What’s the #1 bar complaint clients are most likely to file against you?

Poor client communication.

Do lawyers have a reputation for poor communication? All across the country clients file complaints against their attorneys citing neglect and poor communication. There’s some truth to that though right?

Research shows it’s very common for lawyers struggle with communication.

Here’s the problem with all of that.

Clients can be demanding and entitled

They expect you to keep them in the loop, to communicate with them regularly. Yet, these same clients are easily frustrated when they’re asked to pay for more of your time.

That’s just the start of your headaches.

Your clients subconsciously expect you to treat their case with the utmost priority, as if their case was your only case. When they call, expecting an update on their case, project or problem – they expect you to take their calls.

But sometimes you can’t.

- Sometimes the person on the phone – parents, aunts, employers, ex-wives – isn’t your client. You can’t tell these people anything because you don’t work for them.

- Your clients waste the precious time you need to solve their problem.

- Nothing new has happened. Many clients believe there’s always something going on with their case. It’s often difficult for them to wrap their heads around the fact that you’re waiting for communication from a 3rd party.

- You’re unavailable. It’s the weekend, night time or you’re just busy. There’s a good chance this client’s business isn’t enough to sustain you or your firm on its own.

This isn’t the real problem though. There’s a deeper problem at play here. It’s a fear that’s fuzzy and unclear, lurking in the shadows of your client’s mind.

Uncertainty.

As an attorney, you’re often the unpleasant expense your client wants to avoid. But you’re also their savior, the only one that can make their fear, pain and frustrations go away. Uncertainty makes their problems worse.

Not in reality of course.

Still, research shows people in general and clients in particular, find uncertainty to be incredibly unpleasant.

This is it.

The hidden problem you’re fighting in your practice. It’s not unreasonable or demanding clients so much as it’s uncertainty. Your client’s expectation is twofold.

- “Solve my problem. Win my case, protect me from danger, defend my interests.”

- “Help me manage uncertainty. Relieve my stress and anxiety. Tell me what’s happening.”

Problem solving – pretty straightforward, right?

What about uncertainty?

Managing uncertainty isn’t as complex as it sounds. Believe it or not, it’s actually fairly simple.

Ask clients about their communication style – the who, what, where, when and how. Then, determine what you’re willing to give. Set clear limits upfront. Finally, communicate with clients.

Communication is too difficult, too complex

Your clients are conditioned.

Google, Netflix and Amazon have conditioned clients to expect instant gratification. Clients these days are used to getting the information they want when they want it.

Your clients are no different.

They’re looking for information, they want to know what’s happening with their case or project. Which is reasonable.

Most lawyers do it the hard way

They arrange in-person meetings that are difficult to arrange and incredibly time consuming. They’re bombarded by client emails that are loaded with a combination of useful and useless data. Data they’re now forced to sift through.

Can communication tools solve this problem?

Absolutely.

In-person communication isn’t easy.

With the right communication tools, you gain flexibility. With the right tools, clients have the access they need to deal with uncertainty.

Communication, with the right tools, is easy

With modern communication tools your firm should be able to (a.) send bite-sized messages on specific topics to clients (b.) focus communication on the specifics that, at any given time, matter most (c.) reduce the technological burden on clients and staff and most importantly (d.) give clients the ability to speak their mind freely while limiting the requirements or burden on you.

Are there any tools that meet these requirements?

Absolutely, let’s take a look.

