Internal Time Replacing Travel Time on the Time/Expense Page

[Read more…] about New Features for Internal Time, Flat Fee Projects & Trust Reports

Search Results for: trust accounting

What Is Attorney Time and Billing Software?

Attorney time and billing software helps law firms better manage their billing process by assisting with time tracking, invoice generation, expense monitoring, collections, and more. Timekeeping software for lawyers offers features that typical accounting software does not — features essential for compliance in the practice of law, such as monitoring billable hours and accommodating trust accounting.

Legal time and billing software brings a new level of efficiency, accuracy, and security to the billing process for attorneys. Keep reading to learn the basics of time and billing software for law firms and what benefits this software can provide your practice.

How Do Attorneys Keep Track of Their Time Using Software?

Attorney time and billing software has several features for legal time tracking — namely, digital timers that can be categorized by client, matter, and activity. This allows legal professionals to log time as they work on various tasks throughout the day, easily stopping and starting different timers as they switch tasks. When it’s finally time to prepare an invoice, the timers provide a clear record of what was done.

Rather than needing to remember each task and guess how long it took to perform, time tracking software makes it easy to record the time you spend on each task, even sorting it according to different hourly rates in your firm. Additionally, quality time tracking software often comes with a mobile app version, which lets you track time whether you’re in the office or leaving a court appearance. Switching between matters is as simple as stopping one timer and starting another.

How Does Legal Billing Work Through Software?

Once you’ve completed time entries for your billable tasks, legal billing software helps you quickly convert those entries to invoices. The most helpful features for this process include:

- Flexible rate structures to accommodate hourly rates, flat fees, or any other alternative fee arrangements.

- Customizable formatting to better match your firm’s brand or format aesthetics.

- Batch invoicing to simplify billing for ongoing services or high volumes of transactions.

From there, billing software can also assist with sending out invoices, collecting payment, and even issuing client reminders on automatic schedules. By removing much of the repetitive, time-consuming parts of the billing process, you have more time and mental energy to devote to your clients as well as billable tasks.

Software also speeds up the prebill review process with automation that catches errors and cuts down review time. Plus, it helps firms collect payments faster by giving clients a secure portal with 24/7 access to view and pay invoices online.

What Really Sets Good Time and Billing Software Apart for Attorneys?

The most important traits for time tracking software are convenience, reliability, and user-friendliness. The complex nature of legal billing makes it critical that any support software is simple to navigate, so you can find the information you need when you need it.

Some of the best features of a great billing software include:

- Automatic Payment Reminders | Rather than chasing down every unpaid invoice and having to track what’s been paid, schedule reminders to each client for collections

- Client Portals | Quickly see each client’s key information, including open matters, client budget, and billing rates that are specific to them

- Cloud-Based Software | Using a cloud-based program means less upfront cost, less infrastructure, and far more flexibility — including smartphone-compatible solutions to use on the go

- Reporting and Analytics | Get a better sense of your firm’s expenses, overhead, and which matters bring in the most success for your business

- Trust Accounting Management | Legal billing software works for lawyers in unique ways, including features that accommodate specific needs, such as IOLTA accounts

Legal billing software simplifies the way you track time, generate invoices, and collect payments. It also eliminates the work of transferring time logs to invoices by consolidating both processes to the same place. But also, and perhaps more importantly, it’s designed to fit the way you work.

Good billing software won’t add steps to your day or create more headaches, but quite the opposite: it will remove friction from your billing process, eliminate repetitive tasks, and leave a lot less room for error. Most software is also now cloud-based, meaning that if you have an internet-enabled device of any kind — be it phone, desktop, or laptop — you can start using this software as soon as today.

Bill4Time: The Best Timekeeping and Billing Software for Attorneys

Lawyers need their software to be intuitive, easy to navigate, and compliant with legal ethics. At Bill4Time, we place a strong focus on making solutions that make your job as a legal professional easier: by simplifying, streamlining, and securing the billing process.

Bill4Time lets you spend less time managing, and more time practicing — by automating the most time intensive billing processes and ensuring you always have access to client information, both in and out of the office.

