In uncertain economic times, all businesses are tasked with doing more with less – including law firms.

Every business has to pay what it owes, and with the added complexity of expenses you pay on your client’s behalf, managing invoices is key to saving money and freeing cash flow.

Developing and refining your accounts payable management strategies is essential for your law firm. Let’s take a look at the basics of accounts payable management, how it works in a law firm, and how you can improve your own processes.

What Are Accounts Payable?

Accounts payable includes everything your law firm owes to creditors, such as bills from vendors that are billed to the end client or internal costs for support services.

Typically, accounts payable refers to short-term debts, which are debts that you plan to pay within a year. Long-term debts, such as mortgages or loans for business assets, are usually written as separate liabilities outside of accounts payable.

Law firm accounts payable tends to be complex with strict regulations. With a fiduciary responsibility to your client, missteps in dealing with accounts payable could have ethical implications and consequences.

The Accounts Payable Management Process

Accounts payable management is the manner in which you handle unpaid debts for third-party vendors in your law firm. This may involve acquiring favorable terms of purchase, seeking trade credit lines, or managing the timing and flow of purchases.

The specific process for accounts payable management can vary between law firms, but it generally includes:

- Invoice Receipt: Your law firm receipts invoices from vendors for goods or services.

- Invoice Verification: Your law firm invoices are reviewed internally to ensure they are accurate and in compliance with the agreed-upon terms and rates.

- Invoice Approval: Once reviewed, invoices must be approved. Depending on the process at your law firm, this could mean partners or managers must go over them.

- Coding and Recording: After the invoices are approved, they are coded with relevant account codes for tracking expenses and entered into the accounting system.

- Payment Scheduling: Invoices that are approved and recorded are ready to be entered into the payment schedule, which includes determining the payment terms like due dates.

- Payment Execution: Payments are made to vendors according to the payment schedule. They may be paid using checks, electronic funds transfer, or online payment platforms.

- Reconciliation: Reconciliation involves comparing the firm’s records and the vendor statements to ensure payments have been made, the records are accurate, and any discrepancies are noted for financial reporting.

- Reporting: Tracking and recording accounts payable activities is essential to gain visibility into your law firm’s financial health. This reporting is also necessary for legal and regulatory requirements.

- Vendor Relationship Management: Throughout the process, your law firm must maintain communication and build a relationship with vendors to handle payment discrepancies and address inquiries.

How Do Law Firms Manage Accounts Payable?

Law firms manage accounts payable with robust systems and processes – as well as technology to assist.

Along with an accounts payable management system to ensure accuracy and timeliness, you must have an approval workflow to verify invoices and authorize payment to vendors. Depending on your internal procedures, you may need to institute multiple levels of approval.

