You’ve probably received bad advice.

If you’re wondering how to get your clients to pay you faster, it may be best to avoid common wisdom. The usual advice offered by pundits may create a cash flow crunch for your firm. Follow their advice and your firm may experience a cash flow crunch that negatively impacts your realization rates, siphoning revenue out of your firm.

Revenue that’s rightfully yours.

Legal billing isn’t an administrative function

It’s a relationship function.

This is the core component the vast majority of pundits miss when they hand out advice that could ruin your law firm. Legal billing, whether successful or unsuccessful, is a relationship barometer. The outcome of your legal billing tells you a lot about the state of your attorney/client relationship. The formula is simple:

Successful client relationships = successful billing.

The success of this relationship, and legal billing, in turn, depends on the groundwork you establish in the attorney/client relationships on the front and back end.

But you can’t do that.

Not without a clear sense of the dos and don’ts you need to avoid.

Countering bad legal billing advice from pundits

If you’ve read several articles on this topic, you’ve seen the advice. Pundits seem to share the same tips and strategies, but they ignore the pitfalls that come with them.

Let’s take a brief look.

- Offer discounts for early payment. This can backfire in a variety of ways — clients can accept the discount but pay later anyway. Discounts keep your realization rates permanently depressed. You agree to lose money on work you’ve already done, the time you’ve already invested, and can’t get back.

- Offer net 30 terms. You know how this is likely to go; you offer clients net 30 terms, they decide to pay in 45 or 60 days. You offer net 15; they pay in 30. For many clients, net 30 is an invitation to consistently pay late or renegotiate the terms of their agreement whenever they decide it’s necessary. They know you won’t challenge them. You want their money.

- Issue a late payment penalty. If legal billing is about the attorney/client relationship, what will happen if you issue a late fee legitimately? In most cases, this causes the relationship to deteriorate by a varying degree. If clients believe they’ve been good to you, your late fee may be viewed as an insult or provocation, increasing their resistance to paying.

The list of advice is long, but most of the standard tactics listed by pundits are terrible or require a certain degree of nuance to be effective. Most attorneys aren’t taught about the ins and outs of this, so they struggle to apply this effectively.

How to get clients to pay faster

As I shared in my previous post, there are several strategies you can use to get clients to pay you faster. The strategies are typically front or backend, and they depend on one step most law firms neglect. I’ll provide a brief recap here before discussing strategy and tactics.

First, remember that your clients should need you more than you need them. What’s the easiest way to achieve this relationship dynamic?

An abundance of opportunity.

Let’s do some role-playing. Imagine the partners in your firm are under a considerable amount of pressure. You need to land a large, high profile client in two days, but you only have one prospect. You feel the partners in your firm have to close that lead to avoid disaster.

How would you feel?

Anxious, stressed out – full of fear you won’t close.

Alright.

Same scenario. Your law firm is in demand; more clients are begging for your attention than you can handle. You need to make a sale in two days. You have 79 highly qualified leads. Twenty-five of these prospects are working on signing your agreement. Ten have signed your contract and have sent you a deposit.

Now how do you feel?

If you’re like most partners, you feel happy and excited, maybe a little overwhelmed at the demand for your firm?

See what I mean?

If you want your clients to pay you faster, you’ll need to achieve several things on the front end.

- Build a law firm clients will fight to retain. Warren Buffet popularized the idea of an economic moat. An economic moat helps your business retain clients. In my previous post, I covered the five moats attorneys can use to protect their business from competitors.

- Create a strong business development system. You’ll know you’ve succeeded when your ideal prospects are continually funneled to your firm and clamoring for your attention. Your business development system should help you attract and win clients who are willing and able to spend what you’re asking.

- Develop a strong value proposition. A value proposition answers the question, “Why should I retain your firm?” with an actionable and persuasive response. Your value proposition is appealing; it’s something clients want. It’s exclusive, and clients can only get “it” from you. It’s clear, easy to understand. Finally, it’s credible, your clients believe in your value proposition.

