In the legal profession, your time is one of your most important assets. Every moment spent researching case law, drafting documents, or advising clients contributes directly to your firm’s success.

Keeping track of those moments, however, is often easier said than done. Time tracking frequently gets pushed aside, relegated to quick notes at the end of a long day or overlooked entirely during a busy week. Without consistent and accurate time tracking, billable hours—and, by extension, your revenue—can slip through your fingers.

Many attorneys rely on free timesheet templates in Word, Excel, or Google Docs, but these tools often fall short when applied to the nuanced workflows of a law firm. Others use paper systems that are even more prone to error. If you’ve been asking how to track time as a lawyer, the reality is that modern legal time tracking software offers a more reliable solution.

This guide gets into every aspect of attorney time tracking templates, exploring their uses, limitations, and how they stack up against specialized time tracking software. If your current time tracking method feels outdated, you’ll find practical advice here for improving accuracy, saving time, and increasing revenue. We’ll cover the following below:

- The importance of time tracking

- Methods of time tracking and using templates

- What should go on a billable hours spreadsheet template

- Attorney time tracking template examples in Word, Excel, and Google Docs

- How to use time tracking software

First, Why Is Time Tracking Important for Lawyers?

Tracking time helps lawyers turn their daily work into revenue while maintaining transparency, efficiency, and accountability. From managing client relationships to maintaining professional standards, effective time tracking has benefits that go beyond simple billing, such as:

Bringing Visibility to Your Work

Every phone call, email, and hour spent preparing for a case holds value. Without clear documentation, much of that effort can go unnoticed or unbilled. Time tracking helps you capture the complete picture of your work, making sure no effort is overlooked. It also provides a way to connect the hours you invested with the outcomes you delivered.

Protecting Your Reputation and Staying Transparent

Incomplete or sloppy time records can lead to client concerns—or worse, claims of overbilling. For a profession built on trust, accurate time tracking provides the transparency your clients expect. It also protects your reputation by demonstrating adherence to professional standards.

Discovering Where Time Is Wasted

Time tracking is a chance to see where inefficiencies exist. Maybe you spend too many hours on tasks that don’t require your legal expertise, or administrative work is eating into valuable client-facing time. Identifying these patterns can help you reclaim hours that could be put to better use.

Building Stronger Client Relationships

Clients often have little visibility into what their attorney is doing behind the scenes. Detailed time records can change that. When clients see how their case is progressing and where you’re spending your time to achieve their goals, it fosters confidence and strengthens the relationship. And if that client has friends or family that need an attorney, chances are they’ll likely recommend you.

Despite its clear advantages, time tracking is often treated as an afterthought. Many lawyers delay time tracking, leading to significant losses in billable hours—up to 15% by day’s end, 25% by the next day, and 50% by week’s end. If law firms want to improve their operations and deliver exceptional service, they need to rethink how they approach timekeeping. Better methods lead to more accurate billing, stronger ethics, and smarter growth strategies.

How Do Lawyers Track Their Hours?

Lawyers typically use one of three methods to log billable hours: manual tracking, templates, or specialized software. Each option offers different levels of accuracy and convenience, with templates often acting as a middle ground between old-school methods and modern tools.

1. Manual Timekeeping

Many attorneys still use notebooks or scraps of paper to jot down their hours, often filling in the details after the fact. While this low-tech method requires no fancy tools, it’s full of challenges. You can forget tasks, lack details in your descriptions, and easily leave billable time out completely. Beyond that, manual tracking can create inconsistencies across a firm, making it harder to stay organized and run smooth billing processes. For many lawyers, this approach ends up costing time—and money.

2. Template-Based Tracking

For those seeking more organization, an attorney timesheet template in Word or Excel offers a structured alternative. Templates should include pre-formatted fields for key details such as date, client name, task description, and time spent (you can find some examples in later sections of this blog). A lawyer timesheet template in Excel, for instance, might even include basic formulas to calculate totals.

However, templates come with limitations. They still require manual effort to input and manage data, leaving room for human error. Additionally, templates lack scalability and customization, often making them ill-suited for firms with multiple timekeepers or complex billing needs. Even an attorney timesheet template that’s free to use can feel cumbersome as workloads grow, highlighting the need for a more efficient system.

3. Time Tracking Software

For attorneys seeking both precision and convenience, legal time tracking software like Bill4Time bridges the gap. Unlike templates, legal software automates critical functions such as real-time tracking, task categorization, and invoicing. It also eliminates common pain points, like forgotten entries or inconsistent formats, by providing a unified platform tailored to legal workflows.

Features such as built-in UTBMS codes and detailed reporting capabilities make software the most comprehensive solution. While templates may suffice for solo practitioners or those starting out, software becomes essential as firms grow and face more complex demands.

Templates often appeal to attorneys who want an inexpensive option, but they tend to reveal their shortcomings quickly. When evaluating time tracking methods, it’s important to assess not just the upfront cost but also the long-term impact on accuracy, productivity, and client trust. Attorney time tracking templates offer a stepping stone, but many firms find that modern platforms like Bill4Time ultimately provide the consistency and efficiency they need.

