The best way to manage lawyer burnout is to identify it early on, which is easier said than done. Lawyers are up against constant deadlines, long hours, and never-ending requests for time. In addition, law firms have constant burdens and strict requirements that create a high-stress environment.

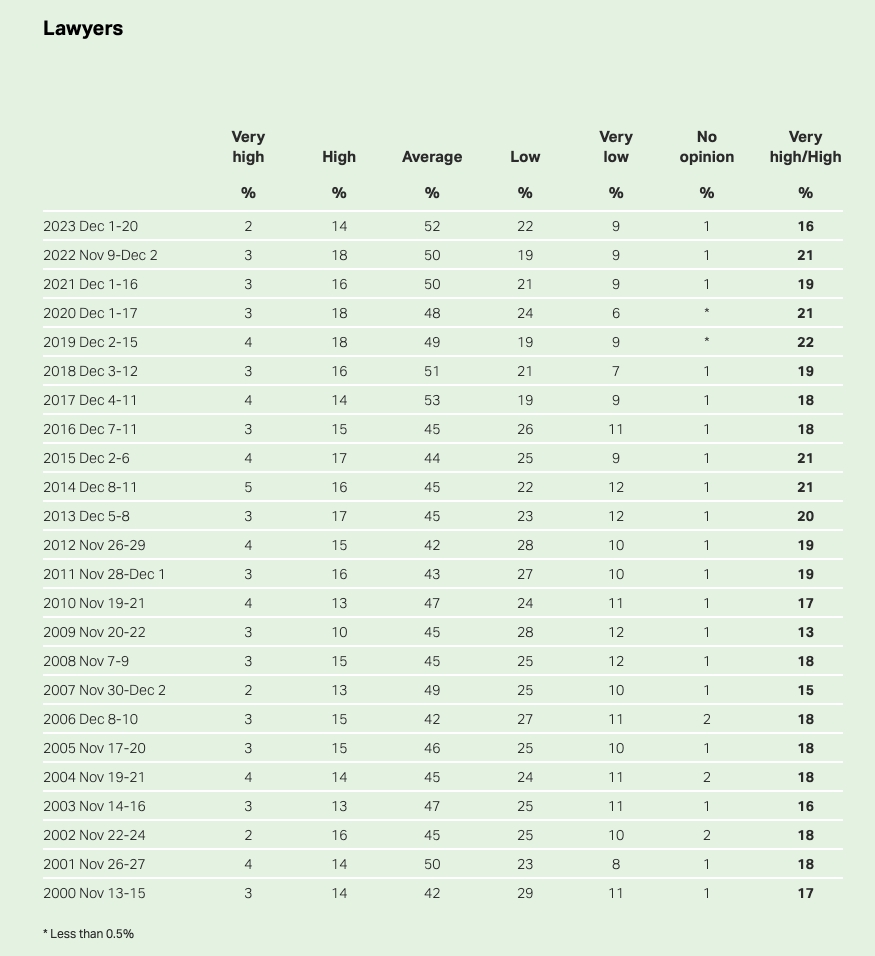

According to ALM’s and Law.com’s latest research on lawyer burnout statistics, nearly 50% of legal professionals believe that substance abuse and mental health problems are at a crisis level in their industry. 71% of lawyers experience some form of anxiety, and 38% admitted to suffering from depression. Many also admitted to feeling exhausted (70%), having trouble concentrating (62%), and being moody and irritable (60%).

These statistics underscore a pervasive issue within the legal profession. While many lawyers struggle with mental health and burnout, there are actionable strategies to manage stress. Law firms can also implement measures to alleviate burnout and foster a healthier, more supportive work environment.

Warning Signs of Lawyer Burnout

Burnout can take different forms, but it has a few common red flags regardless of industry.

Constant Exhaustion

Everyone feels fatigued, overwhelmed, or exhausted at times, whether it’s from a particularly stressful day or a poor night’s sleep. Lawyers who feel exhausted all the time, no matter their sleep patterns or day-to-day stress, may be experiencing burnout.

Increased Irritability or Cynicism

Lawyers’ work is stressful and certain coworkers or clients may inspire conflict at times. But if a lawyer is consistently irritable or impatient with the law firm’s staff or clients, it could be burnout.

The same is true of cynicism. While lawyers may be more naturally cynical and critical as high-performers, excessive cynicism, especially in a lawyer who is usually more even-tempered and optimistic, could indicate a potential for burnout.