Does this feel impossible?

The good news here is that it’s not. Developing one of these three strategies on the front end will lead to a dramatic increase in revenue. Develop all three areas, and you will propel your firm to the front of the line in the mind of your clients.

Here are several posts you can use if you’re not sure where to start.

- 5 Practical Steps for Establishing Your Law Practice

- Understand the difference between reputation and review management

- Local Search for Lawyers: How Online Visibility Leads to Clients

- Your Guide To Earning State Bar Referrals

- How to generate a never-ending supply of law firm clients with the Local SEO traffic pump

- 37+ Places For Lawyers to Get Published That Bring Value to Your Firm

- 2 Ethical Ways Attorneys Can Maximize Their Use of Facebook

- How professional service firms can master social media

- What Should You Include On Your Law Firm’s Website?

Each of the three strategies I’ve mentioned above creates the “you need me more than I need you” dynamic I’ve mentioned above. This is crucial if you’d like your clients to pay your invoice faster and do so consistently. Alright, you’ve done the necessary work needed to prime your clients to pay you more quickly, what’s next?

Tactic #1: Build a client’s trust with transparent billing

One of the biggest concerns clients have in their relationship with you is runaway billing. When clients receive hourly billing, they often feel they’re writing a blank check. If you’d like to receive payment faster, work hard to establish openness and transparency in your relationship with clients, especially with billing.

When openness and transparency are lacking, billing disputes arise, payment speed declines, and collection realization rates fall. Here are some straightforward steps you can take to increase payment speed.

- Make sure your pricing (and pricing model) is fair and communicated to clients.

- Create a mechanism that allows you to adjust pricing

- Evaluate your firm’s pricing. Is it competitive (up or down) with respect to competing firms? It should be.

- Factor your client’s payment history into your pricing model (e.g., higher pricing for delinquents).

- Follow your client’s billing guidelines, accounting for any hidden, implicit, or unrealistic expectations.

- When you send clients an invoice, break every time entry and expense down in detail.

- Communicate any significant variance preemptively (via email or phone). Communicate immediately and personally with clients whether the difference is positive or negative.

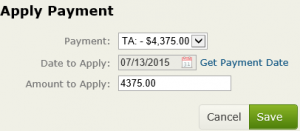

- Provide supporting documents – payments, invoices, expenses, etc. via your billing management software.

Many pundits attempt to position late or nonpayment as a mechanical problem. Remember, poor payment hygiene is a relationship problem. Focus on the formula I mentioned earlier.

Successful client relationships = successful billing.

Here’s why this is important.

When clients come to believe that you’ll always be fair, that they don’t have to watch your every move, they relax. These wonderful, long term clients focus their attention on the work and paying your invoices. They know they can trust you, so they choose to spend their time elsewhere.

Open and transparent billing builds this trust.

Tactic #2: Create payment systems and procedures

Law firms that struggle with accounts receivables fail to perform in two key areas: (1.) They don’t have the processes they need to collect payments reliably from their clients and (2.) They aren’t able to find high-quality clients who are both willing and able to pay.

These struggling firms often don’t have the systems and procedures needed to stabilize collections. If they remember to bill their clients, they’ll send out an invoice.

Using systems and procedures is an easy way to speed up the payment process. Here’s a sample process to show you what I mean.

- Compile invoices accurately, adhering to client billing guidelines.

- Shepherd your client’s invoice through e-billing, looking for red flags or trouble spots.

- Send invoice to your client, making sure to clarify due dates and methods of payment.

- Send an email payment reminder to your client on the invoice due date.

- Call your client once the invoice is one week late.

- Call the client again, send out an email, and snail-mail reminder once the invoice is two weeks late.

- Visit the client in person once the invoice is one month late [special cases only].

- Place client account with a collections agency, suspend or terminate representation.

Your process may be different.

