The Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below!

The Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below!

Take a look at what we’ve released this January:

Updated 1/30/2018

Trust Report Update – Our developers have identified and resolved an issue affecting some users where if they attempt to edit a transaction within the report and click Save the whole report closes. We’ve patched this bug so the report tab remains open after saving a change to a transaction.

Collections Report Group-by Project Type – We have released an update to the Collections report that allows grouping by Project-type. This grouping allows the user to generate data on their collections based on the type of project.

Trust Transfer Custom Project ID Display – We’ve released an update to the Trust Transfer transactions to include the custom project ID. Previously, this transaction was displaying the default internal ID number for the project.

Locked Project Rates Entries – Our developers have identified and resolved a display-only (i.e. does not affect underlying data) bug affecting the billed entries of projects that were subject to a rate lock. Now, when reopening an entry – the Billable Rate displayed will match that which appears on its invoice. Again, this is a display-only bug and did not affect underlying billing calculations or invoice totals.

Updated 1/18/2018

Mobile App Expenses – We’ve implemented a fix for a bug relating to the time zone of a user’s smartphone and the editing of an expense entry. If a user opened and edited the expense from a different time zone than the one it was created it – the timestamp was adjusting to reflect the date relative to the current time. This bug affected a very small number of entries and this has been fully resolved in all instances and for every account going forward.

Updated 1/17/2018

Invoice Status Report Update – Our developers have identified and resolved a display-bug where the outstanding balance amount in the Invoice Status Report was displaying as a negative amount instead of a positive outstanding balance. This issue is now resolved for all users and when using any browser.

Updated 1/16/2018

Alert Dialog Boxes – We’ve released an update to various alerts and dialog boxes within the system. This is part of an ongoing project to prevent these dialog boxes from being blocked by pop-up blocking software.

Updated 1/10/2018

Duplicating Expense Entries – Our developers have released a fix for a bug, which was preventing a user from Duplicating an Expense Entry if that entry included a receipt attachment file. This issue is now resolved for all users.

Updated 1/9/2018

Expense Entry Attachment Types – We’ve implemented a new notifying popup to better alert the user whenever they’ve attempted to upload a file type using a non-supported extension.

Updated 1/3/2018

Time Entries Dashboard Widget – Our developers have identified and resolved an issue where the Calendar Date-Picker tool in the Time Entries widget was not opening for a select number of users. This bug has been resolved and the feature restored for all users.

Click here to view December’s Release Notes

Question or comment about a change we’ve made?

Please contact Bill4Time Support by Email or phone: 877-245-5484

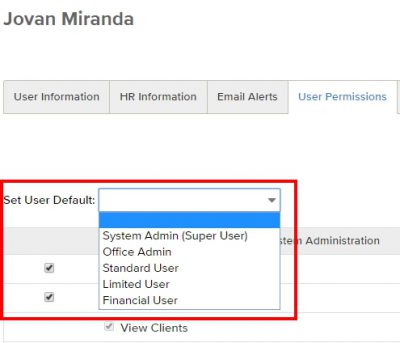

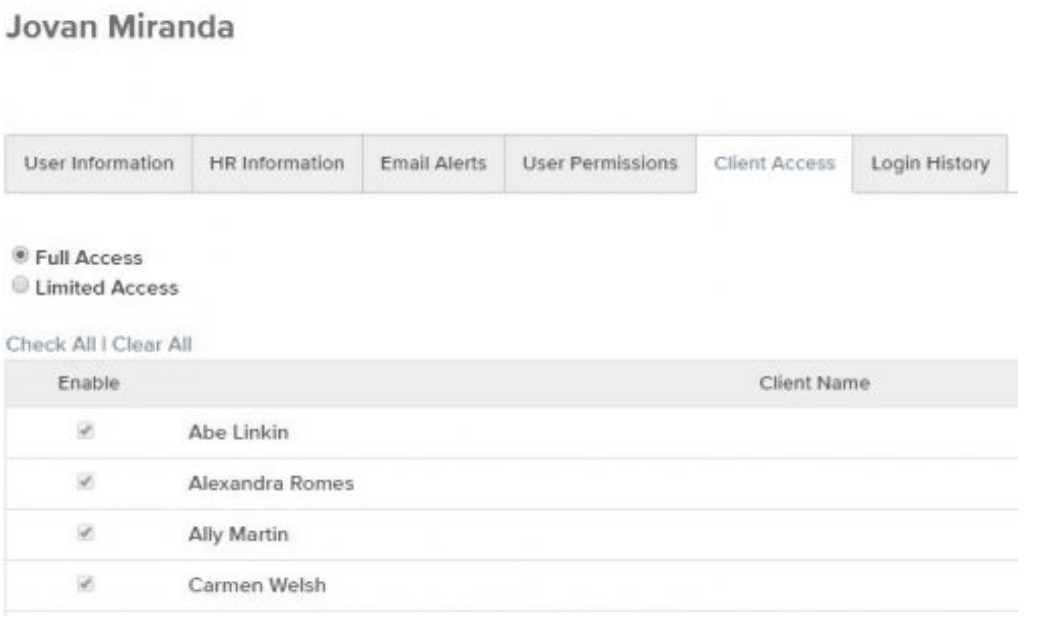

System Admin:

System Admin:

Nothing is more frustrating than realizing a client doesn’t intend to pay you after hours of hard legal work. What starts as a great relationship devolves into a petty dispute over money. Sometimes the amount is trivial, but the issue—left unresolved—can be big, tarnishing an otherwise professional relationship, even your sterling reputation.

Nothing is more frustrating than realizing a client doesn’t intend to pay you after hours of hard legal work. What starts as a great relationship devolves into a petty dispute over money. Sometimes the amount is trivial, but the issue—left unresolved—can be big, tarnishing an otherwise professional relationship, even your sterling reputation.