For those considering free templates, let’s explore how these options compare and how they might work out for your firm.

What Is a Billable Hours Spreadsheet for Lawyers?

A billable hours spreadsheet or template provides a structured way for lawyers to log their work and manage billable time. Typically designed in Excel, these templates allow attorneys to track tasks and hours with predefined categories. They serve as an accessible starting point for organizing timekeeping, especially for solo practitioners or smaller firms. A standard template might include:

- Date: Capturing when the work occurred.

- Client Name/Matter: Clearly associating time entries with the relevant case or client.

- Task Description: Summarizing the activity performed, such as drafting, court appearances, research, client meetings, etc.

- Time Spent: Logging hours in standard increments like six or fifteen minutes to align with industry norms.

- Rate/Total: Fields to calculate fees based on your hourly rate.

While these templates aim to bring order to time tracking, they often fall short of meeting the complex needs of a law firm. Unlike more advanced time tracking systems, a billable hours spreadsheet doesn’t account for interruptions, non-billable tasks, or UTBMS codes. These limitations make templates a stopgap solution, suitable for basic time tracking but insufficient for the detailed invoicing and compliance standards most firms require.

For attorneys exploring time tracking solutions, templates can be helpful for basic organization, but their static format and lack of automation often create inefficiencies. They highlight the need for a more adaptable and scalable system, especially as firms grow or handle increasingly complex billing requirements. An attorney time tracking template should ideally integrate into a broader system that streamlines processes, minimizes errors, and supports compliance.

If you’re looking for an attorney timesheet template, you may be tempted to download one of the many free options online. Let’s evaluate the strengths and weaknesses of these templates before comparing them to more modern solutions.

Does Word Have a Timesheet Template for Law Firms?

Word doesn’t seem to offer a time tracking template specifically for law firms, although you can find a few subpar examples online. For example, consider this one made in Word:

The immediate problems with this template may not be evident right away, but ask yourself this:

- How do you know what the attorney’s hourly rate is?

- How should timekeepers with different rates working on the same case handle their calculations?

- How can you tell what the billing time increment is?

- How should UTBMS codes be applied to specific tasks or line items?

- How can an attorney accurately log time when a task is interrupted multiple times?

- How do you differentiate between services, expenses, travel, etc.?

- How do you calculate legal billable hours?

This template doesn’t address many of the challenges attorneys face, yet it’s been downloaded tens of thousands of times. Users have even pointed out that it doesn’t include basic Excel calculations, leaving them to manually total their billable hours.

We understand the frustration, Linda. With everything attorneys have on their plates, manually calculating hours shouldn’t be part of the process. Unfortunately, even free Excel timesheet templates often fall short. Let’s explore why.

How Do I Create a Time Tracking Sheet in Excel?

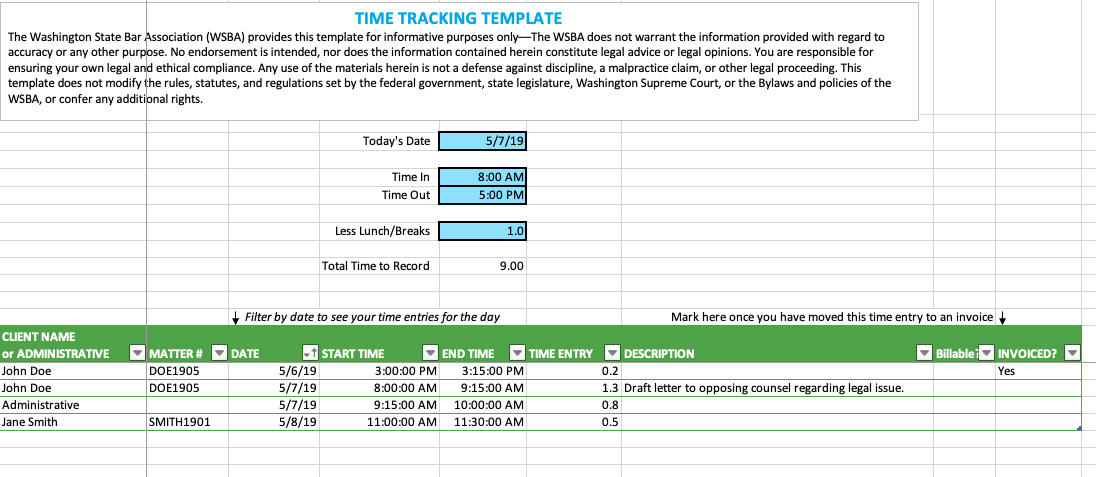

If you’re set on building your own tracking system, “How do I create a simple timesheet in Excel?” is a common question. Consider this example that the Washington State Bar Association provides as a solution to people asking, “How do I create a monthly timesheet in Excel?”

This isn’t a bad start, but again, issues will likely start coming up as you use it, like:

- It requires manual input, leaving room for errors and inconsistencies.

- It doesn’t integrate with any billing systems, so invoices have to be created separately, and there’s no easy way to pull all the time for one client or matter.

