desk. He found that by so decorating the experimental setting, he could boost hypothetical willingness-to-pay estimates by 50% — 200%, relative to the estimates of a control group. We refer to this increase as the credit card premium.”

This willingness to spend more is confirmed by other studies as well, so much so that “framing hypothetical purchases as credit card payments may significantly increase purchase likelihood and willingness to pay.”

Long story short?

The easier it is for clients to use their credit and debit cards, the more money they’ll spend with your law firm.

Benefit #2: Improved realization rates

The 2018 Report on the State of the Legal Market stated that realization rates were well below 85 percent. This trend hasn’t changed course. This means firms are losing a large chunk of the revenue that rightfully belongs to them.

Even worse, when it comes to realization metrics, most law firms are in the dark. They’re unaware of their predicament, and they don’t have the answers to important financial questions.

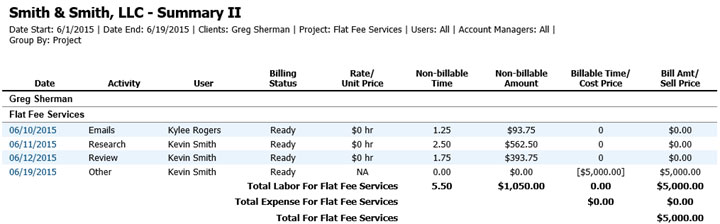

- How many of your clients have paid your invoices?

- Which clients paid early, which ones paid late?

- Which clients consume your time but refuse to pay full price for it?

- Which clients or practice areas produce the greatest amount of revenue for your firm?

- Which clients or practice areas consume the most revenue?

If your law firm only accepts cash or check, it’s hard to answer these questions. It’s harder still to understand why these problems are occurring.

Two interesting things happen when you make it a habit to search for the why.

- Your realization metrics matter less.This is a very good thing. Answering the why shows you that, while realization rates are important, the specifics of your situation should take priority.

- Your collection realization rates go up.As you begin to identify and address the why, your relationships with clients begin to change. Clients realize you’re eager and willing to take their concerns seriously. They see that you’re eager to commit to self-reflection.

Here’s why this is important.

The vast majority of firms are fighting their clients for revenue. Law firms increase their billable rates each year, and each year, clients fight their billable rates down. Realization rates continue to decline as firms are forced to offer discounts, write-downs, and eat write-offs to survive.

This is why benefit #1, a substantial revenue increase, is so important for law firms. Switching to online payments means boosts profitability and realization rates.

Benefit #3: Minimized billing disputes

If you’ve followed your client’s billing guidelines, and you’ve done the upfront work of setting expectations, scheduling payments should be a straightforward affair. If you’re doing exceptional work and clients have a predictable schedule to follow, billing disputes will be less likely.

Not so with traditional invoicing methods.

This makes sense when you realize the average client is afraid. Imagine that your attorney tells you they’re going to help you at the discounted rate of $768 per hour. They’re not sure what they’ll need to do, won’t know how much it costs, but they promise to let you know when they’re finished working.

You’ll receive their bill at the end of the month.

Clients aren’t happy with this, so it’s no surprise then that there’s a struggle for control. With online payments, clients are given a greater degree of predictability and control. You and your client receive more protection from your financial institutions and credit card processors, keeping billing disputes to a minimum.

Benefit #4: Decreased Costs

In my previous post, I referenced research from Finextra. The cost of traditional billing, via paper invoices and snail mail, is estimated to be 9.5 percent of the amount collected on your invoice. This estimate included three specific types of costs.

- Direct costs: Obvious costs like envelopes, postage, printing, and franking are all examples of direct invoicing costs. This also includes unexpected direct costs like ink, toner, and network security for your printers

- Indirect costs: Client service, bill storage costs, dealing with lost invoices, accounting, and reconciliation costs, and sending out undistributed invoices

- Hidden costs: Unexpected transaction or payment processing fees, timekeeping, billing, invoicing, or payment processing errors

When compared with the unexpected expenses listed above, the 2.5 to 3.3 percent, many payment processors are asking for is a bargain. It means there’s a significant amount of money firms are leaving on the table if they choose to stick with the traditional forms of payment.

Accepting online payments comes with significant benefits

As we’ve seen, law firms that choose to offer online payments receive more revenue, faster. Their realization rates are higher, and they keep more of their hard-earned fees. Clients are willing to invest more if their firms position online payments well.

Card payments are mainstays for the vast majority of your clients. They’re comfortable using their credit and debit cards for large and small, routine, set, or one-time transactions. Your clients expect their providers to accept online payments, but the legal industry still isn’t on board.

You can choose to be different.

Find a payment provider that’s willing to shoulder the burden for you. Do what it takes to provide your clients with the flexibility they need to give you what you want, and you’ll find clients are willing to pay you faster.

What is Public Domain?

What is Public Domain?