Ready to make your billing process a whole lot easier? See for yourself what Bill4Time can do, and sign up for a free trial today. You can also click the button below to schedule a free custom demo, and we’ll walk you through how Bill4Time would work for your firm.

What Is the Best Time Tracking Software for Lawyers?

Legal time tracking software is the best way for lawyers to track their time. This software specifically caters to the complex nature of billable hours, with numerous features to help you organize your time and quickly generate accurate invoices. And the best legal time tracking software will be one that’s simple to use, easy to learn, supports your billing process, and has secure remote access.

Want to learn more about time tracking software? Keep reading as we examine what the best apps for keeping track of billable hours have in common. We’ll also take a detailed look at some of the options out there to see how they stack up against each other.

Let’s start with some key criteria you should be looking for in a quality legal time tracking software.

What Should You Look for When Choosing Legal Time Tracking Software?

When reviewing what the best app is for keeping track of your billable hours, the most important qualities are security, simplicity, and support. The software should comply with legal ethics rules, be easy to integrate into your practice, and provide ample support — both to your operations and to you as you learn how to use the software. Let’s look at each of these in further detail.

Security

Above all, the software you choose must protect your firm’s data and your client’s information, per Rule 1.6 of the ABA Model Rules of Professional Conduct. This is potentially the main reason you should be skeptical of using free or very cheap legal billing software: it likely lacks the safety measures to warrant ethical use. As you’re browsing options, make sure to ask about the provider’s security measures. Some examples of questions you could ask the provider might be:

- Are your security measures compliant with Rule 1.6 and similar legal standards?

- How do you protect your customers’ data?

- Who will have access to my data — and how will they gain access?

- How do you ensure the right people have access (and bad actors do not)?

Simplicity

Second to security is simplicity: how easy the software is to learn, and whether or not it simplifies your time tracking process. This applies not only to logging billable hours but also to your entire billing process, as the best software should be able to handle both.

On that note, time tracking works best when it’s part of a complete legal practice management solution; this way, when it’s time to create invoices, you don’t have to transfer your timesheets to another source. As you browse options, here are some questions you can ask the provider to ensure their software fulfills this need:

- Are there any parts of the billing and invoicing process your software doesn’t handle?

- Will I need any third-party integrations for any part of the tracking and billing process?

- How will this software save me time compared to doing it manually with a spreadsheet?

- Do you offer free demos and/or trials so I can see firsthand how your software works?

- How easy is it to log hours, generate invoices, and send them out with your software?

Support

The main benefit of using time tracking software is the assistance it provides and the structure it gives to your operations. For example, using software for task and workflow automation can help cut down time spent on the most repetitive tasks.

But support isn’t just about the software itself; it’s also about how much help the software provider gives you as you’re learning. Training resources, how-to videos, and live customer support are important because they give you the best chance to make the software work for your firm. Make sure to ask providers questions like:

- What resources do you have to help me learn your software?

- Where do I go if I have questions or don’t know how to do something in the software?

- Is there a dedicated account manager or support rep for my firm?

Attorney Time Tracking Software Options

Several providers exist, each with their own spin on software solutions. Here are a few of the most common options out there and some of the benefits they provide to users.

Bill4Time

Bill4Time makes tracking billable hours simple and efficient, with a cloud-based system that allows you to log time from anywhere. Its invoicing feature turns timesheets into invoices instantly, reducing the time spent on this administrative work. You can also customize your invoices with your own branding to keep your firm name top-of-mind.

And unlike many competitors, Bill4Time includes a built-in payment processor, so you can track time, invoice clients, and accept payments — all in one system, without relying on third-party integrations.

Legal professionals also praise Bill4Time’s easy-to-navigate interface and its wealth of legal-specific features, like LEDES or UTBMS formatting. Users also have access to live support, how-to guides, and training materials to get up to speed quickly — which doesn’t take long, as it’s an intuitive, easy-to-use software.

Clockify Time Tracker

Clockify is a general-purpose time tracking app designed for freelancers and businesses, with small-to-medium-sized companies as its primary users. It offers basic time tracking features, letting users log hours, share timesheets with clients, and generate invoices automatically. Clockify also includes productivity monitoring, allowing supervisors to track employee activity.