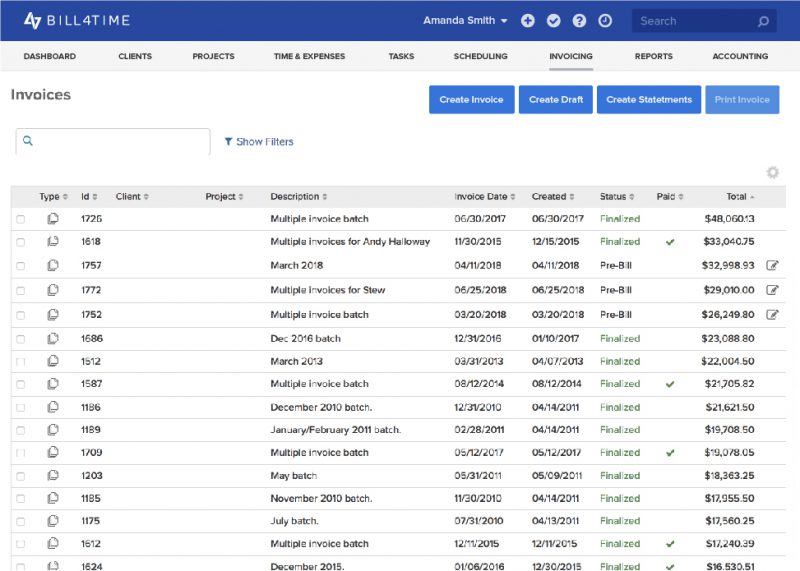

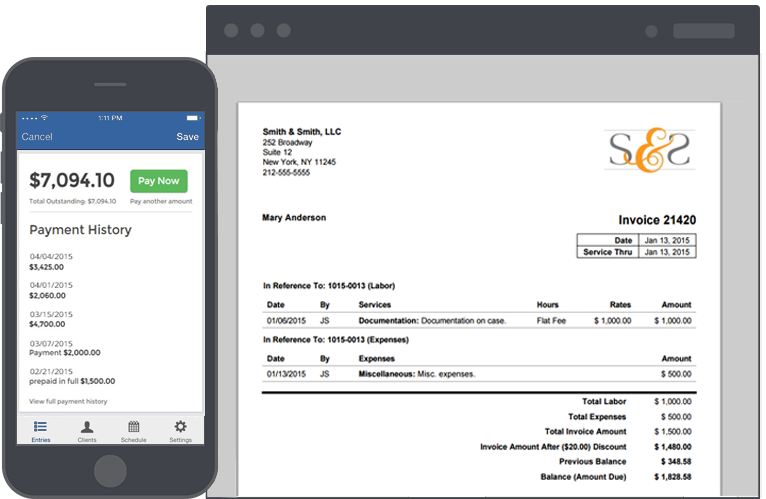

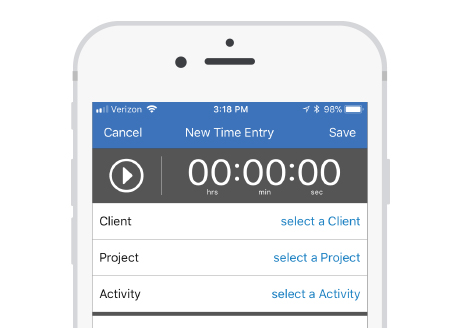

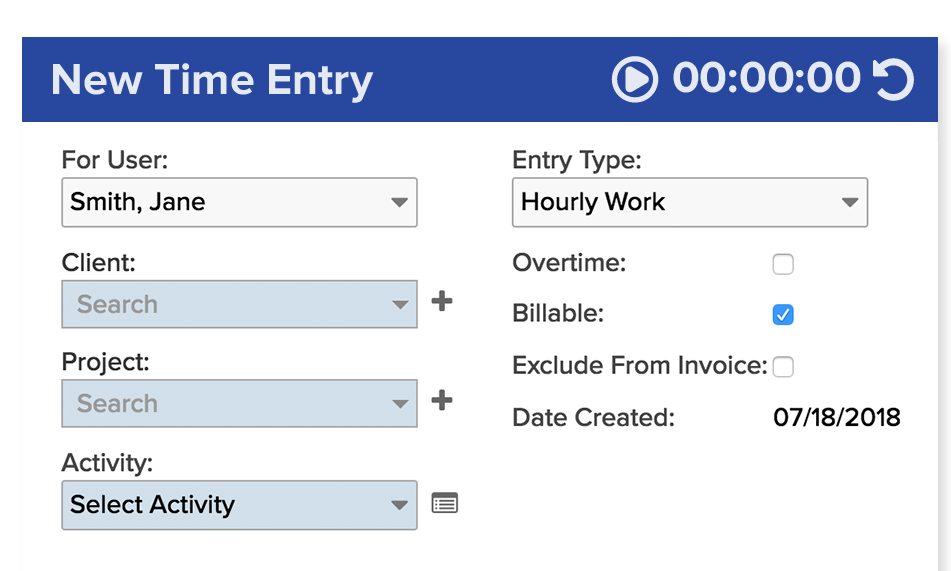

Software like Bill4Time’s law firm invoicing software helps you stay on top of your business’ finances and accounting activity in one centralized dashboard. The billing features in Bill4Time make it easy to track expenses to ensure that you can get reimbursement from clients as needed. Since you can manage all aspects of your billing in Bill4Time, you get a comprehensive view of your firm’s finances.

Common Challenges with Accounts Payable Management

Accounts payable management is key for your firm’s efficiency and financial health, but it can get complicated to manage. Between the reports and payment allocation tracking — here are some common challenges law firms face:

Cost Recovery

Law firms often incur costs on behalf of clients, such as expert witness fees and court filing fees. It’s important to recover these costs and allocate them to different matters, which can be time consuming and error prone.

Billing

Similarly, law firms bill clients based on billable hours spent working on legal matters and case-related expenses. You have to track your billable hours and client expenses accurately to ensure you recover the costs you put out.

Complexity

If your law firm is juggling a range of clients and legal matters, it can be difficult to manage all of them simultaneously and track their respective expenses without a software solution to help.

Trust Accounting

If your law firm manages trust accounts for client funds, that comes with strict compliance that you must adhere to. This includes accurate tracking of client expenses, and allocating payment in the proper accounts.

Invoice Management

Law firms receive invoices from multiple vendors for both law firm and client expenses, including court reporters, expert witnesses, research databases, and legal transcription services. All of those invoices must be processed, verified, and reconciled.

Tips to Better Manage Accounts Payable

Managing accounts payable effectively is crucial for any organization, including law firms. Here are some tips specifically tailored for law firms to better manage their accounts payable:

Establish Clear Procedures

Create well-defined accounts payable procedures specific to your law firm. Document the steps involved in the payment process, including approval levels, invoice handling, and payment methods. Communicate these procedures to all relevant staff members to ensure consistency, transparency, and efficiency.

Implement Electronic Invoice Management

Embrace technology by implementing an electronic invoice management system. This software streamlines the accounts payable process, automating tasks like invoice capture, data entry, and approval workflows. It reduces manual errors, enhances efficiency, and provides better visibility into the payment status.

Maintain Vendor Records

Accurate and up-to-date vendor records will help facilitate smooth communication and payment processing. Ensure that vendor details are correctly recorded, including contact information, payment terms, and any special instructions. Regularly review and update this information to avoid payment delays or miscommunication.

Monitor Payment Terms

Law firms often have specific payment terms agreed upon with their vendors or clients. Monitor these terms closely and adhere to them to maintain good relationships. Missing payment deadlines can strain relationships and may result in penalties or legal consequences. Consider setting up reminders or implementing automated payment plans to stay on top of payment deadlines.

Track Expenses

Stay vigilant about tracking expenses associated with your law firm. Maintain proper documentation of all invoices, bills, and receipts. Accurate expense tracking allows you to review costs, allocate expenses correctly, and plan your budget effectively.

Review and Reconcile Accounts Regularly

Conduct regular reviews and reconciliations of your accounts payable records. Verify that invoices match purchase orders and are accurately recorded in your accounting system. Address any discrepancies promptly to avoid errors and potential financial issues.

Monitor Cash Flow

Keep a close eye on your law firm’s cash flow to ensure you have enough liquidity to cover your accounts payable obligations. Maintain a cash flow projection and regularly review it to anticipate potential shortfalls or surpluses. This analysis will help you make informed decisions regarding payment timing and prioritize invoices accordingly.

Remember, efficient accounts payable management not only helps maintain good financial health but also fosters strong vendor relationships and supports the overall success of your law firm.

Streamline Your Accounts Payable

Accounts payable for law firms can be challenging, but with a smooth management process in plan and support from law firm billing software, you can streamline accounts payable in your firm and improve your financial position.