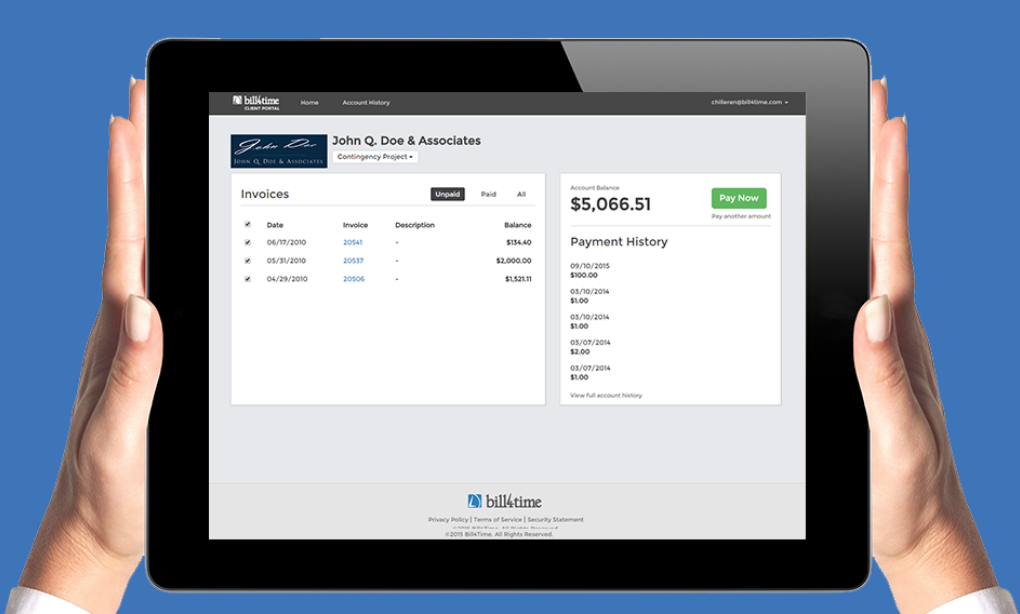

#1: Client portals

It’s easy for clients to see what their doctor does for them. Examinations, x-rays, prescribing medicine – it’s all visual. It’s different for lawyers – clients aren’t entirely sure what you’re doing on their behalf. Client portals come with an unexpected opportunity.

The chance to flood your clients with helpful data.

This isn’t a pointless data dump or useless information that’s shared for the sake of sharing. It’s relevant, actionable and informative. It provides your clients with 24/7 access to important data. Documents, forms, filings, reports – anything that moves your client closer towards their goal.

Why it works:

Providing your clients with a steady stream of data relieves their uncertainty. When you upload content to your client portal, clients receive a visual reminder that (a.) you’re working on their case or project (b.) you’ve shared evidence with them directly and (c.) there’s material for you to discuss at your next meeting.

It gives your meetings structure and focus.

Document management and client portals reduce rambling and confusion in your meetings.

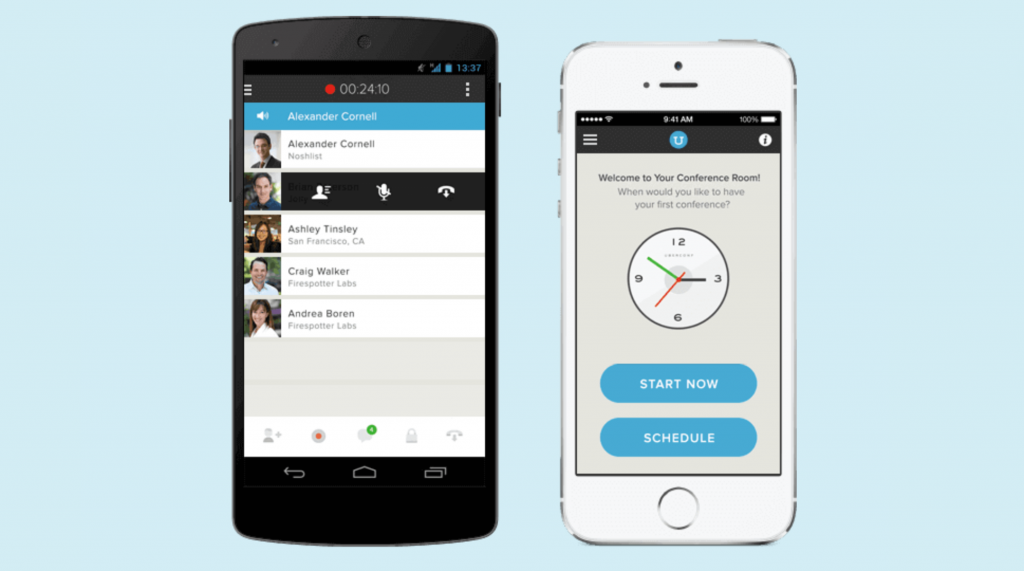

#2: UberConference

Every day, 75 percent of the Fortune 500 rely on conference calls.