While Clockify works well for simple time tracking, it isn’t built specifically for legal professionals. That means it lacks law firm-specific features, such as built-in trust accounting compliance, legal billing codes, and client confidentiality safeguards required under ABA rules.

Google Workspace Options

Google offers a few time tracking solutions — namely, their Time Tracking app. This app focuses on simplicity and collaboration between multiple parties while tracking time. The time tracking components are not necessarily compliant with ethical practice standards, and you will most likely run into security and support issues if you decide to use them.

Does Google have a free time tracker? Technically, yes — some users rely on Google Sheets to create manual timesheets. While this might work in a pinch, spreadsheets can be difficult to organize, prone to errors, and time-consuming when it comes to turning tracked hours into invoices. These inefficiencies are precisely why many attorneys look for dedicated time tracking software instead.

Timesolv

Timesolv is another option that offers a way to track hours anywhere and streamline your billing process. Many of its features are useful for the billing process, but it lacks certain functions that help generate detailed, easy-to-read reports. Another drawback is the high cost of data migration — a necessary step for many firms switching from other case management or billing systems.

While it covers basic billing needs, Timesolv’s branding options are limited, and there are fewer pre-built invoice templates compared to other platforms. For firms that need fast, professional-looking invoices, this could be a roadblock.

Toggl Track

This time tracking software prioritizes generating customized data reports to help with finances and revenue growth. Although it calls out law firms as one of its clients, Toggl is not specific to the legal world, meaning it lacks components critical for legal billing, such as LEDES or UTBMS formatting.

Additionally, Toggl is solely for tracking time and cannot be used as a case management software. And while the low cost of a platform that just does time tracking may sound appealing, you’re likely going to end up spending even more money piecing together your legal workflow tech stack. Time tracking, after all, is just one part of practice management.

Track Your Time — and Your Practice — With Bill4Time

Most time tracking platforms aren’t built for the way law firms work. Even fewer offer the full support and practice management features that attorneys need. Bill4Time does both. It makes tracking billable hours simple and accurate while also providing a complete practice management solution to keep everything organized in one place.

Want to see how Bill4Time could improve your firm’s time tracking and workflows? Sign up for a free trial, or click the button below to schedule a free demo customized for your firm. We look forward to saving you time (and money)!

Law Firm Financial Management Tips for Profitability

Organizational chaos is a common theme in industries today, but it doesn’t have to be yours! While there may be hectic work days, there should never be hectic law firm financial management. If your firm’s finances have become unmanageable, client invoices are never sent out, trust funds are not separated, overspending is a norm, or there is no financial plan for your firm, you may find yourself in the hot seat!

Today, a plethora of technology, such as Bill4Time, helps attorneys prevent situations like this. If you did not know these law firm billing software organizations existed, you may want to consider their services to jump-start your firm’s financial livelihood.

In this blog, we’ll discuss the importance of maintaining financial management, what it looks like, and some strategies to get your firm on the right financial track.

What Is Law Firm Financial Management?

Law firm financial management refers to the systematic and strategic handling of a law firm’s financial resources and operations. This crucial discipline ensures your firm’s stability, growth, and overall success.

Managing finances within a law firm is a multifaceted discipline encompassing a spectrum of financial strategies tailored to the unique demands of legal practices. Accordingly, this intricate process involves a trio of elements: budgeting, billing, and financial planning.

- Budgeting in law firms involves planning and allocating financial resources. It encompasses setting financial goals, estimating revenues, and projecting expenses. Budgeting helps your practice establish a clear financial roadmap for a specified period.

- Billing is a critical component, directly impacting revenue generation. It involves accurately recording and invoicing clients for legal services provided.

- Financial planning involves setting long-term financial goals and devising strategies. It includes assessing your firm’s financial health, identifying improvement areas, and planning contingencies.

Why Proper Law Firm Financial Management Is Important

Effective financial management is the bedrock of a thriving law firm. It would be best to recognize that proficient financial stewardship is the compass guiding your firm toward sustained success, safeguarding against potential hazards.

