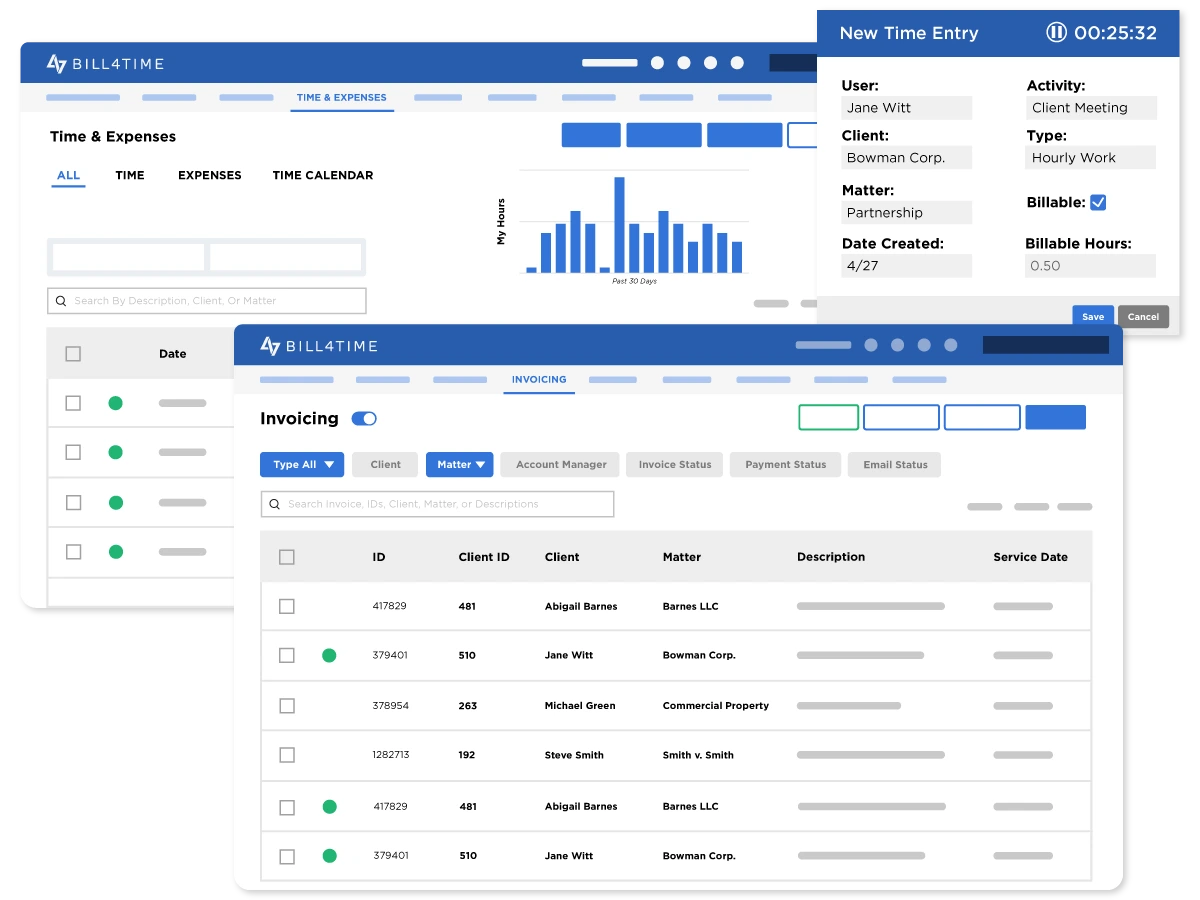

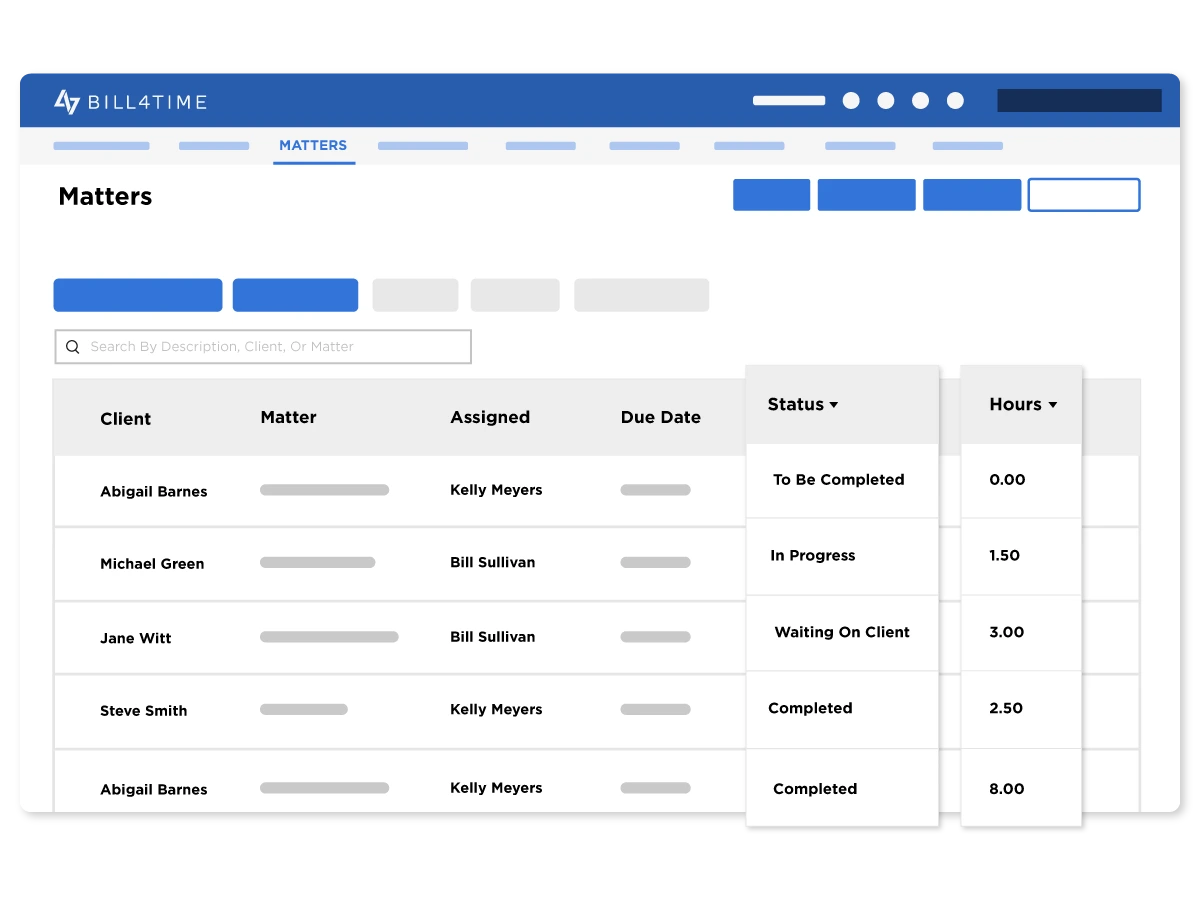

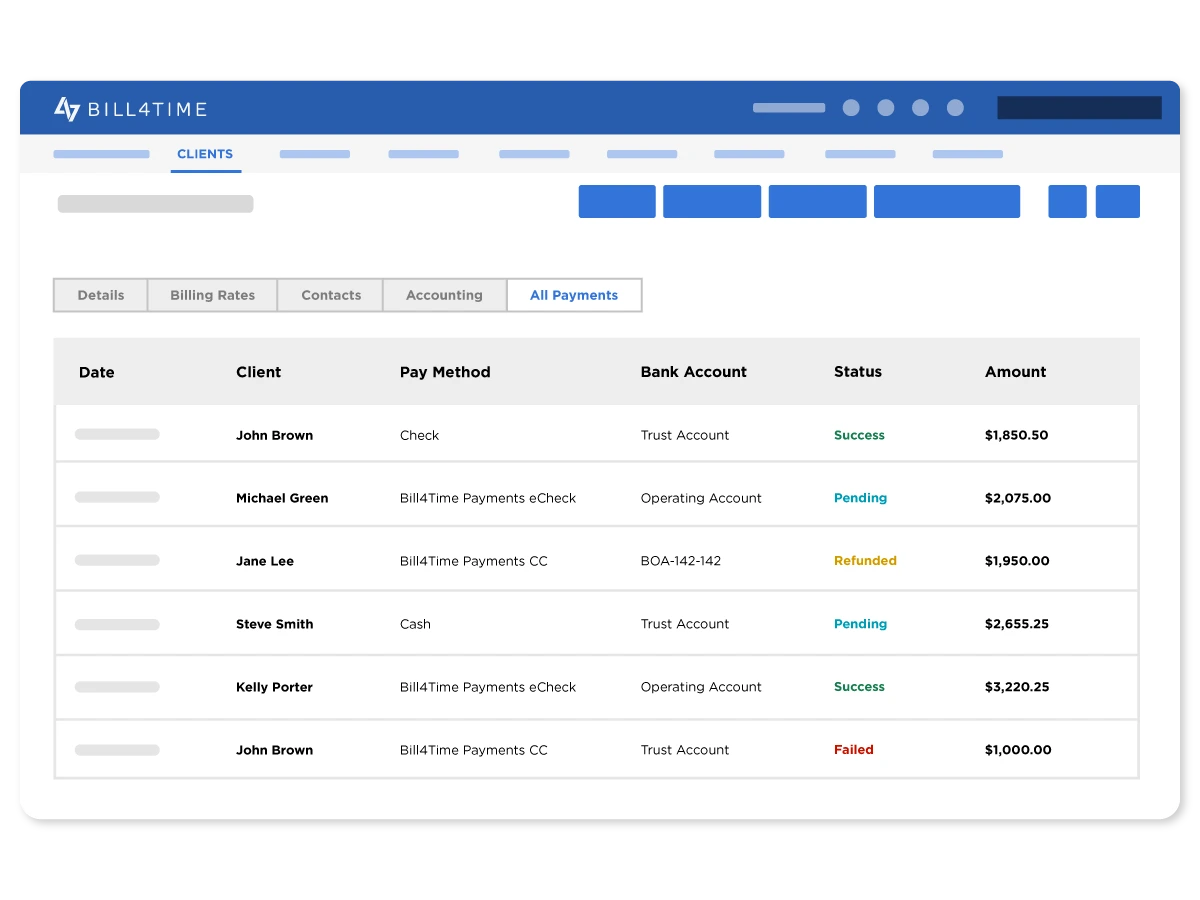

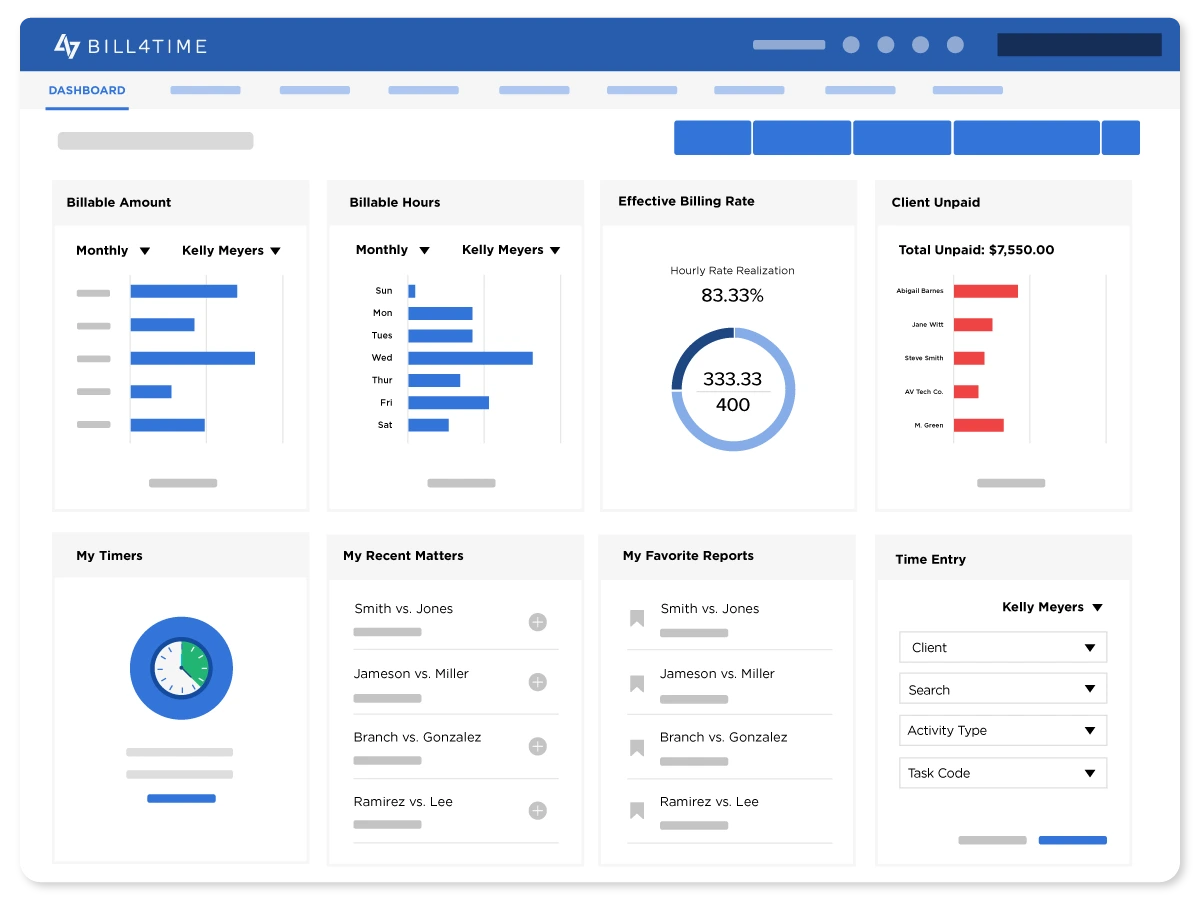

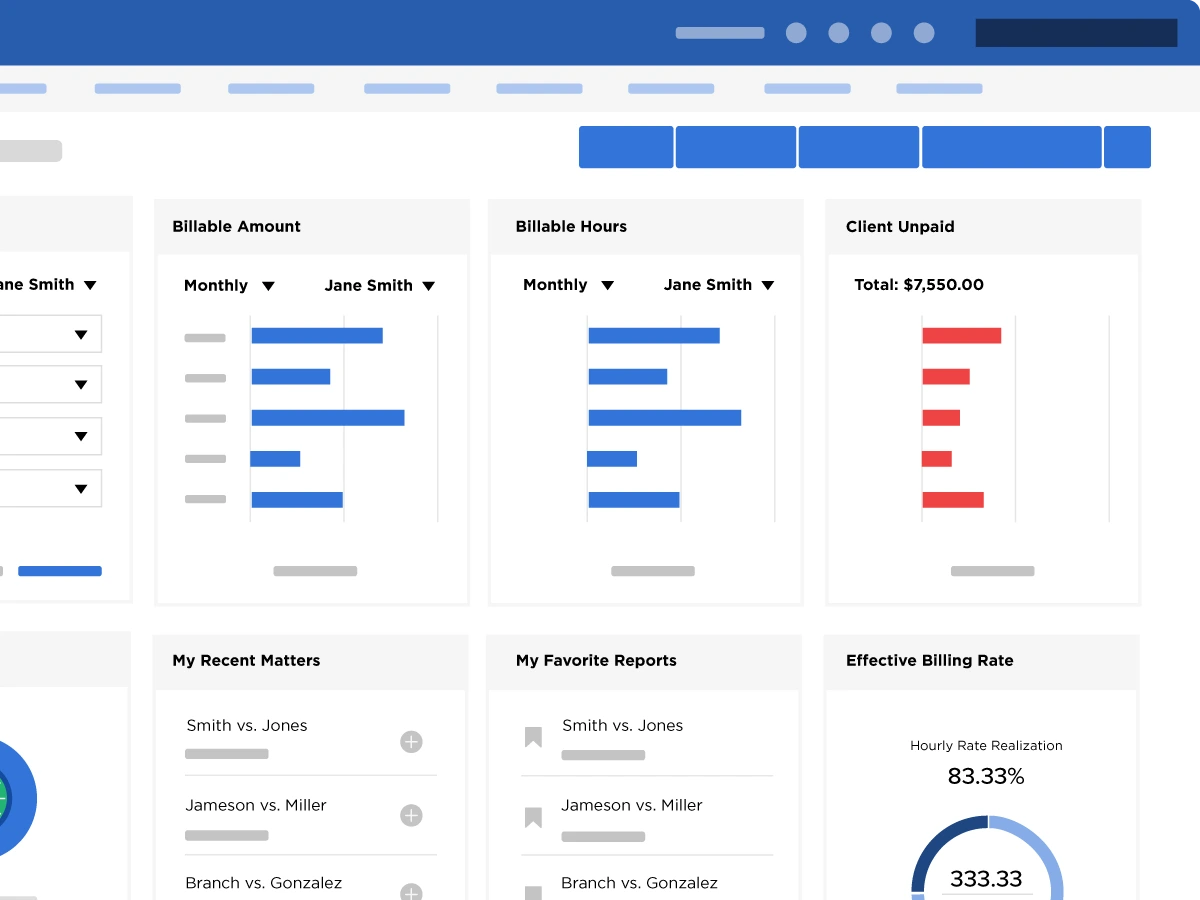

Attorney billing software helps legal professionals record time, track expenses, and invoice clients accurately. Unlike general billing and accounting platforms, Bill4Time is attorney billing software built to support legal-specific needs, such as matter-based billing, trust accounting, and compliance with bar rules.

Bill4Time allows you to create professional invoices from detailed time entries, apply matter-specific rates, manage payments securely, and much more. It also helps track unbilled time and review work in progress, so nothing falls through the cracks. For attorneys focused on accurate billing, compliance, and client transparency, it’s a practical and proven option.