Loss of Focus

Balancing a lot of tasks and managing time effectively requires focus. If a lawyer experiences a loss of focus or motivation, it can be a serious indicator of burnout. Left unmanaged, this loss of focus can affect work.

Self-Medication

As indicated by the results of the cited research, lawyers are experiencing mental health concerns like depression, anxiety, and alcohol or drug abuse. Some lawyers may take to self-medicating for these conditions, whether with alcohol and drugs or with food, developing physical health problems. Self-medicating to address burnout is of particular concern because of its potential for serious health concerns.

Poor Sleep Patterns

Changes in sleep patterns can be telling. Lawyers experiencing burnout could suffer sleep disturbances, whether in difficulty falling asleep or difficulty staying asleep. This can make burnout worse since the lawyer isn’t getting the necessary physical and mental rest needed to handle their stress.

Strategies to Manage Lawyer Burnout

1. Planning

Lawyers are always facing demands, and some of them conflict. Court appearances, casework, and research, client meetings, staff meetings, conference calls, preparing for opposing counsel, responding to emails and text messages, and other tasks all beg for time throughout the day.

Balancing all of these tasks requires precise planning and more than just putting meetings in a calendar. Lawyers should plan out days, weeks, months, and quarters to get a comprehensive view of the track for the future and ensure that all necessary tasks are moving forward. The feeling of being overwhelmed often arises from not meeting expectations.

2. Blocking Out Time

With a big-picture plan for the future, lawyers can focus more on immediate planning for the upcoming days and weeks. Managing all these tasks requires swift mental pivots that can make them more challenging, and a lack of being in the right mindset can cost valuable time as lawyers try to refocus on the new task at hand.

Ideally, the day should be mapped out with time blocks for different tasks. Administrative tasks or tasks that require lower focus and tasks that require deep focus on a lot of mental stamina can be grouped together to prevent constant shifts in focus throughout the day.

Lawyers can start this planning before the week starts to make sure everything gets done and idle time is filled between meetings. Daily schedules can be adjusted as needed, but having a clear plan at the beginning of the week helps lawyers focus and prioritize.

3. Optimize Processes

Planning and time-blocking boost productivity and reduce overwhelm, but you can further enhance these by optimizing work processes.

An organized system that streamlines communications, lead generation, intake, and other processes can significantly reduce administrative burdens for lawyers. By using practice management solutions like Bill4Time, lawyers can do all this and more. Bill4Time automates routine tasks and integrates with existing systems, like email platforms, creating a seamless workflow that improves overall efficiency.

4. Establish Boundaries

Expectations and demands can derail the best of planning. Lawyers need to set and enforce boundaries to keep performing at a high level and ensure they’re setting themselves up for success. Client requests, court appearances, hearings, meetings, and never-ending deadlines can take a toll quickly, especially if they pop up in the middle of a lawyer’s already packed schedule.

Lawyers have to set clear boundaries, with both their clients and themselves, to avoid taking on too much and piling on the stress. With manageable workloads, lawyers can ensure they’re doing their best work.

One of the best ways to accomplish this and get in the habit is with new client onboarding. Clients expect responsiveness, but the first meetings can establish expectations for communications. For example, a lawyer can let their new client know that they may not get back to them within minutes of sending an email, but they can expect a response on the same day. This is another benefit of having time blocks for client responses since it sets up time periods in which clients can expect communication.

It’s also vital that lawyers set up boundaries for themselves. Lawyers should avoid taking too much work home with them, or if they do, they need clear cut-off points for when work stops and personal time begins. Of course, there will be times when lawyers need to spend more time working on briefs or preparing for court appearances, but that shouldn’t be happening every week. When most of the time is balanced, pulling a few more hours won’t be as detrimental.

5. Seek Help When Needed

Despite the best strategies, the pressures of the legal profession can become overwhelming. It’s essential to recognize when to seek help. Reaching out to colleagues, mentors, or professional counselors can provide support and perspective. If stress becomes too much to handle, lawyers can call the 988 Suicide & Crisis Lifeline for immediate help. This confidential service offers support for those experiencing a mental health crisis, providing a lifeline in times of need.

While the legal profession won’t slow down, taking these measures can help lawyers thrive and sustain a healthy work-life balance.