Sound financial management provides stability and growth opportunities. It allows for strategic resource allocation, enhancing your firm’s ability to invest in cutting-edge technology, talent acquisition, and practice area expansion. Proactively approaching your law firm’s financial management bolsters your competitiveness and creates client-centered quality service.

Conversely, neglecting financial management can lead to dangerous pitfalls. The consequences of financial negligence are stark! Without sound management, overspending, client payment issues, and unforeseen expenses can erode profitability. Ethical and regulatory breaches become more likely, tarnishing your firm’s reputation.

Your law firm’s financial management weighs heavily in favor of diligence. Knowing the outcomes enables you to make educated choices about managing your firm’s finances effectively, helps you maintain client trust and reputation, and adhere to ethical and legal standards.

Common Struggles and Errors in Law Firm Budgeting

Effective budgeting is the linchpin of financial stability within law firms, yet many encounter challenges and errors that can impede their financial health. Let’s delve into some of these issues and understand how they can jeopardize a firm’s stability.

- Inadequate Expense Forecasting: Firms often struggle to accurately predict expenses, leading to budget shortfalls. Failure to account for unexpected costs, such as technology upgrades or litigation setbacks, can strain finances.

- Overlooking Revenue Variability: Law firms frequently underestimate the variability of revenue streams. Over-reliance on a single client or practice area can result in financial instability if that source diminishes.

- Ignoring Seasonal Trends: Many firms overlook the seasonal nature of legal work, causing uneven cash flow. Failure to plan for lean periods can lead to cash flow problems and hinder financial stability.

- Unrealistic Growth Projections: Ambitious growth goals can strain resources if not aligned with your firm’s capacity. Expanding too rapidly can lead to overextension and financial difficulties.

- Inadequate Technology Investment: Failing to invest in updated legal technology can hinder efficiency and client service. Inefficient processes can inflate costs and reduce profitability.

Regulations Around Law Firm Budgeting

Within the realm of legal finance management lives regulations surrounding law firm budgeting. Law firm budgeting is subject to an extensive web of legal regulations and industry standards that you must navigate with precision. Failure to comply with these mandates can have far-reaching consequences. Here are some regulations to consider.

- Ethical standards require law firms to maintain accurate client trust accounts, also known as Interest on Lawyers’ Trust Accounts (IOLTA). This ensures that client funds are segregated and used solely for intended purposes.

- Legal ethics emphasize transparent billing practices. Failure to provide clear and accurate billing statements can lead to disputes, damaged client relationships, and potential legal malpractice claims.

- Industry standards dictate that clients must clearly define and understand fee agreements. Ambiguity or non-compliance with agreed-upon terms can lead to fee disputes and legal malpractice claims.

- Some jurisdictions require law firms to submit financial reports. Non-compliance may trigger investigations and legal actions.

Non-compliance can result in professional sanctions, financial penalties, loss of reputation, and even legal consequences, making it crucial for you to navigate these regulations diligently.

Best Practices for Effective Law Firm Financial Management

As you seek to strengthen your firm’s legal financial management strategy, consider the best practices to navigate the complexities of financial management successfully. Here are some actionable tips, including the pivotal role of technology:

- Strategic Budgeting: In order to prevent financial surprises, develop a comprehensive budget that aligns with the firm’s goals and accounts for all expenses, including those often overlooked.

- Expense Monitoring: Regularly review expenses and identify areas where cost-saving measures can be applied without compromising service quality.

- Diverse Revenue Streams: Diversify your client base and practice areas to reduce reliance on a single source of revenue, thus mitigating financial risks.

- Billing Efficiency: Implement efficient billing processes using technology such as Bill4Time, ensuring accuracy, transparency, and timeliness in invoicing clients.

- Client Trust Accounting: Scrupulously manage client trust accounts, adhering to ethical standards, and employ dedicated accounting software to automate and simplify trust accounting tasks.

- Financial Technology: Leverage modern financial management tools and software to streamline tasks like financial reporting, analytics, and compliance monitoring.

- Regular Financial Review: Conduct periodic financial reviews. Then, track progress, identify trends, and adjust strategies as needed.

- Professional Development: Invest in staff training to enhance financial acumen throughout the firm.

