Legal data analytics opens a new world of possibilities for law firms to achieve operational efficiency and improve outcomes for clients – all with existing data sources.

It’s likely that you already use legal analytics without realizing it but devising a strategy can help maximize your firm’s success. Here’s everything you need to know about legal data analytics.

What Are Legal Data Analytics?

Legal analytics is the process of including data-driven insights into the decision-making process for law firms, such as legal strategy, resource management, and matter forecasting. This offers a competitive advantage by providing full visibility and transparency into law firm operations.

Types of Legal Data Analytics

There are two types of legal data analytics: business and practice. The former focuses on data that are relevant to all businesses, while the latter is specific to legal practices. Each is broken down into specific topics.

Business Data Analysis

- Financial Analysis: At the end of the day, a law firm is still a business. Financial analysis is important to identify cost-saving opportunities, optimize billing processes, and assess profitability. This includes important financial statements like the income statement, balance sheet, and cash flow statement.

- Client Relationship Management (CRM): CRM improves the client experience by enhancing client interactions, identifying cross-selling opportunities, and improving client retention rates. The CRM holds all your relevant client data, including case history, communication history, and demographics, segments the client base according to industry, revenue, or location, and provides granular details to personalize interactions.

- Marketing and Business Development: Marketing analytics can help you understand your ideal client, where your practice stands compared to competitors, and how your marketing initiatives are performing. You can also learn where your prospective clients are coming from to determine the best marketing channels for your budget.

Practice Data Analytics

- Case Outcome Prediction: Predictive legal analytics provides forecasting for case timelines to the most probable outcome to build a case, devise litigation and negotiation strategies, and evaluate options.

- Legal Research and Document Analysis: Legal research can be a time-consuming process, but it’s key in identifying the important precedents or statutes that provide a competitive edge. Legal research analytics helps you identify the relevant cases in your practice area more efficiently to spend more time developing your case strategy.

- Workflow Optimization: Lawyers often struggle with time management, but you can improve your firm’s workflows by analyzing data on workloads, case duration, and resource allocation. You’ll save time with streamlined processes and enhance your firm’s productivity and ensure that you’re allocating resources and delegating tasks effectively.

Why Should My Law Firm Track Legal Data

Legal data is important for all firms, big and small. Here’s why:

Strategic Decision-Making

With legal data, you can make informed decisions that are backed by evidence and trends instead of assumptions and biases. Whether you’re planning to branch into a new practice area or looking to expand your law firm into new markets or locations, you can rely on data insights for more favorable outcomes.

Client Service Improvement

The client experience is one of the most important aspects of staying competitive in the modern legal market. By tracking legal data, law firms can better understand client needs, preferences, and patterns to improve client satisfaction and loyalty.

Competitive Advantage

With increased competition and savvier clients, law firms often struggle to stay ahead and acquire new clients. Legal data gives you a competitive edge by identifying emerging trends, market opportunities, and potential risks, so you can stand out in a crowded market.

Performance Evaluation

Tracking legal data gives you insights to continuously improve your firm’s performance and identify areas for improvement. Data trends reveal strengths, weaknesses, and blind spots for an objective view of your performance and success.

How to Track Legal Data Analytics

Ready to include legal data analytics in your firm’s processes? Here’s how:

Define Key Metrics

It’s important to have a goal in mind and metrics to define success with legal analytics. Your metrics will vary depending on the type of analytics. For example, client acquisition, the cost to acquire a new client, and the average value of a client or case aid your marketing strategy, while realization rate, utilization rate, and billable hours inform your productivity. Clearly define these metrics to zero in on the relevant data.

Data Collection and Storage

You likely already have data for your firm in the form of financial records, client information, and marketing metrics, but you should have systems in place to collect and store it all. Implement processes to gather and organize it effectively, then store it in a secure and reliable data storage system.

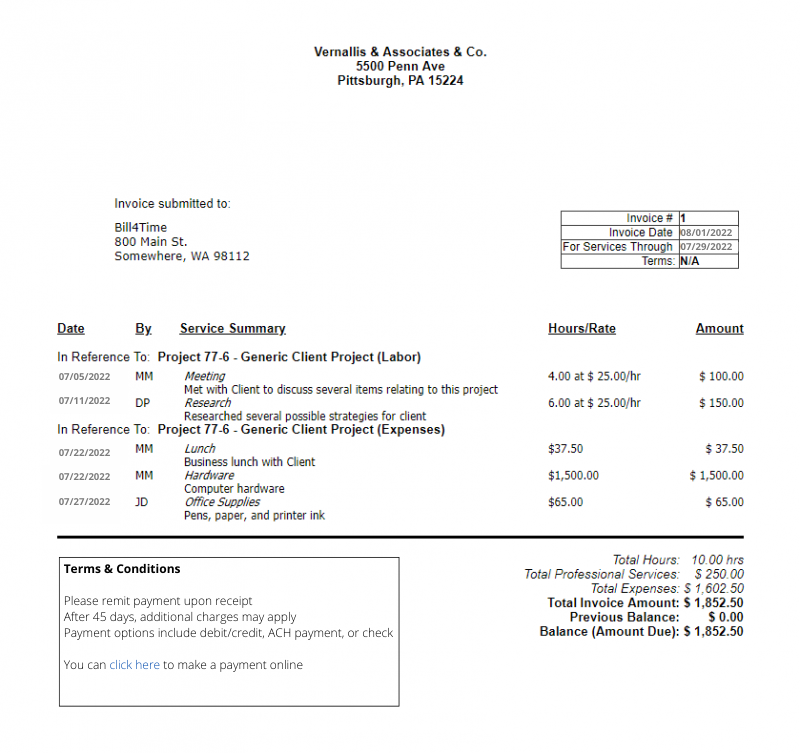

Data Analysis Tools

Data analysis tools are key to successful legal analytics. You can rely on external tools like Excel or Power BI, but a comprehensive law practice management solution with reporting helps you home in on targeted, relevant data for your goals. With Bill4Time, you can get a robust view of your data from time tracking and billable hours to clients and matters.

Team Collaboration and Training

Legal data analytics is a firmwide initiative that involves lawyers and support staff. All team members should be trained in the importance of legal data analytics and how to use your data analysis tools for insights.

Cloud-based law practice management software offers a secure, centralized source for all your firm data that staff can access at any time, from anywhere. If you want some users to have limited access, you can customize permissions and track activity for full control and visibility.

Continuous Improvement

Legal analytics is an ongoing process. You should conduct regular sessions with staff and stay updated on the latest trends and developments in legal data analytics to enhance your processes and continue to derive meaningful insights.

Final Thoughts

Legal data analytics changes the way law firms and legal professionals use their time, strategize cases, enhance the client experience, and make informed business decisions. As the legal market becomes more competitive, legal data is the key to attracting clients, staying profitable, and encouraging future growth.