Conference calls aren’t always convenient.

They’re not always as straightforward as they should be either. UberConference is a free/paid option that allows you to contact clients automatically and at your convenience. Schedule a call, add participant’s phone numbers to the list and UberConference will automatically call everyone when it’s time.

Clients aren’t required to remember pins, it’s available via mobile and desktop apps and can handle web conferences. The calls are free, recording is included and it’s always available.

Why it works:

It’s a simple, quick and easy way to bring clients, attorneys and support teams together. It’s inexpensive and thanks to UberConference, it’s free.

This gives your clients structure.

Scheduling meetings / calls means you have the tools you need to train your clients. There’s no reason you have to deal with random or unexpected client phone calls. Use your client portal to share access to important data, then just schedule a client meeting ahead of time.

It’s simple and clear.

#3: Legaler

Apple’s Facetime, Microsoft Skype and Google Hangouts have been touted as helpful tools for lawyers to use in their practice. Here’s the problem: Facetime and Hangouts stores your content on their servers indefinitely. Skype stores content from calls with more than two participants.

Your conversations aren’t necessarily private.

They’re easily accessible via legal (subpoenas) and illegal (hacks, phishing) methods which means this is a huge liability waiting to happen. There’s also a few significant downsides. These options don’t record meetings, chats and files. They also don’t integrate with the tools and resources your firm is already using.

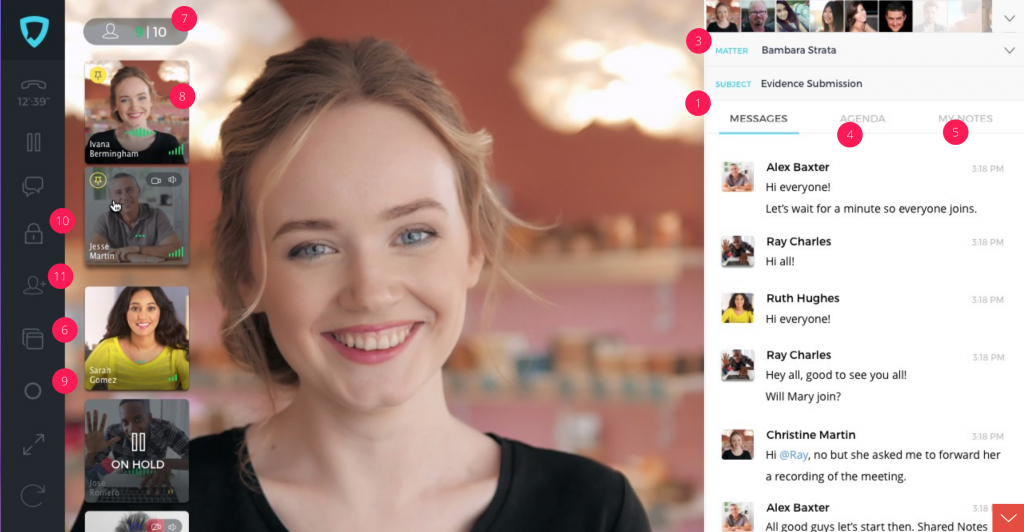

Enter Legaler.

Legaler is free video conferencing software that offers:

- In-browser, video face-to-face meetings with multiple participants (and no software, plug-ins or downloads to install)

- Screen sharing and one-click collaboration

- Cloud based video storage with end-to-end encryption

- Integration with 3rd party legal software from a variety of SaaS providers

- Private, shareable content (e.g. agendas, meeting notes, documents, etc.)

Why it works:

Browser based software makes it easy for clients to use. There’s nothing to install, no apps to track, no complicated instructions to cover.

This is a bonus.

Clients already know how to use their browser. Associates and paralegals aren’t required to install anything new. There’s little to no transitional pain involved and customers are focused on what matters most. Legaler provides flexibility.

Attorneys are able to meet with clients for a quick two to three minute call – unheard of with in-person meetings. If they need to schedule an in-depth call, Legaler does that too.