What is Law Firm Billing Software?

With law firm financial management, the smoking gun relies on having the best software to implement the processes. Law firm billing software is a specialized tool designed to streamline and optimize the complex process of invoicing clients for legal services rendered. Likewise, it plays a pivotal role in supporting efficient financial management within legal practices.

For example, here are some core functionalities to have in your billing software:

- Time and expense tracking

- Customized invoicing

- Automated billing

- Client portals

- Billing integration tools

When considering streamlining billing processes, choose a billing software such as Bill4Time that:

- Reduces errors

- Enhances efficiency

- Increases compliance

- Improves Client relations

In order to benefit your firm, your billing software should accelerate payment collection and enhance compliance with ethical regulatory billing standards. Streamlining processes support comprehensive financial reporting and analysis, enabling you to make informed decisions about your firm’s finances.

How Legal Payment Software Supports Financial Management at Law Firms

Legal payment software plays a pivotal role in law firms’ revenue collection and financial management strategies. Its multifaceted functionalities enhance economic efficiency and accuracy, eventually contributing to the firm’s financial health.

One key aspect is automated invoicing. Legal payment software automates the billing process, therefore, generating invoices promptly and accurately. This expedites revenue collection and reduces the risk of billing errors that can strain client relationships.

Plus, billing software solutions often offer secure payment processing options, ensuring clients can make payments conveniently and securely and enhance overall satisfaction. Another critical feature to have is real-time financial reporting. Legal payment software provides insights into your firm’s financial performance.

The right billing management software, such as Bill4Time, is indispensable for your firm’s financial management. Its ability to streamline revenue collection, secure payments, and offer real-time financial insights empowers your firm to maintain financial health and confidently make strategic decisions.

Steps to Effectively Manage Finances at Law Firms

Managing finances at your firm demands a strategic approach. In order to ensure fiscal stability and growth, follow this step-by-step guide that includes budget creation, expense tracking, revenue analysis, and financial reporting:

- Comprehensive Budget Creation: Craft a comprehensive budget that covers all financial aspects of your firm, from day-to-day operational expenses to long-term investments.

- Precise Expense Tracking: Implement a robust system for tracking expenses. After that, categorize and monitor expenditures closely to identify areas for cost-saving and resource optimization.

- Thorough Revenue Analysis: Regularly scrutinize your revenue streams. Then, identify the most profitable practice areas or clients and assess the effectiveness of your billing and collection processes.

- Strategic Financial Reporting: Develop a system for regular financial reporting. This provides insights into your firm’s financial health, enabling you to make data-driven decisions.

- Continuous Evaluation and Adaptation: Above all, be adaptable. Continuously evaluate your financial strategies and adjust them as needed in response to changing market conditions or firm-specific factors.

By following these steps, your firm can precisely navigate the intricate terrain of financial management, ensuring financial stability and a strong foundation for growth in a competitive legal landscape.

Secure Your Firm’s Financial Future By Having A Law Firm Financial Management Plan

In short, proper law firm financial management is vital to your firm’s success. A well-crafted budget, a healthy understanding of your firm’s financial position, and the appropriate law firm billing software management like Bill4Time are crucial to ensure your firm has what it takes to go the distance! Embracing financial best practices can significantly boost profitability and drive sustained growth.

The Ultimate Guide to Easy Legal Billing Software

As a law firm, one of the biggest challenges you face is ensuring that you get paid for your services. Invoicing can be a time-consuming and complicated process, but with the right legal billing software, you can simplify your billing process and accelerate your revenue. In this comprehensive guide, we will explore what makes a billing software easy to use and how you can find the best solution for your law firm’s needs.

Why is Easy Legal Billing Software Important?

In the midst of a busy legal practice, it’s crucial to have a billing software that is user-friendly and efficient. Here are some key reasons why easy legal billing software is important for your law firm:

- Time-Saving: Easy-to-use billing software streamlines the invoicing process, allowing you to quickly create, print, or email professional invoices in minutes. This saves you valuable time that can be better spent on serving your clients.