- Users must manually transfer recorded hours to an invoicing platform, increasing the risk of lost data or missed entries.

- There’s no way to automatically capture time in real-time, making it easy to forget tasks.

- Interruptions aren’t accounted for, so fragmented work is difficult to track.

- You can’t easily pull reports or analytics to understand productivity or profitability.

For those with more complex needs, Excel’s versatility can be a double-edged sword. While you can tailor templates to fit your firm’s workflows, the process often requires advanced knowledge of formulas and formatting. And even then, creating an invoice from the template becomes a headache on its own.

So, what about Google Docs? Is there a better solution there? Let’s take a look.

Is There a Billable Hours Template in Google Docs?

Google Docs is another popular tool for free templates. A billable hours template in Google Docs mimics the functionality of Word with slightly easier collaboration features. While convenient, it suffers from the same limitations:

- No built-in calculations or tracking

- Lack of fields for legal-specific data like UTBMS codes

- Potential inconsistencies across user-generated templates

These shortcomings often prompt attorneys to seek more robust solutions tailored to their profession.

How Do Lawyers Record Billable Hours Using Time Tracking Software?

Tracking time with templates or spreadsheets may work for small tasks, but it often leads to missed hours and unnecessary frustration. After exploring the limitations of manual systems, Word, Excel, and Google Docs templates, it becomes clear why many attorneys turn to legal time tracking software, like Bill4Time. Here’s how it works:

1. Log Hours as You Work

Manual methods often lead to legal professionals entering their time at the end of the day—or even later—which will result in forgotten details. Bill4Time eliminates this issue by allowing you to track time in real time. For example, if you’re interrupted by a client call while drafting a motion, you can pause one timer, start another, and pick up where you left off without missing a moment.

2. Make Billing Easier

Manual billing is tedious and leaves too much room for mistakes. With Bill4Time, recorded hours flow directly into automatically generated invoices, complete with task-specific rates for partners, associates, or paralegals. You can skip the hours of recalculating totals and instead generate detailed invoices with just a few clicks.

3. Use Customizable Categories

Unlike most templates you’ll find on the internet, Bill4Time is built with legal workflows in mind. Attorneys can categorize their time entries by specific tasks, such as drafting, client meetings, or court appearances, and even use UTBMS codes for clients who require detailed, task-based billing.

Additionally, these detailed categorizations make pulling reports significantly easier and more meaningful. Firms can analyze time spent by task type, client, or matter to identify inefficiencies, optimize workflows, and evaluate profitability.

4. Track Billable and Non-billable Hours

Attorneys don’t spend all their time on billable tasks—administrative work, team meetings, and training also take up hours. Bill4Time makes it simple to log both billable and non-billable time. Insight like this can help you identify inefficiencies, like excessive time spent on admin tasks, and make smarter decisions about delegating or reorganizing workloads.

5. Access from Anywhere

While templates can be stored on a cloud drive, their usability on mobile devices leaves much to be desired. Adjusting columns, scrolling through rows, and entering data on a small screen can be cumbersome and error-prone—especially for attorneys working in fast-paced environments.

Bill4Time, on the other hand, is cloud-based and optimized for desktop and mobile use, offering a seamless experience across devices. After a client meeting at the courthouse, you can easily log your time using the Bill4Time mobile app without struggling with clunky formatting or awkward data entry.

6. Pull Automatic Audit Trails for Transparency

Spreadsheets and templates won’t inherently offer a secure, tamper-proof way to track changes across different users or devices. With Bill4Time, every action—whether it’s creating, editing, or adjusting a time entry—is automatically logged. Having a built-in audit trail helps your firm stay transparent and resolve any client questions by knowing exactly who made changes and when. Plus, all the data is stored in one centralized system, making it far more reliable and accessible than scattered spreadsheets.

7. Track Time and Expenses in One Place

Many templates focus only on time and require attorneys to manage expenses separately. Bill4Time combines both, allowing you to log expenses like travel, lodging, or filing fees alongside your hours.

What Do Lawyers Use to Keep Track of Billable Hours?

For many attorneys, time tracking starts with templates—simple, easy-to-access tools that promise to bring structure to their day. But as we’ve explored, templates often reveal their limitations as workloads grow or billing needs become more complex. They’re a stepping stone, not the end solution.

Today’s legal professionals increasingly turn to software like Bill4Time, which not only offers robust time tracking but is also a full legal practice management solution (LPMS). Having your time tracking integrated directly into your LPMS streamlines every aspect of your firm’s operations, from case management and client communications to billing and reporting. With all your tools connected in one platform, there’s no need to juggle separate systems or risk errors from manual data transfers.

While templates can work as a temporary fix, they don’t grow with your firm’s needs or provide the holistic support of a complete practice management solution. Bill4Time does, combining time tracking with the tools you need to manage your firm effectively and profitably. Whether you’re working from the courthouse, the office, or home, Bill4Time makes tracking your hours—and managing your practice—effortless.

If you’re ready to experience a more efficient way to manage your time and billing, try a free trial of Bill4Time or click the button below to schedule your personalized walkthrough today.