#4: Signal Messenger

When it comes to secure or private messages Slack is an option that’s presented regularly. It’s easy-to-use, has widespread adoption and a large user base. It’s the client communication tool of choice for many law firms…

And a disaster waiting to happen.

Why?

Encryption is on and controlled by Slack. Slack owns and reads your conversations. What does this mean? Your conversations on Slack can be subpoenaed. Not so great for attorney-client privilege.

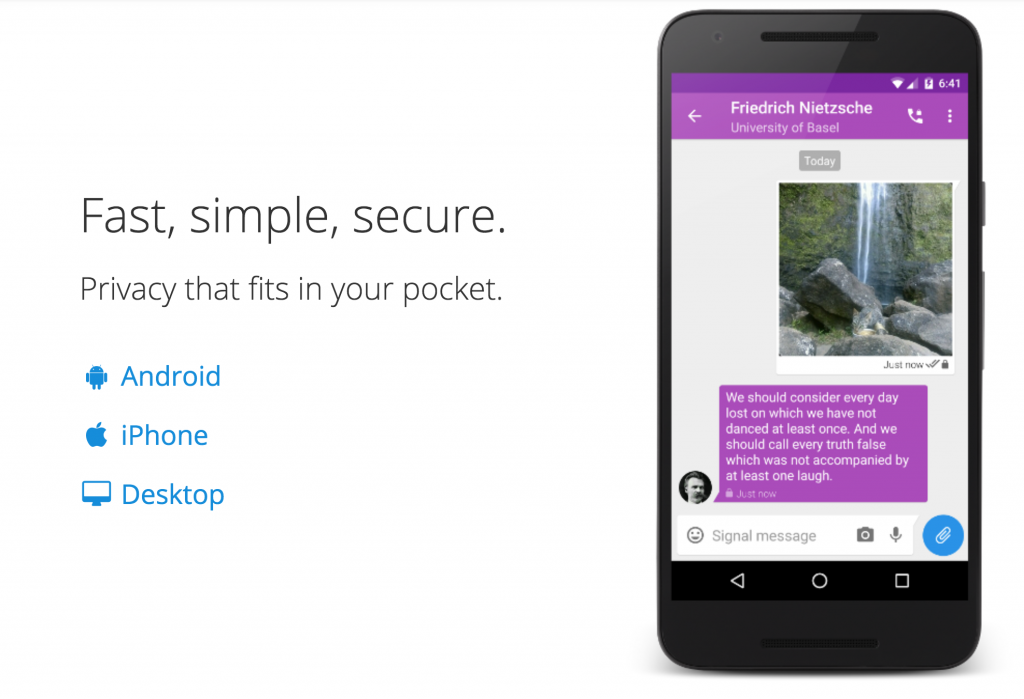

Signal Messenger works with, not against you.

Open Whisper Systems, the organization behind Signal Messenger, created a tool that enables you to send high quality text, voice, video, document and picture messages anywhere in the world, without SMS or MMS fees.

It’s end-to-end encrypted, free and peer reviewed.

Why it works:

With Signal, you’re able to send clients encrypted, bite-sized communication morsels. Data that’s easy-to- share, easy to generate and requires very little time.

It’s available on Android, iPhone and desktop. Platforms your clients are already using. A simple install link is all it takes for clients to get started.

Communication is easy because…

Every client is your number one priority

At least from their point of view.

Your clients subconsciously expect you to treat their case with the utmost priority, as if their case was your only one. They call, looking for an update on their case or project – they expect you to take their calls, but sometimes you can’t.

Communication can be easy.

You’re the only one that can save your client from the specific fear, stress and pain they’re going through. As it turns out, you have two jobs – solving their legal problem and relieving their uncertainty.

Communication, at its core, is about relieving uncertainty.

Most lawyers have a reputation for poor communication. All across the country clients file complaints against their attorneys citing neglect and poor communication.

This doesn’t have to be your story.

You can relieve the pain and anxiety your clients feel today. With the right approach and the best communication tools available, you’ll find you can communicate with clients on your terms, no bar complaints needed.