- Faster Payments: Clients often delay payment if they don’t understand the invoice. With easy legal billing software, you can provide detailed invoices that make it easier for clients to understand and pay promptly. You can also offer online payment options, further accelerating the payment process.

- Increased Productivity: Easy legal billing software allows you to batch invoices, apply payments to current invoices, and create invoice summaries quickly and easily. These features increase your workflow efficiencies and enable you to handle billing tasks more effectively.

- Professional Branding: A professional invoice template is a reflection of your law firm’s brand. With easy legal billing software, you can customize your invoices with your logo, company details, payment terms, late fees, and more. This branding helps create a positive impression and enhances your firm’s professionalism.

Now that we understand the importance of easy legal billing software, let’s dive into the features you should look for when evaluating different options.

Finding the Right Legal Billing Software for Your Firm

With the multitude of options available, finding the right legal billing software for your law firm can be overwhelming. Here are some steps to help you find the best solution:

1. Identify Your Firm’s Needs

Start by identifying your law firm’s specific billing requirements. Consider factors such as the number of users, types of cases you handle, billing rates, and integration needs with other software. This will help you narrow down the options and focus on software that aligns with your firm’s needs.

2. Research and Compare Software Options

Conduct thorough research on different legal billing software providers. Read customer reviews, visit their websites, and request demos or free trials. Pay attention to the features, ease of use, customer support, and pricing plans. Make a list of software options that meet your firm’s requirements.

3. Evaluate Integration Capabilities

Consider the software’s integration capabilities with other tools you use in your law firm, such as case management software or accounting software. Seamless integration can streamline your workflow and reduce manual data entry.

4. Check for Data Security and Compliance

Ensure that the legal billing software you choose prioritizes data security and complies with industry standards and regulations. Look for features like encryption, secure data storage, and regular backups to protect your firm’s sensitive information.

5. Consider Pricing and Scalability

Evaluate the pricing plans of the software options you are considering. Consider whether they offer flexible pricing based on the number of users or cases. Also, think about the scalability of the software. Will it be able to grow with your firm’s needs in the future?

6. Request a Demo or Free Trial

Before making a final decision, request a demo or take advantage of a free trial. This will allow you to test the software’s features, user interface, and overall usability. It also gives you an opportunity to assess the level of customer support provided by the software provider.

Easy Legal Billing Features with Bill4Time

When evaluating legal billing software options, one name that stands out is Bill4Time. Bill4Time offers a comprehensive suite of features designed specifically for law firms. Let’s explore how Bill4Time meets the criteria we discussed earlier:

User-Friendly Interface: A user-friendly interface is crucial for easy legal billing software. Look for software that has an intuitive design and a straightforward navigation system. This will ensure that you and your team can quickly adapt to the software and start using it efficiently.

Bill4Time provides an intuitive and easy-to-use interface, allowing you and your team to quickly adapt to the software.

Customizable Invoice Templates: The ability to customize invoice templates is essential for creating professional and branded invoices. Look for software that allows you to add your law firm’s logo, contact information, payment terms, and late fees. This customization will help you maintain consistency in your branding and provide a polished image to your clients.

With Bill4Time, you can easily customize invoice templates with your law firm’s branding, ensuring a professional and consistent image.

Flexible Billing Rates: Different clients may require different billing rates. Ensure that the legal billing software you choose offers flexibility in setting billing rates. Look for software that allows you to mix hourly and flat rates for every user and easily override default rates when necessary.

Bill4Time allows you to set and manage flexible billing rates, like task-based flat fees, accommodating the unique needs of your clients.

Detailed Invoices and Statements: Clear and detailed invoices are crucial for ensuring prompt payment. Look for software that allows you to create pre-bills, detailed invoices, and statements. This feature will enable you to provide clients with the necessary information to understand and pay your invoices quickly.

You can create detailed invoices and statements with Bill4Time, providing clients with the necessary information to understand and pay promptly.

Online Payment Options: Offering online payment options with Bill4Time Payments can significantly speed up the payment process. Bill4Time seamlessly integrates the invoicing process with payments, allowing your clients to make payments directly from the invoice. This convenient feature not only accelerates payment, but also enhances the client experience.

