It’s a common problem.

You’ve sent invoices to your clients, but you haven’t received payment. You’re a professional, so you pick up the phone and call your client.

You’re hit with the news.

Your client states they haven’t received your invoice. You look into the problem and you discover that the invoice was automatically rejected due to the missing budget for a matter on the invoice.

Are you compiling and guiding your invoices?

You know invoicing is complicated.

The billing workflow in many law firms is a multi-step process.

- Timekeepers track/reconstruct their time (if reconstructed, firms lose as much as 70 percent of their income if they wait one week to record their time)

- Accounting creates pre-bills for managers/partners to review. These invoices then are submitted to clients

- Accounting runs into errors with their eBilling systems and has to document them. Managers/partners have no idea that clients haven’t received their bills. Collection with accounts receivables is delayed

- Accounting reaches out to timekeepers to resolve the issue

- Collection teams attempt to collect on an invoice the client (a.) has never received (b.) is completely unaware of. Collection activity stops temporarily as teams work to resolve the issue.

- If they’re lucky, managers/partners in the firm are aware of the problem at this stage, they’re unhappy. Clients may feel they’re treated unreasonably or that the firm has acted unprofessionally.

Several issues stand out here:

- Firms have lost 70 percent of their income due to attorneys reconstructing their time after just one week (many wait a month pushing losses further)

- Accounting runs into billing issues but the appropriate parties aren’t notified. Without appropriate reconciliation procedures, firm leadership may not identify the problem quickly

- Accounts receivables are delayed, disrupting cash flow. Multiply this scenario by 25 to 100 invoices and cash flow is severely disrupted

- The client/firm relationship is harmed. This leads to a breakdown in the relationship, adding yet another barrier to client retention.

Are you seeing this?

This is a common problem for many law firms. There’s a disconnect that exists at each stage of the workflow.

Compile Invoices accurately, shepherd carefully

The success of your billing workflow depends on both. There are simple strategies you can use to eliminate unnecessary disruption.

Compile invoices accurately

- Verify and monitor contemporaneous (as-it-happens) billing in your firm. Timekeepers should track their time automatically, as-it-happens. Your practice management software should provide you with the reporting you need to audit timekeepers in your firm. Provide your accounting team with the access they need to verify compliance.

- Provide managers/partners with timekeeping reports at specific intervals (e.g. daily, weekly, monthly, etc.).

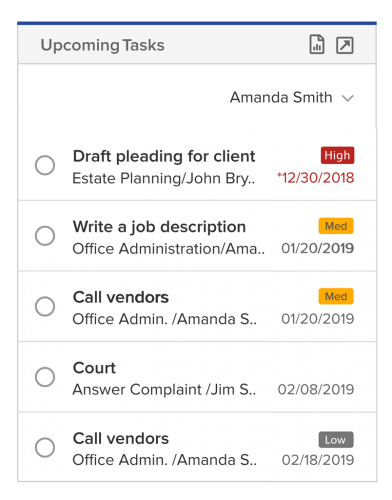

- Verify billing guidelines are met and that invoices are prepared per client guidelines. Work to minimize/eliminate eBilling errors and mistakes. Use a task management system to notify involved parties (e.g. managers, partners and timekeepers).

Shepherd carefully

- Create a map of client billing expectations. Identify, ahead of time, what’s allowed, what requires client approval, and what’s forbidden. Identify the stop words and hidden rules that immediately flag your pre-bill for review. Then revise them.

- Treat timesheets like precious cargo. Think of your time as products in a store. Each and every shred of time generates revenue. Each line item is a unit of revenue. Every improvement timekeepers and accounting teams make to timesheets/invoices increases firm realization rates and revenue.

- Deliver unexpected news to clients before they receive their invoice. Have timekeepers and accounting review pre-bills before clients are invoiced. Verify that invoices are accurate, confirm to billing guidelines and are received by clients.

- Use a task management system to maintain swift communication with accounting teams and timekeepers.

Is this really necessary?

Aren’t timekeepers supposed to stay focused on billable work? It seems like timekeepers are being punished with more non-billable work. They’re already overloaded is this necessary?

Absolutely.

These issues crop up at specific times in the attorney/client relationship.

- With new clients

- Changes to existing client relationships

In the beginning, you’ll need to pay close attention to the requirements and guidelines your clients have laid out. It requires careful attention until everyone on a client’s matter is acclimated to the way things need to be done.

Paying close attention in the beginning reduces the amount of work you’ll have to do in the end.

It’s a win for everyone.

Your invoices should be compiled accurately and shepherded carefully

It’s never a set and forget ordeal.

If you’re like most law firms, your billing workflow is a complicated, multi-step process. Give your invoices the attention they deserve.

All it takes is a little bit of your attention.

Give your invoices the upfront attention they need and you’ll reap the rewards. A 50 to 70 percent increase in revenue, a decrease in non-billable work (over time) and higher realization rates.

It’s another way to stand out.

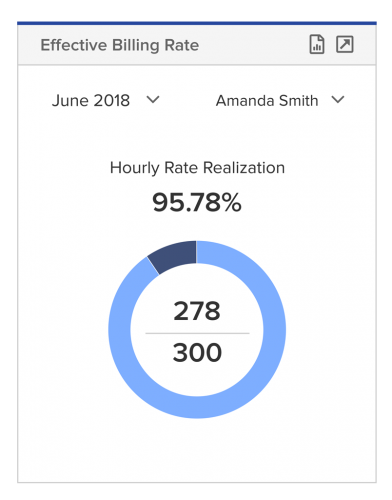

You’re a professional. If you’re focused on serving your clients and serving your firm, you’ll do what it takes to compile invoices accurately and shepherd them carefully. With some upfront attention and a bit of effort, you’ll have everything you need to achieve sky high realization rates.

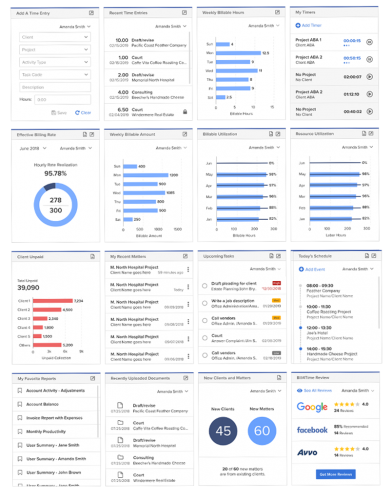

Why was the new KPI dashboard added to the Bill4Time platform?

Why was the new KPI dashboard added to the Bill4Time platform?

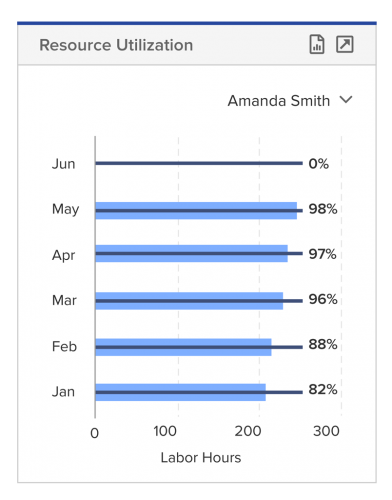

So whether you’re a grinder, putting in all of those billable hours, or a finder prospecting new clients, you’re still able to track your utilization of work towards the firm on your Bill4Time dashboard. And each individual attorney is able to set these targeted amounts within their profile.

So whether you’re a grinder, putting in all of those billable hours, or a finder prospecting new clients, you’re still able to track your utilization of work towards the firm on your Bill4Time dashboard. And each individual attorney is able to set these targeted amounts within their profile.