What’s crucial is that your process is documented, employees are trained in that process, and it’s practiced regularly.

Tactic #3: Use alternative fee arrangements

A Legal Trends report found 44 percent of law firms list client’s inability to pay all at once as the most common reason for nonpayment. Firms also state that 31 percent of clients pay late even when they have the funds.

How do you counteract this stinginess?

Provide clients with alternative fee arrangements (AFAs). In a previous article, I mentioned that 84 percent of proactive firms find their non-hourly projects to be at least as profitable as their hourly projects. Nontraditional AFAs can generate a significant amount of income.

Why are AFAs so profitable?

Let’s compare two clients, Richard and Geoffrey, who spend money on the same matter.

Richard pays a $17,000 retainer to get started with his firm. He feels a burning desire to get his money’s worth, but the pain of his initial purchase (e.g., the potential for loss) will decrease with time. He’s invested far more than his initial trust can support, so he’s far more likely to be aggressive and overbearing. Richard is less likely to continue with his firm unless they can help him with another matter.

On the other hand, Geoffrey requests an AFA and spends $2,450 per mo. He also feels the need to get his money’s worth every month. He’ll ask you for more help, which will develop his habit of relying on his attorney (you) to take care of things for him, increasing his loyalty over time. Why? In the course of one year, Geoffrey has spent $29,400.

This example illustrates why AFAs are so powerful. Here are several ways you can use AFAs to get paid faster.

- Require clients to prepay (they will if you’ve done tip #1).

- Use fixed fees to systematically increase your rates and pay in large blocks (i.e., 25% upfront).

- Increase contingency fees via barter (i.e., get cash advance now).

- Require prepay via holdbacks.

- Use portfolio fixed fees to auto-bill clients for a portfolio of bundled services each month.

- Create subscriptions for routine work at a predetermined price that’s both prepaid and paid monthly.

These AFAs can be used to attract more clients who are willing to pay much more than average if they’re provided with options that are flexible enough.

Tactic #4: Motivate clients to pay faster

With the right motivation, clients will pay your invoice as quickly as they can. One approach is the use of rewards; the right rewards can generate a significant amount of interest, value, and goodwill with clients. Here are a few examples of rewards you can use to motivate clients.

- Create a membership system that rewards your best clients with access to exclusive benefits (e.g., select software, services, tools, or additional support)

- Vanishing rewards to clients who pay their invoice by # date (i.e., a one-time reward that’s different each month)

- Irresistible offers for clients who’ve made [#] payments early

- Events, connections, and meet and greets with thought leaders, key influencers, or power brokers in your client’s industry (e.g., entrepreneur lunch with a key influencer, client workshop with a government regulator, etc.).

- After service support (e.g., helping bankruptcy clients rebuild their credit within 90 days).

Here’s the secret to these rewards.

There needs to be strings attached. In order for clients to receive these extra rewards, they need to do something for you. It is very much a quid pro quo arrangement. Here are a few examples you can test in your firm.

- Clients will receive X if they pay [5 days before their invoice due date]

- Clients will receive Y if they’ve made [15 payments ahead of their invoice due date]

- Clients who pay their invoice in full will receive Y

- Clients who respond to our queries within X days consecutively will receive Y

Can you see what’s happening?

You’re priming and training clients to behave appropriately. Clients who bristle under these rewards and requirements will leave. The wonderful clients who stay will provide you with the assurance and comfort that comes with a roster of loyal and trustworthy clients.

Legal billing is oriented around the relationship

Legal billing, whether successful or unsuccessful, is a relationship barometer. The success or failure of your legal billing depends on the health of the attorney/client relationship. This is the core component the vast majority of pundits miss when they hand out advice that could ruin your law firm.

It’s all about the relationship formula.

Successful client relationships = successful billing.

The success of your relationships with clients determines the impact your legal billing will have on your revenues. Lay the right groundwork, nurture client relationships, and you’ll find your clients are eager and willing to pay your invoices faster than you expect.