Trust Accounting Reconciliation: If your law firm handles trust accounts, ensure that the legal billing software you choose includes trust accounting reconciliation features. This will help you maintain accurate records of client funds and ensure compliance with legal and ethical requirements.

Bill4Time includes trust accounting reconciliation features, ensuring accurate management of client funds.

Integration with Accounting Software: To streamline your billing and accounting processes, look for legal billing software that integrates with popular accounting software like QuickBooks. This integration will allow you to transfer billing and financial data seamlessly, saving you time and reducing the risk of errors.

If you’re looking to switch softwares or integrate what you use now with Bill4Time, the process is easy. Bill4Time integrates with popular accounting software like QuickBooks, streamlining your billing and accounting processes.

24/7 Client Access: Consider legal billing software that provides a secure client portal where clients can access their invoices 24/7. This feature allows clients to review their invoices at their convenience and make online payments via credit card or other online payment options. It enhances client satisfaction and expedites payment.

Clients can access their invoices 24/7 via the secure Bill4Time client portal, enhancing convenience and expediting payment.

Reporting and Analytics: Reporting and analytics features provide valuable insights into your firm’s billing performance. Look for software that offers robust reporting capabilities, allowing you to track billable hours, monitor outstanding invoices, and analyze your firm’s financial performance. These features help you make informed decisions to optimize your billing processes.

Bill4Time offers robust reporting and analytics features, providing valuable insights into your firm’s billing performance.

Security and Data Protection: When considering any legal billing software, prioritize the security and protection of your data. Ensure that the software uses encryption and other security measures to safeguard your firm’s sensitive information. Additionally, review the software provider’s data handling practices, such as server location, data backup procedures, and access controls.

Bill4Time prioritizes the security and protection of your data, employing encryption and other security measures.

Use Bill4Time to Make Legal Invoicing and Billing Easy

Finding easy legal billing software is essential for streamlining your law firm’s billing process and accelerating your revenue. Consider the features we discussed, evaluate different options, and choose a software solution that meets your firm’s specific needs. With the right legal billing software, you can simplify your invoicing, get paid faster, and focus on serving your clients effectively.

To see for yourself how Bill4Time can simplify your legal billing process, request a demo from our website. Take advantage of our 14-day free trial to explore all the features and experience the ease of use firsthand.

How Customers Shaped Our New Electronic Retainers in Bill4Time Payments

When it comes to product development, one thing is certain, customer feedback is our guiding star. As product manager it’s my responsibility to listen to that feedback to ensure we are creating the right features for our customers. Over the past few months while scoping out our Bill4Time Payments launch, we repeatedly saw the need for electronic retainer payment functionality. Today, I’m happy to announce that electronic retainer payments are now available for organizations that have activated Bill4Time Payments. For the first time ever, you can now process payments online into a Trust account directly and send requests for retainer payments within Bill4Time.

Requesting Retainers or Advanced Fees With Bill4Time Payments

While accounting for law firms presents many unique challenges, the Trust accounting and retainer processes are crucial to get right in order for your law firm to remain compliant. Knowing this, our product and engineering teams worked directly with our customers to ensure that this sensitive task of maintaining compliance while using Trust payments was as simple and user-friendly as the rest of the Bill4Time platform.

