Your employees are all mercenaries.

According to Gallup and Steve Rasmussen, former CEO of Nationwide, your employees fall into one of two camps, patriots or mercenaries. Not because they want to be but because they have to be.

It’s a for or against problem.

This problem makes it difficult to solve a more urgent problem law firms are struggling with today. Their compensation model.

The hidden problem behind compensation models

As Rasmussen saw it, employees were comprised of these two groups.

“Patriots totally identify with their company, and mercenaries are more likely to focus on personal outcomes.”

Patriot employees are engaged. They have ownership, they believe in their firm and their firm believes in them. Instead of looking out for themselves, they’re focused on looking out for their firm.

Why would they do that?

Because they trust their firm to look out for them, their interests, their families, etc., on the other hand, mercenaries are focused on themselves. They’re job hoppers and social climbers. They’re focused on getting as much value as they can for themselves.

They’re typically disengaged.

If the interests of the firm happen to align with their own interests, they’ll do what’s best for the firm. But they’re not really focused on putting their firm ahead of themselves.

They’re the opposite of patriots.

Research from Gallup shows employee engagement in the US is at 34 percent, the highest it’s ever been. This data is promising, isn’t it? Yet it’s hiding an unpleasant dark side.

Sixty-six percent of employees are disengaged

Of that number, 13 percent are actively disengaged, meaning they’re working to sabotage their company and undermine progress made by their co-workers.

Why engagement is a compensation problem

Firm leaders are seen as mercenaries.

This doesn’t mean they are in reality, but for many employees, perception is reality. Here’s why firm leadership is viewed this way. If anything changes, if associates bend over backward to increase their billable time do they see the rewards?

Maybe, it all depends on the firm.

For most firms, the answer is No. If timekeepers bend over backward, they don’t see another dime — traditional compensation models pit partners and associates against each other. Teams are told to work together, but they actually end up competing with each other.

Collaboration, teamwork, those aren’t the things that increase revenue or make firms successful.

Actually, it is.

When firms compete, it’s incredibly harmful.

According to Law.com research, when clients were served by three practice groups, revenues were 5.7 times higher than those served by one. Clients who were served by five practice groups generated fees that were 17.6 times higher than those served by one.

Firms aren’t cooperating though.

Why?

I’ve shared the answer before. The hidden problem behind compensation boils down to your law firm’s identity. That identity is built and defined by three areas – culture, personality and values. Today we’re going to look at two.

- Culture

- Personality

1. Culture

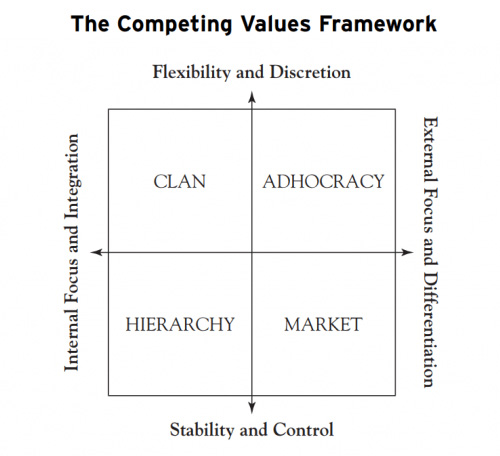

Robert E. Quinn and Kim S. Cameron at the University of Michigan at Ann Arbor discovered there are four types of organizational cultures.

- Adhocracy cultures are temporary and driven by change. They’re often characterized as “tents rather than palaces.” These firms reconfigure themselves rapidly in the face of change. They’re adaptable, flexible and creative in the face of uncertainty, ambiguity and disruption.

- Clan cultures are family-like. There’s a focus or special emphasis placed on mentoring, nurturing and investing in the growth of those in the clan. It’s all about doing and accomplishing together. Prioritizing employee development is crucial, viewing clients as joint partners essential — an emphasis on engagement, commitment and loyalty non-negotiable.

- Hierarchy cultures follow a set structure. These firms are focused on perfection, efficiency, stability and doing things the right way. Clear lines of decision-making authority, standardized rules and procedures, control and accountability mechanisms. These are seen as the keys to success.

- Market cultures are often utilitarian and primarily focused on results. The internal environment in market cultures is competitive, achievement-focused, and driven by outcomes and prestige. “In the words of General Patton, market organizations “are not interested in holding on to [their] positions. Let the [enemy] do that. [They] are advancing all the time, defeating the opposition, marching constantly toward the goal.”

These cultures each have strengths and weaknesses.

| Strengths | Weaknesses | |

| Adhocracy | Adaptable, able to change | Struggle to commit or be consistent |

| Clan cultures | Loyal and committed to the team | Unwilling to accept outsiders or naysayers |

| Hierarchy cultures | Precise, detail oriented, stable | Inflexible, rules driven, perfectionism |

| Market cultures | Utilitarian, ends justify the means | Competitive, performance driven to a fault |

These strengths are unbelievable.

On the other hand, these weaknesses are unbelievably destructive. They create major problems in law firms, especially when it comes to compensation.

Why though?

Because of the next component.

2. Personality

Like people, your employees have a mix of the big five personality traits. These traits existed at the individual and firm-level. These traits are:

- Openness: Individuals and firms high in this trait have a higher degree of intelligence and intellectual curiosity. These individuals and firms value knowledge, experience and data more than others. Firms with a large number of people who are high in Openness may prefer any of the four cultures, provided that they meet their goals or objectives.

- Extraversion: These individuals and firms are skilled connectors. They’re able to build relationships inside and outside their industry. They’re the life of the party. Influential partners can connect with influencers, leaders and essentials who can provide these firms with a significant amount of leverage. Firms with a large number of people who are high in extraversion may prefer clan, market or adhocracy cultures.

- Agreeableness: These individuals and firms are socially minded. There’s an emphasis on taking care of their own (employees/clients). They’re cooperative, easy to work with, polite and compassionate. Firms with a large number of people who are high in agreeableness may prefer clan cultures.

- Conscientiousness: These individuals and firms have a high degree of amount of self-discipline. They’re reliable, trustworthy, organized and efficient. These individuals and firms thrive with proper planning. Firms with a large number of people who are high in conscientiousness may prefer hierarchy cultures.

See why this is a compensation problem?

No?

The employees in your firm may not match the culture of your firm. This mismatch creates major problems if the culture and compensation model you’ve selected doesn’t fit with the employees in your firm.

Michael Anderson, author of Partner Compensation, the vast majority of compensation models fall into seven basic categories.

- Equal partnership

- Lockstep

- Modified Hale and Dorr

- Simple Unit

- 50/50 Subjective-Objective

- Team Building

- Eat What You Kill

To be successful, these compensation models (as well as it’s variations) are dependent on both your firm’s culture and the collective personality of your team and firm.

What does that mean?

It means that an “Eat what you kill” model, that’s focused on a timekeeper’s individual effort, will create major problems in a clan culture.

Here’s where it gets worse.

Partners who are at a sufficient level in the firm may refuse to work with the culture or personality of the firm. This means a partner in a clan culture may decide to behave like a mercenary, every partner for him or herself.

The hidden problem with compensation models is people

Your employees fall into one of two camps, patriots or mercenaries. Not because they want to be but because they have to be. Your firm’s culture, personality and values determine whether your firm is filled with patriots or mercenaries.

As I said, it’s a for or against problem.

In my next posts, we’ll unpack the problem further and provide solutions you can use.