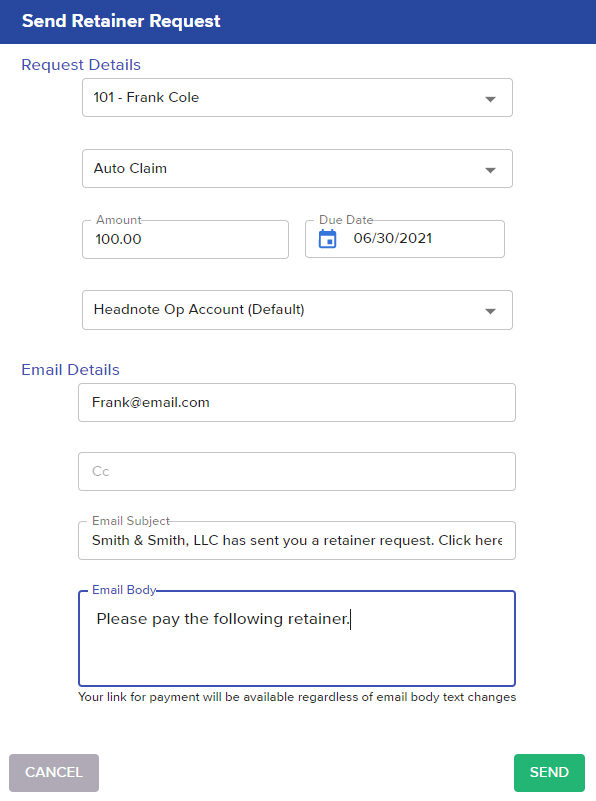

So how does it work? Now in Bill4Time Payments, retainers or advanced fee requests can be utilized to request funds from your client without having to send an invoice. Depending on your unique circumstances, you have the capability to select the bank account you would like to receive the payment into — your Operating or Trust account. These payments will be tied to the Client and Matter selected and can be easily applied to pay off any outstanding or future invoices.

To remain compliant, Bill4Time never takes processing fees from any Trust account payment. In addition, any Trust fees are pulled from the linked Operating account automatically, so Trust money stays Trust money.

If you need a refresher on Trust accounting and the importance of separate Operating and Trust accounts, I highly recommend reading our Trust accounting refresher blog that gives a great overview of what you need to know in order to remain compliant.

A Familiar, User-Friendly Experience Awaits

Receiving retainer payments should feel intuitive for organizations using Bill4Time Payments and their clients who have used the platform already. Just as you would send a request for payment to your client from the new Bill4Time Payments tab, you can now do the same for a retainer request. The primary difference here is the necessary steps needed to select which bank account your funds will be deposited into.

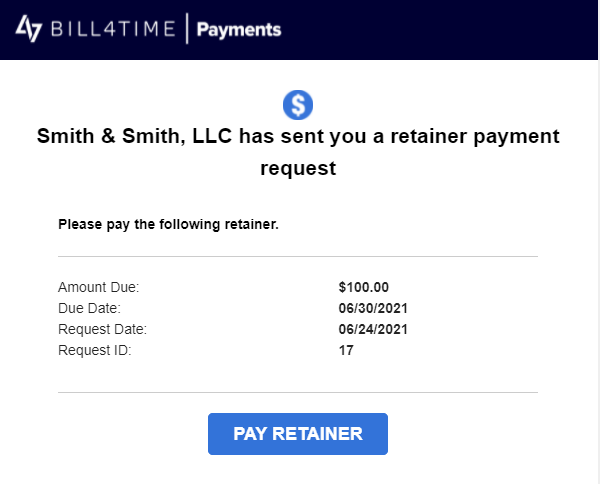

Once sent, your clients will receive an email containing a link to pay, just as they do when sent an invoice directly from Bill4Time. They will then be able to pay the retainer request via Credit Card or eCheck. Once the payment has been processed, they will receive a payment confirmation email with all relevant information for their personal records.

For a complete walkthrough of the Bill4Time Payments Retainer process, check out our Knowledge Base article.

While these sample screens seem relatively straightforward, they hold a tremendous amount of information that can be read by any attorney in a matter of moments. This isn’t by chance — it took many iterations and reviews by our dedicated Bill4Time Product Council customers before we felt we had the right workflow for all of our customers to succeed.

Whether it be Zoom walkthroughs, feedback via phone and email, or even deep-dive surveys, our Product Council customers were integral to the success of this new electronic retainer feature. If you are curious about being part of our Product Council and wish to shape the future of Bill4Time as a whole, we are always looking for willing participants. Current customers can fill out this simple form to begin the process.

We’re thrilled to offer electronic retainer payments to Bill4Time Payments customers. We know how important it is to the integrity of your billing process and the overall success of your business. You can get started with electronic retainer payments today by visiting the payments tab in your account, or activate Bill4Time Payments by submitting the application in your account — it only takes ten minutes to apply.

If you’ve been waiting on retainer payment functionality to get started using Bill4Time, sign up for a customized demo below to learn how to get started.